Wells Fargo 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital Management (continued)

imposed by regulators at their discretion if it is determined

that a period of excessive credit growth is contributing to an

increase in systemic risk;

x revise “Basel I” rules for calculating risk-weighted assets to

enhance risk sensitivity;

x modify the existing Basel II advanced approaches rules for

calculating risk-weighted assets to implement Basel III; and

x comply with the Dodd-Frank Act provision prohibiting the

reliance on external credit ratings.

Although the proposals contemplated an effective date of

January 1, 2013, with phased in compliance requirements, the

rules have not yet been finalized by the U.S. banking regulators

due to the volume of comments received and concerns expressed

during the comment period. The notices of proposed rulemaking

did not address the BCBS capital surcharge proposals for G-SIBs

or the proposed Basel III liquidity standards. U.S. regulatory

authorities have indicated that these proposals will be addressed

at a later date. The U.S. banking regulators have approved a final

rule to implement changes to the market risk capital rule, which

requires banking organizations with significant trading activities

to adjust their capital requirements to better account for the

market risks of those activities.

Although uncertainty exists regarding final capital rules, we

evaluate the impact of Basel III on our capital ratios based on

our interpretation of the proposed capital requirements and we

estimate that our Tier 1 common equity ratio under the Basel III

capital proposals exceeded the fully phased-in minimum of 7.0%

by 119 basis points at December 31, 2012. The proposed Basel III

capital rules and interpretations and assumptions used in

estimating our Basel III calculations are subject to change

depending on final promulgation of Basel III capital rulemaking.

In October 2012, the FRB issued final rules regarding stress

testing requirements as required under the Dodd-Frank Act

provision imposing enhanced prudential standards on large

bank holding companies (BHCs) such as Wells Fargo. The OCC

issued and finalized similar rules during 2012 for stress testing

of large national banks. These stress testing rules, which became

effective for Wells Fargo on November 15, 2012, set forth the

timing and type of stress test activities large BHCs and banks

must undertake as well as rules governing testing controls,

oversight and disclosure requirements.

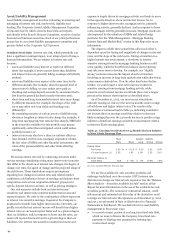

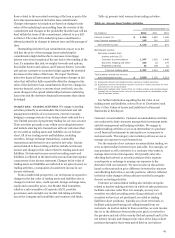

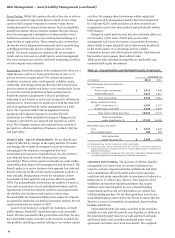

Table 49 and Table 50, which appear at the end of this

Capital Management section, provide information regarding our

Tier 1 common equity calculations under Basel I and as

estimated under Basel III, respectively.

Capital Planning

In late 2011, the FRB finalized rules to require large BHCs to

submit capital plans annually for review to determine if the FRB

had any objections before making any capital distributions. The

rule requires updates to capital plans in the event of material

changes in a BHC’s risk profile, including as a result of any

significant acquisitions.

On March 13, 2012, the FRB notified us that it did not object

to our 2012 capital plan included in the 2012 Comprehensive

Capital Analysis and Review (CCAR). Since the FRB notification,

the Company took several capital actions during 2012, including

increasing its quarterly common stock dividend rate to

$0.22 per share, completing the redemption of $2.7 billion of

trust preferred securities that will no longer count as Tier 1

capital under the Dodd-Frank Act and the proposed Basel III

capital standards, repurchasing shares of our common stock,

and purchasing an aggregate of $2.2 billion of our subordinated

debt with an effective yield of 2.02% in tender offers for such

securities. In January 2013, the Company increased its dividend

to $0.25 per share and submitted for redemption an additional

$2.8 billion of trust preferred securities. Each of these actions

was contemplated by the capital plan included in the 2012

CCAR.

Under the FRB’s capital plan rule, our 2013 CCAR included a

comprehensive capital plan supported by an assessment of

expected uses and sources of capital over a given planning

horizon under a range of expected and stress scenarios, similar

to the process the FRB used to conduct a CCAR in 2012. As part

of the 2013 CCAR, the FRB also generated a supervisory stress

test driven by a sharp decline in the economy and significant

decline in asset pricing using the information provided by the

Company to estimate performance. The FRB is expected to

review the supervisory stress results both as required under the

Dodd-Frank Act using a common set of capital actions for all

large BHCs and by taking into account the Company’s proposed

capital actions. We submitted our board approved 2013 capital

plan to the FRB on January 4, 2013. The FRB has indicated that

it will publish its supervisory stress test results as required

under the Dodd-Frank Act on March 7, 2013, and the related

CCAR results taking into account the Company’s proposed

capital actions on March 14, 2013.

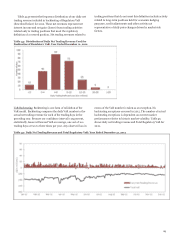

Securities Repurchases

From time to time the Board authorizes the Company to

repurchase shares of our common stock. Although we announce

when the Board authorizes share repurchases, we typically do

not give any public notice before we repurchase our shares.

Future stock repurchases may be private or open-market

repurchases, including block transactions, accelerated or

delayed block transactions, forward transactions, and similar

transactions. Additionally, we may enter into plans to purchase

stock that satisfy the conditions of Rule 10b5-1 of the Securities

Exchange Act of 1934. Various factors determine the amount

and timing of our share repurchases, including our capital

requirements, the number of shares we expect to issue for

employee benefit plans and acquisitions, market conditions

(including the trading price of our stock), and regulatory and

legal considerations, including the FRB’s response to our capital

plan and to changes in our risk profile.

In first quarter 2011, the Board authorized the repurchase of

200 million shares of our common stock, which was completed

in 2012. In October 2012, the Board authorized the repurchase

of an additional 200 million shares. At December 31, 2012, we

had remaining authority under this authorization to purchase

approximately 198 million shares, subject to regulatory and legal

conditions. For more information about share repurchases

during 2012, see Part II, Item 5 of our 2012 Form 10-K.

Historically, our policy has been to repurchase shares under

the “safe harbor” conditions of Rule 10b-18 of the Securities

90