Wells Fargo 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wells Fargo & Company Annual Report 2013

The right people. The right markets. The right model.

Serving customers in the real economy.

Table of contents

-

Page 1

Wells Fargo & Company Annual Report 2013 The right people. The right markets. The right model. Serving customers in the real economy. -

Page 2

... 10 Relationships, Not Transactions 22 Educating Communities in New Ways 27 Board of Directors, Senior Leaders 29 2013 Financial Report • Financial Review • Controls and Procedures • Financial Statements • Report of Independent Registered Public Accounting Firm 267 Stock... -

Page 3

... in agriculture, works side by side with customers like Fowler Packing Co. every day on products and services, from its line of credit to treasury management. Co-owner Dennis Parnagian - whose father founded Fowler Packing in 1950 - said, "Wells Fargo 'gets it.' They understand our world and our... -

Page 4

John G. Stumpf Chairman, President and Chief Executive Officer, Wells Fargo & Company 2 -

Page 5

..., and investing in communities. It also means instilling conï¬dence in our customers as their ï¬nancial partner - from providing checking accounts and automobile loans to treasury management and investment banking services. As we have grown over the years, we have never lost our focus on... -

Page 6

... foreign exchange. We also operate offices in international locations - including Hong Kong, London, Sydney, and Toronto - to meet the global needs of our corporate customers and provide services to ï¬nancial institutions around the world. Helping people plan and prepare for retirement As... -

Page 7

...a key driver of business competitiveness and long-term economic growth - in everything from biotechnology and medical devices to wireless technology, social networking, and cloud computing. The U.S. also has become a world leader in energy production and the use of clean energy sources, which... -

Page 8

... checking, savings certiï¬cates, certain market rate and other savings, and certain foreign deposits (Eurodollar sweep balances). 4 Retail core deposits are total core deposits excluding Wholesale Banking core deposits and retail mortgage escrow deposits. 5 See Note 26 (Regulatory and Agency... -

Page 9

...in 2013. While rising long-term interest rates slowed reï¬nance volume and impacted our mortgage revenue, we experienced growth in other businesses such as asset-backed ï¬nance, asset management, capital markets, commercial real estate, corporate banking, credit cards, retail brokerage, small... -

Page 10

... do many things right. We avoided the risky practices that hurt other banks during the ï¬nancial crisis, and we consistently focused on responsible, traditional banking practices that customers and communities expect and rely on. Over the past several years, a number of new industry reforms... -

Page 11

.... Ensure our lines of business have primary accountability for risk, while our Corporate Risk group provides oversight at the enterprise level. Our Corporate Audit group provides an independent, objective view to evaluate and improve the effectiveness of our risk management processes. In... -

Page 12

...across the U.S. They keep Wells Fargo credit and loan decisions as close to car dealers and customers as possible. Such local knowledge is why Lithia knows it can count on Wells Fargo Dealer Services to provide a broad spectrum of ï¬nancing options during any economic cycle. Gougherty said, "I like... -

Page 13

11 -

Page 14

...do that with the decision making and service of a local bank." For example, Wells Fargo ï¬nanced the purchase of new equipment and technology that allows Taylor's customers to pay by credit or debit card. Now Taylor is ready for the next step in the business she founded in 2002 - building an... -

Page 15

13 -

Page 16

14 -

Page 17

... buy that ï¬rst home," said Peter de Jong, branch manager for the mortgage team in Oak Lawn, a community outside the city. "Our office and team members serve many residents in the greater Chicago area. We pride ourselves on being knowledgeable about mortgage down payment assistance programs... -

Page 18

... stores and corporate offices, and around the globe. We provide a range of products and services, including treasury management, a commercial card program, depository accounts, a revolving line of credit, and more." Wells Fargo also provides international banking services in London and Canada... -

Page 19

17 -

Page 20

18 -

Page 21

... has smart ATMs with shortcuts that remember customers' frequent transactions. But that's not all. Customers at this store can access Wells Fargo mobile, or any site on the internet, through a complimentary Wi-Fi hotspot. And the bankers here have secure wireless tablets. Store Manager Michael... -

Page 22

...J.C. Penney, and Sears. Steve credits customer service as a key reason for long-term business success. "Wells Fargo has tremendous customer service, and we're a customer service company, too! We ï¬nd it's little things, like speaking with customers after they place an order, that set us apart... -

Page 23

21 -

Page 24

... the state." The Hands on Banking program is free and not a liated with any product. It is designed to teach money and credit basics to kids, adults, entrepreneurs, seniors, and members of the military. The handsonbanking.org site reaches thousands of users each year in more than 190 countries... -

Page 25

23 -

Page 26

24 -

Page 27

... a trial period - paying no rent or mortgage - but is required to attend ï¬nancial education courses. At the end of the trial period, the veteran receives the deed to the home free and clear. In 2012, Wells Fargo committed $35 million to military service members and veterans, including $30... -

Page 28

... helped with $190 million $18.9 billion in down payment assistance, program support, and local initiatives through Wells Fargo LIFT programs in 24 housing markets in 2012 - 2013 in new loan commitments to small businesses across the U.S. in 2013 Team member engagement We support our team... -

Page 29

... D. Roberson Enterprise Efficiency & Global Services James H. Rowe Investor Relations Eric D. Shand Chief Loan Examiner Timothy J. Sloan Chief Financial Officer * James M. Strother General Counsel * Oscar Suris Corporate Communications Carrie L. Tolstedt Community Banking * * " Executive... -

Page 30

... Credit Officer International Business Banking Group Hugh C. Long David L. Pope, Business Banking Sales and Service Debra B. Rossi, Merchant Services David J. Rader, SBA Lending Deposit Products Group Kenneth A. Zimmerman Daniel I. Ayala, Global Remittance Services Edward M. Kadletz, Debit... -

Page 31

... Securities Loans and Allowance for Credit Losses Premises, Equipment, Lease Commitments and Other Assets Securitizations and Variable Interest Entities Mortgage Banking Activities Intangible Assets Deposits Short-Term Borrowings Long-Term Debt Guarantees, Pledged Assets and Collateral Legal... -

Page 32

...at the end of this Report for terms used throughout this Report. Financial Review Overview Wells Fargo & Company is a nationwide, diversified, community-based financial services company with $1.5 trillion in assets. Founded in 1852 and headquartered in San Francisco, we provide banking, insurance... -

Page 33

... in several of our commercial and consumer loan portfolios, reflecting our long-term risk focus and the benefit from the improving housing market. Net charge-offs of $4.5 billion were 0.56% of average loans, down 61 basis points from a year ago. Net losses in our commercial portfolio were only $206... -

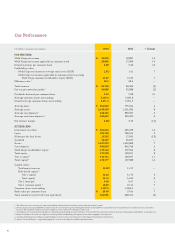

Page 34

... interests Wells Fargo net income Earnings per common share Diluted earnings per common share Dividends declared per common share Balance sheet (at year end) Investment securities Loans Allowance for loan losses Goodwill Assets Core deposits (2) Long-term debt Wells Fargo stockholders' equity... -

Page 35

... value Market price (5) High Low Year end (1) (2) (3) (4) (5) The efficiency ratio is noninterest expense divided by total revenue (net interest income and noninterest income). See Note 26 (Regulatory and Agency Capital Requirements) to Financial Statements in this Report for additional information... -

Page 36

... losses, reflecting strong underlying credit performance. We also generated diversified sources of fee income across many of our businesses and grew loans and deposits. Revenue, the sum of net interest income and noninterest income, was $83.8 billion in 2013, compared with $86.1 billion in 2012... -

Page 37

... adjustment Net interest income (A) Noninterest income Service charges on deposit accounts Trust and investment fees (1) Card fees Other fees (1) Mortgage banking (1) Insurance Net gains from trading activities Net gains (losses) on debt securities Net gains from equity investments Lease income... -

Page 38

... yield-related loan fees) and other interestearning assets minus the interest paid for deposits, short-term borrowings and long-term debt. The net interest margin is the average yield on earning assets minus the average interest rate paid for deposits and our other sources of funding. Net interest... -

Page 39

... junior lien mortgag Credit card Automobile Other revolving credit and installment Total consumer Total loans (1) Other Total earning assets Funding sources Deposits: Interest-bearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices Total... -

Page 40

...rates 2012 Interest income/ expense (in millions) Earning assets Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets (3) Investment securities (4): Available-for-sale securities: Securities of U.S. Treasury and federal agencies Securities... -

Page 41

... Includes $6.3 billion of federal agency mortgage-backed securities purchased during the fourth quarter of 2013 and $6.0 billion of auto asset-backed securities that were transferred near the end of 2013 from the available-for-sale portfolio. (6) Nonaccrual loans and related income are included in... -

Page 42

... of Net Interest Income Year ended December 31, 2013 over 2012 (in millions) Increase (decrease) in interest income: Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets Investment securities: Available-for-sale securities: Securities of... -

Page 43

... trust and investment fees Card fees Other fees: Charges and fees on loans Merchant transaction processing fees Cash network fees Commercial real estate brokerage commissions Letters of credit fees All other fees Total other fees Mortgage banking: Servicing income, net Net gains on mortgage loan... -

Page 44

... "Risk Management - Mortgage Banking Interest Rate and Market Risk" section in this Report for additional information regarding our MSRs risks and hedging approach. Net gains on mortgage loan origination/sale activities were $6.9 billion in 2013, compared with $10.3 billion in 2012 and $4.6 billion... -

Page 45

... assessment rates related to improved credit performance and the Company's liquidity position. Operating losses were down 63% in 2013 compared with 2012, which was elevated predominantly due to mortgage servicing and foreclosure-related matters, including the Attorneys General settlement announced... -

Page 46

... in 2011. The decrease in 2013 was a result of lower mortgage banking revenue, partially offset by higher trust and investment fees, and revenue from debit, credit and merchant card volumes. The increase in 2012 was the result of higher mortgage banking revenue and growth in deposit service charges... -

Page 47

... Capital Markets, Commercial Mortgage Servicing, Corporate Trust, Equipment Finance, Wells Fargo Securities, Principal Investments, Asset Backed Finance, and Asset Management. Wholesale Banking cross-sell was a record 7.1 products per customer in September 2013, up from 6.8 in September 2012 and... -

Page 48

...by a $30.4 billion decrease in mortgages held for sale. Deposit growth of $76.3 billion, total equity growth of $12.1 billion and an increase in long-term debt of $25.6 billion from December 31, 2012 were the predominant sources funding our asset growth during 2013. The deposit growth resulted in an... -

Page 49

... see Note 1 (Summary of Significant Accounting Policies - Investments) and Note 5 (Investment Securities) to Financial Statements in this Report. At December 31, 2013, investment securities included $42.5 billion of municipal bonds, of which 86% were rated "A-" or better based predominantly on... -

Page 50

... in the "Risk Management - Credit Risk Management" section in this Report. Period-end balances and other loan related Table 13: Maturities for Selected Commercial Loan Categories information are in Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report. Table 13 shows... -

Page 51

...of customers, (2) manage our credit, market or liquidity risks, and/or (3) diversify our funding sources. Transactions with Unconsolidated Entities We routinely enter into various types of on- and off-balance sheet transactions with special purpose entities (SPEs), which are corporations, trusts or... -

Page 52

..., and market rate and other savings accounts. (2) Balances are presented net of unamortized debt discounts and premiums and purchase accounting adjustments. (3) Represents the future interest obligations related to interest-bearing time deposits and long-term debt in the normal course of business... -

Page 53

... in their businesses. All of our team members have accountability for risk management. x We recognize the importance of strong oversight. Our Corporate Risk group, led by our Chief Risk Officer who reports to the Board's Risk Committee, as well as other corporate functions such as the Law Department... -

Page 54

... lending policies and credit underwriting standards x Credit stress testing activities Corporate Responsibility Committee Oversight includes: x Mortgage and other consumer lending reputational risks x Reputation with customers, including complaints and service matters x Social responsibility risks... -

Page 55

... taken by the businesses, and provides credible challenge to risks incurred. The Chief Risk Officer, as well as the Chief Enterprise, Credit, Market, and Operational Risk Officers as his or her direct reports, work closely with the Board's committees and frequently provide reports and updates to the... -

Page 56

... 2012 We manage our credit risk by establishing what we believe are sound credit policies for underwriting new business, while monitoring and reviewing the performance of our existing loan portfolios. We employ various credit risk management and monitoring activities to mitigate risks associated... -

Page 57

...-a-Pay mortgage (1) Liquidating home equity Legacy Wells Fargo Financial indirect auto Legacy Wells Fargo Financial debt consolidation Education Finance - government guaranteed Legacy Wachovia other PCI loans (1) Total consumer Total non-strategic and liquidating loan portfolios (1) Net of purchase... -

Page 58

.... Each pool is accounted for as a single asset with a single composite interest rate and an aggregate expectation of cash flows. Resolutions of loans may include sales to third parties, receipt of payments in settlement with the borrower, or foreclosure of the collateral. Our policy is to remove an... -

Page 59

... sales to third parties (2) Reclassification to accretable yield for loans with improving credit-related cash flows (3) Use of nonaccretable difference due to: Losses from loan resolutions and write-downs (4) Balance, December 31, 2012 Addition of nonaccretable difference due to acquisitions Release... -

Page 60

...December 31, 2012. A majority of our commercial and industrial loans and lease financing portfolio is secured by short-term assets, such as accounts receivable, inventory and securities, as well as longlived assets, such as equipment and other business assets. Generally, the collateral securing this... -

Page 61

... our charge-off policies, generally to the net realizable value of the collateral securing the loan, if any. At the time of any modification of terms or extensions of maturity, we evaluate whether the loan should be classified as a TDR, and account for it accordingly. For more information on TDRs... -

Page 62

... each country through a centralized oversight process based on customer needs, and in consideration of relevant economic, political, social, legal, and transfer risks. We monitor exposures closely and adjust our country limits in response to changing conditions. We evaluate our individual country... -

Page 63

...total loans at December 31, 2013, compared with 18% at December 31, 2012. We believe we have manageable adjustable-rate mortgage (ARM) reset risk across our owned mortgage loan portfolios. We do not offer option ARM products, nor do we offer variable-rate mortgage products with fixed payment amounts... -

Page 64

... 31, 2013 Real estate Real estate 1-4 family 1-4 family first (in millions) PCI loans: California Florida New Jersey Other (1) Total PCI loans All other loans: California Florida New York New Jersey Virginia Pennsylvania North Carolina Texas Georgia Other (2) Government insured/ guaranteed loans... -

Page 65

... Pick-a-Pay loans on which there is a deferred interest balance re-amortize (the monthly payment amount is reset or "recast") on the earlier of the date when the loan balance reaches its principal cap, or generally the 10-year anniversary of the loan. After a recast, the customers' new payment terms... -

Page 66

... The ratio of carrying value to current value is calculated as the carrying value divided by the collateral value. To maximize return and allow flexibility for customers to avoid foreclosure, we have in place several loss mitigation strategies for our Pick-a-Pay loan portfolio. We contact customers... -

Page 67

... program strategy. Table 26 reflects the outstanding balance of our home equity portfolio segregated into scheduled end of draw or end of term periods and products that are currently amortizing, or in balloon repayment status. It excludes real estate 1-4 family first lien line reverse mortgages... -

Page 68

... and loss rates for our junior lien mortgages and lines by the holder of the first lien. Table 27: Home Equity Portfolios Performance by Holder of 1st Lien (1) % of loans Outstanding balance (2) December 31, (in millions) Junior lien mortgages and lines behind: Wells Fargo owned or serviced first... -

Page 69

... 31, 2012 Loss rate Year ended December 31, 2013 2012 (2) (1) Consists predominantly of real estate 1-4 family junior lien mortgages and first and junior lines of credit secured by real estate, but excludes PCI loans because their losses were generally reflected in PCI accounting adjustments at... -

Page 70

... the related first lien mortgage may be 120 days past due or in the process of foreclosure regardless of the junior lien delinquency status; or performing consumer loans are discharged in bankruptcy, regardless of their delinquency status. Note 1 (Summary of Significant Accounting Policies - Loans... -

Page 71

... construction Lease financing Foreign Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Automobile Other revolving credit and installment Total consumer Total nonaccrual loans Foreclosed assets: Government insured/guaranteed Non-government... -

Page 72

... have changed the foreclosure process in a manner that significantly increases the time to complete the foreclosure process; therefore loans remain in nonaccrual status for longer periods. In certain other states, including New York, New Jersey and Florida, the foreclosure timeline has significantly... -

Page 73

... 31, 2012. At December 31, 2013, 68% of foreclosed assets of $3.9 billion have been in the foreclosed assets portfolio one year or less. Given our real estate-secured loan concentrations, current economic conditions, and recent changes to loan modification programs slowing down foreclosures in prior... -

Page 74

... modified in TDRs. The allowance for loan losses for TDRs was $4.5 billion and $5.0 billion at December 31, 2013 and 2012, respectively. See Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report for additional information regarding TDRs. In those 72 situations where... -

Page 75

... refinanced or restructured at market terms and qualify as a new loan. Quarter ended Dec. 31, (in millions) Commercial TDRs Balance, beginning of period Inflows Outflows Charge-offs Foreclosure Payments, sales and other (1) Balance, end of period Consumer TDRs Balance, beginning of period Inflows... -

Page 76

... 31, 2012. Table 36 reflects non-PCI loans 90 days or more past due and still accruing by class for loans not government insured/guaranteed. For additional information on delinquencies by loan class, see Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report. December... -

Page 77

...: Net Charge-offs Year ended December 31, Net loan ($ in millions) 2013 Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Foreign Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card... -

Page 78

... a net recovery position every quarter in 2013. Our consumer real estate portfolios continued to benefit from the improvement in the housing market with losses down $3.5 billion, or 59%, from 2012. ALLOWANCE FOR CREDIT LOSSES The allowance for credit losses, which consists of the allowance for loan... -

Page 79

... for Credit Losses (ACL) Dec. 31, 2013 Loans as % (in millions) Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Foreign Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card... -

Page 80

... the breach. We have established a mortgage repurchase liability, initially at fair value, related to various representations and warranties that reflect management's estimate of losses for loans for which we could have a repurchase obligation, whether or not we currently service those loans, based... -

Page 81

... by FHA/HUD or the VA. The Post Endorsement Technical Review is a process whereby HUD performs underwriting audits of closed/insured FHA loans for potential deficiencies. Our liability for mortgage loan repurchase losses incorporates probable losses associated with such indemnification. Table 39... -

Page 82

.... Of the $1.8 trillion in the residential mortgage loan servicing portfolio at December 31, 2013, 94% was current, less than 2% was subprime at origination, and less than 1% was related to home equity loan securitizations. Our combined delinquency and foreclosure rate on this portfolio was 6.40% at... -

Page 83

...loans, net of recovery from third party originators, based on historical experience and current economic conditions. The average loss rate includes the impact of repurchased loans for which no loss is expected to be realized. (2) Represents the combination of the estimated investor audit/file review... -

Page 84

..., the Department of Veterans Affairs, the Federal Trade Commission (FTC), the Executive Office of the U.S. Trustee, the Consumer Financial Protection Bureau, a task force of Attorneys General representing 49 states, Wells Fargo, and four other servicers related to investigations of mortgage industry... -

Page 85

..., Wells Fargo believes the civil money obligations were satisfied through payments made under the Foreclosure Assistance Program to the federal government and participating states for their use to address the impact of foreclosure challenges as they determine and which may include direct payments to... -

Page 86

... reduce rates paid on checking and savings deposit accounts by an amount that is less than the general decline in market interest rates); x short-term and long-term market interest rates may change by different amounts (for example, the shape of the yield curve may affect new loan yields and funding... -

Page 87

...originate, fund and service mortgage loans, which subjects us to various risks, including credit, liquidity and interest rate risks. Based on market conditions and other factors, we reduce credit and liquidity risks by selling or securitizing some or all of the long-term fixed-rate mortgage loans we... -

Page 88

... used in our hedging are reviewed daily and rebalanced based on our evaluation of current market factors and the interest rate risk inherent in our MSRs portfolio. Throughout 2013, our economic hedging strategy generally used forward mortgage purchase contracts that were effective at offsetting... -

Page 89

...market risk perspective, our net income is exposed to changes in the fair value of trading assets and liabilities due to changes in interest rates, credit spreads, foreign exchange rates, equity and commodity prices. Our Market Risk Committee, which is a management committee reporting to the Finance... -

Page 90

...-related net interest income and trading-related intra-day gains and losses. Net trading-related revenue does not include activity related to long-term positions held for economic hedging purposes, period-end adjustments and other activity not representative of daily price changes driven by market... -

Page 91

... the Company's market risk. The group is responsible for quantitative market risk model development, establishing independent risk limits, calculation and analysis of market risk capital, and reporting aggregated and line of business market risk information. Limits are regularly reviewed to ensure... -

Page 92

... risk factors from each trading day in the previous 12 months. The risk drivers of each trading position with respect to interest rates, credit spreads, foreign exchange rates, and equity and commodity prices are updated on a daily basis. We measure and report VaR for a 1-day holding period and a 10... -

Page 93

... responsibilities include evaluating the adequacy of business unit risk management programs, maintaining company-wide model validation policies and standards and reporting the results of these activities to management and CMoR. Regulatory Market Risk Capital Effective January 1, 2013, U.S. banking... -

Page 94

... by the market risk capital rule are generally a subset of our trading assets and trading liabilities, specifically those held by the Company for the purpose of short-term resale or with the intent of benefiting from actual or expected short-term price movements, or to lock in arbitrage profits. The... -

Page 95

Table 48: 10-Day 99% Regulatory General VaR Categories Quarter ended December 31, 2013 Period (in millions) Wholesale General VaR Risk Categories Credit Interest rate Equity Commodity Foreign exchange Diversification benefit (1) Wholesale General VaR Company General VaR $ $ 102 40 7 4 1 (81) 73 79 ... -

Page 96

... rule requires capital for correlation trading positions. The net market value of correlation trading positions that meet the definition of a covered position at December 31, 2013 was a net loss of less than $1 million, all of which were long positions. Correlation trading is a discontinued business... -

Page 97

... of the daily VaR estimate with the actual clean profit and loss (clean P&L) as defined by the market risk capital rule. Clean P&L is the change in the value of the Company's covered trading positions that would have occurred had previous end-of-day covered trading positions remained unchanged... -

Page 98

... liquidity management is to ensure that we can meet customer loan requests, customer deposit maturities/withdrawals and other cash commitments efficiently under both normal operating conditions and under periods of Wells Fargo-specific and/or market stress. To achieve this objective, the Corporate... -

Page 99

...in 2013 and $51.2 billion in 2012. We access domestic and international capital markets for long-term funding (generally greater than one year) through issuances of registered debt securities, private placements and asset-backed secured funding. Investors in the long-term capital markets, as well as... -

Page 100

... amended in April 2012 and April 2013. For securities to be admitted to listing on the Official List of the United Kingdom Financial Conduct Authority and to trade on the Regulated Market of the London Stock Exchange. (5) For securities that will not be admitted to listing, trading and/or quotation... -

Page 101

... guaranteed by the Parent. FEDERAL HOME LOAN BANK MEMBERSHIP The Federal Home Loan Banks (the FHLBs) are a group of cooperatives that lending institutions use to finance housing and economic development in local communities. We are a member of the FHLBs based in Dallas, Des Moines and San Francisco... -

Page 102

... that it is in the process of considering new rules to address the amount of equity and unsecured debt a company must hold to facilitate its orderly liquidation and to address risks related to banking organizations that are substantially reliant on short-term wholesale funding. In addition, the FRB... -

Page 103

... and legal conditions. For more information about share repurchases during 2013, see Part II, Item 2 in this Report. Historically, our policy has been to repurchase shares under the "safe harbor" conditions of Rule 10b-18 of the Securities Exchange Act of 1934 including a limitation on the daily... -

Page 104

... assets are net of any associated deferred tax liabilities. (2) Tier 1 common equity is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews Tier 1 common equity along with... -

Page 105

...Total RWAs under Basel I (1) Represents fed funds sold and securities purchased under resale agreements. (2) Represents loans held for sale and loans held for investment. (3) Primarily includes financial standby letters of credit and other unused commitments. 2013 2012 $ 93,445 10,385 680,953 36... -

Page 106

... 126.2 1,293.4 9.76 % December 31, 2013 $ 123.5 (1) Common Equity Tier 1 is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews Common Equity Tier 1 along with other measures... -

Page 107

... industry regarding the provision of short-term, small-dollar loans to consumers, such as our direct deposit advance service. On January 17, 2014, we announced that we would discontinue our direct deposit advance service. New consumer checking accounts opened February 1, 2014, or later will not be... -

Page 108

... bank subsidiary, Wells Fargo Bank, N.A., as a swap dealer, which occurred at the end of 2012. In addition, the CFTC has adopted final rules that, among other things, require extensive regulatory and public reporting of swaps, require certain swaps to be centrally cleared and traded on exchanges... -

Page 109

... These policies govern: x the allowance for credit losses; x PCI loans; x the valuation of residential MSRs; x liability for mortgage loan repurchase losses; x the fair valuation of financial instruments; and x income taxes. Management has reviewed and approved these critical accounting policies and... -

Page 110

... group operating in accordance with Company policies. OTHER ACL MATTERS The allowance for credit losses for both subjective factors, including industry trends and risk assessments for our commitments to regulatory and government agencies regarding settlements of mortgage foreclosure-related... -

Page 111

... (including housing price volatility), discount rates, default rates, cost to service (including delinquency and foreclosure costs), escrow account earnings, contractual servicing fee income, ancillary income and late fees. Net servicing income, a component of mortgage banking noninterest income... -

Page 112

... about these loan sales and the related risks that may result in liability see the "Risk Management - Credit Risk Management - Liability for Mortgage Loan Repurchase Losses" section in this Report. We may be required to repurchase mortgage loans, indemnify the securitization trust, investor or... -

Page 113

... that we may incur for various representations and warranties in the contractual provisions of our sales of mortgage loans. Because the level of mortgage loan repurchase losses is dependent on economic factors, investor demand strategies and other external conditions that may change over the life of... -

Page 114

... obligations (CDOs), certain collateralized loan obligations (CLOs), asset-backed securities, auction-rate securities, certain derivative contracts such as interest rate lock loan commitments on residential MHFS and credit default swaps related to collateralized mortgage obligation (CMO), CDO and... -

Page 115

...credits to reduce federal income taxes payable. We account for interest and penalties as a component of income tax expense. The income tax laws of the jurisdictions in which we operate are complex and subject to different interpretations by the taxpayer and the relevant government taxing authorities... -

Page 116

...Consumer Mortgage Loans upon Foreclosure x ASU 2014-01, Investments - Equity Method and Joint Ventures (Topic 323): Accounting for Investments in Qualified Affordable Housing Projects x ASU 2013-11, Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss... -

Page 117

...third parties, and the credit quality of or losses on such repurchased mortgage loans; negative effects relating to our mortgage servicing and foreclosure practices, including our obligations under the settlement with the Department of Justice and other federal and state government entities, as well... -

Page 118

... our investment advisory, mutual fund, securities brokerage, wealth management, and investment banking businesses. In 2013, approximately 25% of our revenue was fee income, which included trust and investment fees, card fees and other fees. We earn fee income from managing assets for others and... -

Page 119

... in stock market prices could affect the trading activity of investors, reducing commissions and other fees we earn from our brokerage business. The U.S. stock market experienced all-time highs in 2013 and there is no guarantee that those price levels will continue. Poor economic conditions and... -

Page 120

.... We primarily rely on bank deposits to be a low cost and stable source of funding for the loans we make and the operation of our business. Core customer deposits, which include noninterest-bearing deposits, interestbearing checking, savings certificates, certain market rate and other savings, and... -

Page 121

may decrease when customers perceive alternative investments, such as the stock market, as providing a better risk/return tradeoff. When customers move money out of bank deposits and into other investments, we may lose a relatively low cost source of funds, increasing our funding costs and ... -

Page 122

...trust preferred securities; (x) permitted banks to pay interest on business checking accounts beginning on July 1, 2011; (xi) authorized the FRB under the Durbin Amendment to adopt regulations that limit debit card interchange fees received by debit card issuers; and (xii) includes several corporate... -

Page 123

... our business include proposals to reform the housing finance market in the United States. These proposals, among other things, consider winding down the GSEs and reducing or eliminating over time the role of the GSEs in guaranteeing mortgages and providing funding for mortgage loans, as well as... -

Page 124

... new rules to implement the G-SIB capital surcharge, to address the amount of equity and unsecured debt certain large BHCs must hold in order to facilitate their orderly resolution, and to address risks related to banking organizations that are substantially reliant on short-term wholesale funding... -

Page 125

...is our largest banking state in terms of loans and deposits, deterioration in real estate values and underlying economic conditions in those markets or elsewhere in California could result in materially higher credit losses. In addition, deterioration in macroeconomic conditions generally across the... -

Page 126

... offsetting revenue benefit from more originations and the MSRs relating to the new loans would generally accrue over time. It is also possible that, because of economic conditions and/or a weak or deteriorating housing market, even if interest rates were to fall or remain low, mortgage originations... -

Page 127

... - Asset/Liability Management - Mortgage Banking Interest Rate and Market Risk" and "Critical Accounting Policies" sections in this Report. We may be required to repurchase mortgage loans or reimburse investors and others as a result of breaches in contractual representations and warranties. We sell... -

Page 128

..., the Department of Veterans Affairs, the Federal Trade Commission (FTC), the Executive Office of the U.S. Trustee, the Consumer Financial Protection Bureau, a task force of Attorneys General representing 49 states, Wells Fargo, and four other servicers related to investigations of mortgage industry... -

Page 129

... our customers. Third parties with which we do business or that facilitate our business activities, including exchanges, clearing houses, financial intermediaries or vendors that provide services or security solutions for our operations, could also be sources of operational and information security... -

Page 130

... industry generally or Wells Fargo specifically could adversely affect our ability to keep and attract customers. Negative public opinion could result from our actual or alleged conduct in any number of activities, including mortgage lending practices, servicing and foreclosure activities, corporate... -

Page 131

...institutions such as Wells Fargo, and possible public backlash to bank fees, there is increased competitive pressure to provide products and services at current or lower prices. Consequently, our ability to reposition or reprice our products and services from time to time may be limited and could be... -

Page 132

... trading assets and liabilities, investment securities, certain loans, MSRs, private equity investments, structured notes and certain repurchase and resale agreements, among other items, require a determination of their fair value in order to prepare our financial statements. Where quoted market... -

Page 133

... and chief financial officer concluded that the Company's disclosure controls and procedures were effective as of December 31, 2013. Internal Control Over Financial Reporting Internal control over financial reporting is defined in Rule 13a-15(f) promulgated under the Securities Exchange Act of 1934... -

Page 134

... as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, changes in equity, and cash flows for each of the years in the three-year period ended December 31, 2013, and our report dated February 26, 2014, expressed an unqualified opinion on those... -

Page 135

... after provision for credit losses Noninterest income Service charges on deposit accounts Trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net gains (losses) on debt securities (1) Net gains from equity investments (2) Lease income Other... -

Page 136

... Reclassification of net gains on cash flow hedges to net income Defined benefit plans adjustments: Net actuarial gains (losses) arising during the period Amortization of net actuarial loss, settlements and other to net income Foreign currency translation adjustments: Net unrealized losses arising... -

Page 137

...shares) Assets Cash and due from banks Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets Investment securities: Available-for-sale, at fair value Held-to-maturity, at cost (fair value $12,247 and $0) Mortgages held for sale (includes $13... -

Page 138

... Tax benefit from stock incentive compensation Stock incentive compensation expense Net change in deferred compensation and related plans Net change Balance December 31, 2011 Cumulative effect of fair value election for certain residential mortgage servicing rights Balance January 1, 2012 Net income... -

Page 139

...(1,531) 3,207 (2,558) (844) Unearned ESOP shares (663) (663) Total Wells Fargo stockholders' equity 126,408 126,408 15,869 (1,531) (37) 1,296 (2,416) 959 ... 51,918 51,918 15,869 Treasury stock (487) (487) Noncontrolling interests 1,481 1,481 342 (12) (365) Total equity 127,889 127,889 16,211 (1,543... -

Page 140

... Changes in Equity Preferred stock (in millions, except shares) Balance December 31, 2012 Balance January 1, 2013 Net income Other comprehensive loss, net of tax Noncontrolling interests Common stock issued Common stock repurchased (1) Preferred stock issued to ESOP Preferred stock released by ESOP... -

Page 141

... earnings 77,679 77,679 21,878 Cumulative other comprehensive income 5,650 5,650 (4,264) Treasury stock (6,610) (6,610) Wells Fargo stockholders' equity Total Unearned Wells Fargo ESOP stockholders' shares equity (986) (986) 157,554 157,554 21,878 (4,264) 28 2,733 (5,356) 1,006 3,145 (6,086... -

Page 142

... Excess tax benefits related to stock incentive compensation Net change in noncontrolling interests Other, net Net cash provided by financing activities Net change in cash and due from banks Cash and due from banks at beginning of year Cash and due from banks at end of year Supplemental cash flow... -

Page 143

... of Significant Accounting Policies Wells Fargo & Company is a diversified financial services company. We provide banking, insurance, trust and investments, mortgage banking, investment banking, retail banking, brokerage, and consumer and commercial finance through banking stores, the internet and... -

Page 144

... of the price decline, such as the general level of interest rates or adverse conditions specifically related to the security, an industry or a geographic area; x the issuer's financial condition, near-term prospects and ability to service the debt; x the payment structure of the debt security and... -

Page 145

... low income housing tax credit investments, equity securities that are not publicly traded and securities acquired for various purposes, such as to meet regulatory requirements (for example, Federal Reserve Bank and Federal Home Loan Bank (FHLB) stock). We elected the fair value option for certain... -

Page 146

...," subject to periodic review under our corporate asset/liability management process. In determining the "foreseeable future" for these loans, management considers (1) the current economic environment and market conditions, (2) our business strategy and current business plans, (3) the nature and... -

Page 147

... reasonable time frames; x the loan has been classified as a loss by either our internal loan review process or our banking regulatory agencies; x the customer has filed bankruptcy and the loss becomes evident owing to a lack of assets; or x the loan is 180 days past due unless both well-secured and... -

Page 148

... loans, generally by product types with similar risk characteristics, such as residential real estate mortgages and credit cards. As appropriate and to achieve greater accuracy, we may further stratify selected portfolios by sub-product, origination channel, vintage, loss type, geographic location... -

Page 149

... assets on a straight-line basis over the lives of the respective leases. Goodwill and Identifiable Intangible Assets Goodwill is recorded in business combinations under the purchase method of accounting when the purchase price is higher than the fair value of net assets, including identifiable... -

Page 150

... cash flows expected to result from the lease payments and the estimated residual value upon the eventual disposition of the equipment. Liability for Mortgage Loan Repurchase Losses We sell residential mortgage loans to various parties, including (1) government-sponsored entities (GSEs) Federal Home... -

Page 151

...benefits. Foreign taxes paid are generally applied as credits to reduce federal income taxes payable. We account for interest and penalties as a component of income tax expense. Stock-Based Compensation We have stock-based employee compensation plans as more fully discussed in Note 19. Our Long-Term... -

Page 152

... of Significant Accounting Policies (continued) credit loss assumptions and estimated prepayment speeds) discounted at an appropriate market discount rate to reflect the lack of liquidity in the market that a market participant would consider. For other securities where vendor or broker pricing is... -

Page 153

... our open-market common stock repurchase strategies, to allow us to manage our share repurchases in a manner consistent with our capital plans, currently submitted under the 2013 Comprehensive Capital Analysis and Review (CCAR), and to provide an economic benefit to the Company. Our payments to the... -

Page 154

...variable interest entities: Trading assets Available-for-sale securities Loans Long-term debt Consolidation of reverse mortgages previously sold: Loans Long-term debt 5,483 5,425 1,950 (2,268) (354) (40) (245) (293) 7 (599) (628) $ 2013 (77) 47,198 3,616 127 7,610 274 4,470 6,042 750 2012 921 85,108... -

Page 155

... Partners (GP), LLC / EverKey Global Focus (GP), LLC - Bahamas/New York, New York Burdale Financial Holdings Limited / Certain Assets of Burdale Capital Finance, Inc. - England/Stamford, Connecticut Energy Lending Business of BNP Paribas, SA - Houston, Texas Merlin Securities, LLC / Merlin Canada... -

Page 156

... The following table provides the detail of federal funds sold, securities purchased under short-term resale agreements (generally less than one year) and other short-term investments. The majority of interest-earning deposits at December 31, 2013 and 2012, were held at the Federal Reserve. Dec. 31... -

Page 157

..., respectively, at December 31, 2013, and $5.9 billion each at December 31, 2012. The remaining balances in the "Other" category of available-for-sale securities primarily include asset-backed securities collateralized by credit cards, student loans and home equity loans. Included in the "Other... -

Page 158

... of time since the credit-related OTTI write-down. Less than 12 months Gross unrealized (in millions) December 31, 2013 Available-for-sale securities: Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Mortgage-backed securities: Federal agencies... -

Page 159

... rates. We estimate losses to a security by forecasting the underlying mortgage loans in each transaction. We use forecasted loan performance to project cash flows to the various tranches in the structure. We also consider cash flow forecasts and, as applicable, independent industry analyst reports... -

Page 160

... Rating Services (S&P) or Moody's Investors Service (Moody's). Credit ratings express opinions about the credit quality of a security. Securities rated investment grade, that is those rated BBB- or higher by S&P or Baa3 or higher by Moody's, are generally considered by the rating agencies and market... -

Page 161

... 31, 2012 Available-for-sale securities: Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Mortgage-backed securities: Federal agencies Residential Commercial Total mortgage-backed securities Corporate debt securities Collateralized loan and other... -

Page 162

... debt securities, marketable equity securities and nonmarketable equity investments. Year ended December 31, (in millions) OTTI write-downs included in earnings Debt securities: U.S. states and political subdivisions Mortgage-backed securities: Federal agencies Residential Commercial Corporate debt... -

Page 163

... the same securities. Year ended December 31, (in millions) OTTI on debt securities Recorded as part of gross realized losses: Credit-related OTTI Intent-to-sell OTTI Total recorded as part of gross realized losses Changes to OCI for increase (decrease) in non-credit-related OTTI (1): U.S. states... -

Page 164

... prepay the mortgage. The expected remaining life of loan loss rates for commercial MBS with credit impairment losses ranged from 4% to 15%, 3% to 18%, and 4% to 18%, while the current subordination level ranges were 0% to 21%, 0% to 13%, and 3% to 15% for the years ended December 31, 2013, 2012 and... -

Page 165

... underlying economic or market conditions for all geographic areas of our real estate 1-4 family mortgage portfolio as part of our credit risk management process. Some of our real estate 1-4 family first and junior lien mortgage loans include an interest-only feature as part of the loan terms. These... -

Page 166

...loan losses in the same manner because the loans are predominantly insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA). On a net basis, such purchases net of transfers to MHFS were $8.2 billion and $9.8 billion for the year ended 2013 and 2012... -

Page 167

... short-term liquid assets such as accounts receivable or inventory and long-lived asset, such as equipment and other business assets. Collateral requirements for each loan or commitment may vary according to the specific credit underwriting, including terms and structure of loans funded immediately... -

Page 168

... estate 1-4 family junior lien mortgage Credit card Automobile Other revolving credit and installment Total consumer Total loan recoveries Net loan charge-offs (2) Allowances related to business combinations/other (3) Balance, end of year Components: Allowance for loan losses Allowance for unfunded... -

Page 169

...and consumer portfolio segments. Year ended December 31, 2013 (in millions) Balance, beginning of period Provision for credit losses Interest income on certain impaired loans Loan charge-offs Loan recoveries Net loan charge-offs Allowance related to business combinations/other Balance, end of period... -

Page 170

...354 357,221 3,977 361,198 The following table provides past due information for commercial loans, which we monitor as part of our credit risk management practices. Commercial and (in millions) December 31, 2013 By delinquency status: Current-29 DPD and still accruing 30-89 DPD and still accruing 90... -

Page 171

... value) Total consumer loans December 31, 2012 By delinquency status: Current-29 DPD 30-59 DPD 60-89 DPD 90-119 DPD 120-179 DPD 180+ DPD Government insured/guaranteed loans (1) Total consumer loans (excluding PCI) Total consumer PCI loans (carrying value) Total consumer loans $ $ $ $ mortgage... -

Page 172

...the U.S. Department of Education under FFELP. LTV refers to the ratio comparing the loan's unpaid principal balance to the property's collateral value. CLTV refers to the combination of first mortgage and junior lien mortgage (including unused line amounts for credit line products) ratios. LTVs and... -

Page 173

... default, the loss content would generally be limited to only the amount in excess of 100% LTV/CLTV. (2) Represents loans whose repayments are predominantly insured by the FHA or guaranteed by the VA. NONACCRUAL LOANS The following table provides loans on nonaccrual status. PCI loans are excluded... -

Page 174

... insured by the FHA or guaranteed by the VA for mortgages and the U.S. Department of Education for student loans under the FFELP were $22.2 billion at December 31, 2013, up from $21.8 billion at December 31, 2012. The following table shows non-PCI loans 90 days or more past due and still... -

Page 175

... or otherwise have zero recorded investment. (2) At December 31, 2013 and December 31, 2012, includes the recorded investment of $2.5 billion and $1.9 billion, respectively, of government insured/guaranteed loans that are predominantly insured by the FHA or guaranteed by the VA and generally do not... -

Page 176

... on accruing TDRs, interest recognized related to certain impaired loans which have an allowance calculated using discounting, and amortization of purchase accounting adjustments related to certain impaired loans. See footnote 1 to the table of changes in the allowance for credit losses. 174 -

Page 177

... not consider any loans modified through a loan resolution such as foreclosure or short sale to be a TDR. We may require some borrowers experiencing financial difficulty to make trial payments generally for a period of three to four months, according to the terms of a planned permanent modification... -

Page 178

... family junior lien mortgage Credit card Automobile Other revolving credit and installment Trial modifications (6) Total consumer Total Year ended December 31, 2012 Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Foreign Total commercial Consumer... -

Page 179

... 2,134 Purchased Credit-Impaired Loans Substantially all of our PCI loans were acquired from Wachovia on December 31, 2008. The following table presents PCI loans net of any remaining purchase accounting adjustments. Real estate 1-4 family first mortgage PCI loans are predominantly Pick-a-Pay loans... -

Page 180

... noninterest income due to sales (2) Reclassification from nonaccretable difference for loans with improving credit-related cash flows Changes in expected cash flows that do not affect nonaccretable difference (3) Total, end of year $ $ 2013 18,548 1 (151) 971 (144) 17,392 2012 15,961 3 (5) 1,141... -

Page 181

..., December 31, 2011 Provision for losses due to credit deterioration Charge-offs Balance, December 31, 2012 Reversal of provision for losses Charge-offs Balance, December 31, 2013 $ $ Commercial 850 (520) 330 712 (776) 266 106 (207) 165 25 (102) 88 (52) (10) 26 Pick-a-Pay consumer 3 3 59 (30) 32 54... -

Page 182

... the remaining purchase accounting adjustments, which were established at a pool level. The following table provides the delinquency status of consumer PCI loans. December 31, 2013 Real estate Real estate 1-4 family 1-4 family junior lien mortgage Total first mortgage December 31, 2012 Real estate... -

Page 183

...by CLTV Total December 31, 2012 Real estate Real estate 1-4 family first mortgage by LTV 1-4 family junior lien mortgage by CLTV Total (1) Reflects total loan balances with LTV/CLTV amounts in excess of 100%. In the event of default, the loss content would generally be limited to only the amount in... -

Page 184

... Total equity method Fair value (2) Total nonmarketable equity investments Corporate/bank-owned life insurance Accounts receivable Interest receivable Core deposit intangibles Customer relationship and other amortized intangibles Foreclosed assets: Government insured/guaranteed (3) Non-government... -

Page 185

...: • underwriting securities issued by SPEs and subsequently making markets in those securities; providing liquidity facilities to support short-term • obligations of SPEs issued to third party investors; providing credit enhancement on securities issued by SPEs • or market value guarantees of... -

Page 186

... 31, 2013 Cash Trading assets Investment securities (1) Mortgages held for sale Loans Mortgage servicing rights Other assets Total assets Short-term borrowings Accrued expenses and other liabilities Long-term debt Total liabilities Noncontrolling interests Net assets December 31, 2012 Cash Trading... -

Page 187

... and guarantees Net assets Maximum exposure to loss Other Debt and equity interests Residential mortgage loan securitizations: Conforming (4) Other/nonconforming Commercial mortgage securitizations Collateralized debt obligations: Debt securities Loans (2) Asset-based finance structures Tax credit... -

Page 188

...current, and over 72% and 83% were rated as investment grade by the primary rating agencies at December 31, 2013 and 2012, respectively. These senior loans are accounted for at amortized cost and are subject to the Company's allowance and credit charge-off policies. (3) Includes structured financing... -

Page 189

... mortgage loan securitizations are financed through the issuance of fixed- or floating-rate-asset-backed-securities, which are collateralized by the loans transferred to a VIE. We typically transfer loans we originated to these VIEs, account for the transfers as sales, retain the right to service... -

Page 190

...is indicative of power in them. INVESTMENT FUNDS We do not consolidate the investment OTHER TRANSACTIONS WITH VIEs Auction rate securities (ARS) are debt instruments with long-term maturities, but which re-price more frequently, and preferred equities with no maturity. At December 31, 2013, we held... -

Page 191

... 31, 2013 Other Mortgage (in millions) Sales proceeds from securitizations (1) Fees from servicing rights retained Other interests held Purchases of delinquent assets Servicing advances, net of repayments (1) Represents cash flow data for all loans securitized in the period presented. 2012 Other... -

Page 192

... Cost to service assumption ($ per loan) Decrease in fair value from: 10% adverse change 25% adverse change Credit loss assumption Decrease in fair value from: 10% higher losses 25% higher losses Fair value of interests held at December 31, 2012 Expected weighted-average life (in years) Key economic... -

Page 193

...form of continuing involvement, we would only experience a loss if required to repurchase a delinquent loan due to a breach in representations and warranties associated with our loan sale or servicing contracts. Net charge-offs Total loans December 31, (in millions) Commercial: Real estate mortgage... -

Page 194

... form of limited recourse and liquidity to facilitate the remarketing of short-term securities issued to third party investors. Other than this limited contractual support, the assets of the VIEs are the sole source of repayment of the securities held by third parties. MUNICIPAL TENDER OPTION BOND... -

Page 195

... the right to receive benefits and bear losses that are proportional to owning the underlying municipal bonds in the trusts. The trusts obtain financing by issuing floating-rate trust certificates that reprice on a weekly or other basis to third-party investors. Under certain conditions, if we elect... -

Page 196

...deposit balances). (3) Includes costs to service and unreimbursed foreclosure costs. (4) Reflects discount rate assumption change, excluding portion attributable to changes in mortgage interest rates; the year ended December 31, 2012, change reflects increased capital return requirements from market... -

Page 197

... fair value Net derivative gains (losses) from economic hedges (4) Total servicing income, net Net gains on mortgage loan origination/sales activities Total mortgage banking noninterest income Market-related valuation changes to MSRs, net of hedge results (2) + (4) (1) (2) (3) (4) 2013 2012 2011... -

Page 198

...mortgage loan repurchase losses is difficult to estimate and requires considerable management judgment. We maintain regular contact with the GSEs, the Federal Housing Finance Agency (FHFA), and other significant investors to monitor their repurchase demand practices and issues as part of our process... -

Page 199

... on management reporting. The following table shows the allocation of goodwill to our reportable operating segments for purposes of goodwill impairment testing. Wealth, Community (in millions) December 31, 2011 Goodwill from business combinations December 31, 2012 December 31, 2013 $ $ $ Banking 17... -

Page 200

... Commercial paper Other short-term borrowings Total Year ended December 31, Average daily balance Federal funds purchased and securities sold under agreements to repurchase Commercial paper Other short-term borrowings Total Maximum month-end balance Federal funds purchased and securities sold under... -

Page 201

... hybrid trust securities Floating-rate notes Total junior subordinated debt - Parent (3) Total long-term debt - Parent (2) Wells Fargo Bank, N.A. and other bank entities (Bank) Senior Fixed-rate notes Floating-rate notes Floating-rate extendible notes (4) Fixed-rate advances - Federal Home Loan Bank... -

Page 202

... a periodic basis. (5) At December 31, 2013, Federal Home Loan Bank advances are secured by residential loan collateral. Outstanding advances at December 31, 2012, were secured by investment securities and residential loan collateral. (6) For additional information on VIEs, see Note 8. (7) Primarily... -

Page 203

...to loss includes direct pay letters of credit (DPLCs) of $16.8 billion and $18.5 billion at December 31, 2013 and December 31, 2012, respectively. We issue DPLCs to provide credit enhancements for certain bond issuances. Beneficiaries (bond trustees) may draw upon these instruments to make scheduled... -

Page 204

... fixed-rate municipal bonds and consumer or commercial assets that are partially funded with the issuance of money market and other short-term notes. See Note 8 for additional information on securitizations and VIEs. WRITTEN PUT OPTIONS Written put options are contracts a securities lending... -

Page 205

...management, insurance agency and other acquisitions we have made, the terms of the acquisition agreements provide for deferred payments or additional consideration, based on certain performance targets. OTHER GUARANTEES We are members of exchanges and clearing houses that we use to clear our trades... -

Page 206

..., respectively, classified on our consolidated balance sheet in Federal funds sold, securities purchased under resale agreements and other short-term investments and $10.1 billion and $9.5 billion, respectively, in Loans. (3) Represents the fair value of non-cash collateral we have received under... -

Page 207

... affiliated business and instead operated to conceal Wells Fargo Bank, N.A.'s role in the loans at issue. A plaintiff class of borrowers who received a mortgage loan from Prosperity Mortgage Company that was funded by Prosperity Mortgage Company's line of credit with Wells Fargo Bank, N.A. from... -

Page 208

... and Wells Fargo Bank, N.A., as well as many other banks, challenging the high to low order in which the banks post debit card transactions to consumer deposit accounts. There are currently several such cases pending against Wells Fargo Bank (including the Wachovia Bank cases to which Wells Fargo... -

Page 209

... Credit contracts - protection purchased Other derivatives Subtotal Customer accommodation, trading and other free-standing derivatives: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts - protection sold Credit contracts - protection purchased... -

Page 210

...) The following table provides information on the gross fair values of derivative assets and liabilities, the balance sheet netting adjustments and the resulting net fair value amount recorded on our balance sheet, as well as the non-cash collateral associated with such arrangements. We execute... -

Page 211

... Gross amounts offset in Net amounts in Gross amounts (in millions) December 31, 2013 Derivative assets Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts-protection sold Credit contracts-protection purchased Other contracts Total derivative... -

Page 212

... million and $53 million, respectively, for years ended December 31, 2013, 2012, and 2011 of the time value component recognized as net interest income (expense) on forward derivatives hedging foreign currency available-for-sale securities and long-term debt that were excluded from the assessment of... -

Page 213

... each period end is due to changes in the underlying market indices and interest rates as well as the purchase and sale of derivative financial instruments throughout the period as part of our dynamic MSR risk management process. Interest rate lock commitments for residential mortgage loans that we... -

Page 214

.... Year ended December 31, (in millions) Net gains (losses) recognized on free-standing derivatives (economic hedges): Interest rate contracts Recognized in noninterest income: Mortgage banking (1) Other (2) Equity contracts (3) Foreign exchange contracts (2) Credit contracts (2) Subtotal Net gains... -

Page 215

... sold nonFair value (in millions) December 31, 2013 Credit default swaps on: Corporate bonds Structured products Credit protection on: Default swap index Commercial mortgagebacked securities index Asset-backed securities index Other Total credit derivatives December 31, 2012 Credit default swaps... -

Page 216

... including determining the legal enforceability of the arrangement, it is our policy to present derivative balances and related cash collateral amounts net on the balance sheet. We incorporate credit valuation adjustments (CVA) to reflect counterparty credit risk in determining the fair value of our... -

Page 217

...is based upon various sources of market pricing. We use quoted prices in active markets, where available, and classify such instruments within Level 1 of the fair value hierarchy. Examples include exchange-traded equity securities and some highly liquid government securities, such as U.S. Treasuries... -

Page 218

... and junior lien mortgages, we calculate fair value by discounting contractual cash flows, adjusted for prepayment and credit loss estimates, using discount rates based on current industry pricing (where readily available) or our own estimate of an appropriate discount rate for loans of similar size... -

Page 219

... whether the underlying securities have readily obtainable quoted prices in active exchange markets. LONG-TERM DEBT Long-term debt is generally carried at amortized cost. For disclosure, we are required to estimate the fair value of long-term debt. Generally, the discounted cash flow method is used... -

Page 220

... have processes in place to approve such vendors to ensure information obtained and valuation techniques used are appropriate. Once these vendors are approved to provide pricing information, we monitor and review the results to ensure the fair values are reasonable and in line with market experience... -

Page 221

... 31, 2012 Trading assets (excluding derivatives) Available-for-sale securities: Securities of U.S. Treasury and federal agencies Securities of U.S. states and political subdivisions Mortgage-backed securities Other debt securities (1) Total debt securities Total marketable equity securities Total... -

Page 222

... securities Total available-for-sale securities Mortgages held for sale Loans held for sale Loans Mortgage servicing rights (residential) Derivative assets: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Netting... -

Page 223

... securities Total available-for-sale securities Mortgages held for sale Loans held for sale Loans Mortgage servicing rights (residential) Derivative assets: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Netting... -

Page 224

... Fair Value Levels Level 1 (in millions) Year ended December 31, 2013 Trading assets (excluding derivatives) (2) Available-for-sale securities (2)(3) Mortgages held for sale Loans Net derivative assets and liabilities (4) Short sale liabilities Total transfers Year ended December 31, 2012 Trading... -

Page 225

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) (8) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 226

... securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Total derivative contracts Other assets Short... -

Page 227

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) (7) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 228

... securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Total derivative contracts Other assets Short... -

Page 229

... equity securities Total marketable equity securities Total available-for-sale securities Mortgages held for sale Loans Mortgage servicing rights (residential) (7) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 230

... securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Total derivative contracts Other assets Short... -

Page 231

... rate preferred equity securities with no maturity date that are callable by the issuer. Consists predominantly of reverse mortgage loans securitized with GNMA which were accounted for as secured borrowing transactions. The high end of the range of inputs is for servicing modified loans. For non... -

Page 232

... of auction rate preferred equity securities with no maturity date that are callable by the issuer. (6) Consists predominantly of reverse mortgage loans securitized with GNMA which were accounted for as secured borrowing transactions. (7) The high end of the range of inputs is for servicing modified... -

Page 233

... in basis points of outstanding unpaid principal balance. Loss severity - is the percentage of contractual cash flows lost in the event of a default. Prepayment rate - is the estimated rate at which forecasted prepayments of principal of the related loan or debt instrument are expected to occur... -

Page 234

... may counteract or magnify the fair value impact. SECURITIES, LOANS and MORTGAGES HELD FOR SALE The fair values of predominantly all Level 3 trading securities, mortgages held for sale, loans, other nonmarketable equity investments, and available-for-sale securities have consistent inputs, valuation... -

Page 235

... value hierarchy and carrying amount of all assets that were still held as of December 31, 2013, and 2012, and for which a nonrecurring fair adjustment was recorded during the years then ended. December 31, 2013 (in millions) Mortgages held for sale (LOCOM) (1) Loans held for sale Loans: Commercial... -

Page 236

... 31, 2012 Residential mortgages held for sale (LOCOM) $ 1,045 (3) Discounted cash flow Default rate(5) Discount rate Loss severity Prepayment rate (6) Insignificant level 3 assets Total 148 1,193 2.9 4.1 2.0 1.0 21.2 % 11.9 45.0 100.0 7.9 % 10.9 6.0 66.7 505 242 1,640 Market comparable pricing... -

Page 237

...investments with a fair value of $144 million and $189 million at December 31, 2013 and December 31, 2012, respectively, due to lock-up provisions that will remain in effect until October 2015. Private equity funds invest in equity and debt securities issued by private and publicly-held companies in... -

Page 238

... of credit are included in trading account assets or liabilities, and the nonmarketable equity securities are included in other assets. Loans that we measure at fair value consist predominantly of reverse mortgage loans previously transferred under a GNMA reverse mortgage securitization program... -

Page 239

...-specific credit risk related to assets accounted for under the fair value option. Year ended December 31, (in millions) Gains (losses) attributable to instrument-specific credit risk: Mortgages held for sale Loans held for sale Total $ $ 126 126 (124) 21 (103) (144) 32 (112) 2013 2012 2011... -

Page 240

... Mortgages held for sale (2) Loans held for sale (2) Loans, net (3) Nonmarketable equity investments (cost method) Financial liabilities Deposits Short-term borrowings (1) Long-term debt (4) December 31, 2012 Financial assets Cash and due from banks (1) Federal funds sold, securities purchased... -

Page 241

... for additional information about the liquidation preference for the ESOP Cumulative Preferred Stock. December 31, 2013 Shares issued and outstanding 96,546 $ 25,010 2,150,375 3,352,000 3,968,000 30,000 26,000 25,000 69,000 33,600 1,105,664 10,881,195 $ Par Carrying value value Discount 2,501 2,150... -

Page 242

... reserve of the 401(k) Plan is converted into shares of our common stock based on the stated value of the ESOP Preferred Stock and the then current market price of our common stock. The ESOP Preferred Stock is also convertible at the option of the holder at any time, unless previously redeemed. We... -

Page 243

...stock direct purchase plans may purchase shares of our common stock at fair market value by reinvesting dividends and/or making optional cash payments, under the plan's terms. Employee Stock Plans We offer stock-based employee compensation plans as described below. For information on our accounting... -

Page 244

... into stock options to purchase our common stock based on the terms of the original stock option plan and the agreed-upon exchange ratio. In addition, we converted restricted stock awards into awards that entitle holders to our stock after the vesting conditions are met. Holders receive cash... -

Page 245

... benefit plans, market conditions (including the trading price of our stock), and regulatory and legal considerations. These factors can change at any time, and there can be no assurance as to the number of shares we will repurchase or when we will repurchase them. The fair value of each option... -

Page 246

... which are allocated to the 401(k) Plan participants and invested in the Wells Fargo ESOP Fund within the 401(k) Plan. The balance of common stock and unreleased preferred stock held in the Wells Fargo ESOP fund, the fair value of unreleased ESOP preferred stock and the dividends on allocated shares... -

Page 247

... value of plan assets, the funded status and the amounts recognized on the balance sheet were: December 31, 2013 Pension benefits Non(in millions) Change in benefit obligation: Benefit obligation at beginning of year Service cost Interest cost Plan participants' contributions Actuarial loss (gain... -

Page 248

...value of plan assets $ 2013 10,822 10,820 9,364 2012 12,391 12,389 9,490 The components of net periodic benefit cost and other comprehensive income were: December 31, 2013 Pension benefits Non(in millions) Service cost Interest cost Expected return on plan assets Amortization of net actuarial loss... -

Page 249

... 2013 Pension benefits Non(in millions) Net actuarial loss (gain) Net prior service credit Net transition obligation Total $ $ Qualified 1,887 (2) 1,885 qualified 148 148 Other benefits (321) (22) (343) Qualified 3,323 (2) 3,321 Pension benefits Nonqualified 184 184 Other benefits 19 (25) 1 (5) 2012... -

Page 250

... expected long-term rate of return with a prudent level of risk given the benefit obligations of the pension plans and their funded status. Our overall investment strategy is designed to provide our Cash Balance Plan with long-term growth opportunities while ensuring that risk is mitigated through... -

Page 251

... Domestic small-cap stocks (4) International stocks (5) Emerging market stocks Real estate/timber (6) Hedge funds (7) Private equity Other Total plan investments Payable upon return of securities loaned Net receivables Total plan assets December 31, 2012 Cash and cash equivalents Long duration fixed... -

Page 252

...companies valued at the NAV of shares held at year end. Long Duration, Intermediate (Core), High-Yield, and International Fixed Income - includes investments traded on the secondary markets; prices are measured by using quoted market prices for similar securities, pricing models, and discounted cash... -

Page 253