Wells Fargo 2012 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

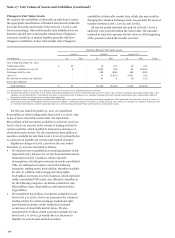

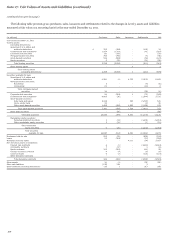

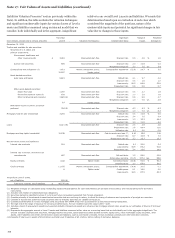

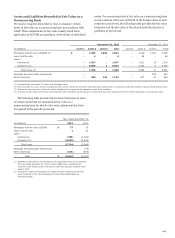

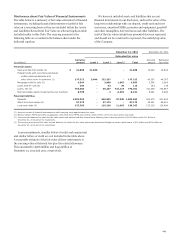

Note 17: Fair Values of Assets and Liabilities (continued)

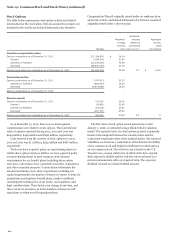

The table below provides quantitative information about the

valuation techniques and significant unobservable inputs used in

the valuation of substantially all of our Level 3 assets and

liabilities measured at fair value on a nonrecurring basis for

which we use an internal model.

We have excluded from the table classes of Level 3 assets and

liabilities measured using an internal model that we consider,

both individually and in the aggregate, insignificant relative to

our overall Level 3 nonrecurring measurements. We made this

determination based upon an evaluation of each class which

considered the magnitude of the positions, nature of the

unobservable inputs and potential for significant changes in fair

value due to changes in those inputs.

Fair Value Significant Range Weighted

($ in millions) Level 3 Valuation Technique(s) (1) Unobservable Inputs (1) of inputs Average (2)

December 31, 2012

Residential mortgages held for sale

(LOCOM) $ 1,045 (3) Discounted cash flow Default rate (4) 2.9 - 21.2 % 7.9 %

Discount rate 4.1 - 11.9 10.9

Loss severity 2.0 - 45.0 6.0

Prepayment rate (5) 1.0 - 100.0 66.7

Insignificant level 3 assets 148

Total 1,193

(1) Refer to the narrative following the recurring quantitative Level 3 table of this Note for a definition of the valuation technique(s) and significant unobservable inputs.

(2) Weighted averages are calculated using outstanding unpaid principal balance of the loans.

(3) Consists of approximately $942 million government insured/guaranteed loans purchased from GNMA-guaranteed mortgage securitization and $103 million of other mortgage

loans which are not government insured/guaranteed.

(4) Applies only to non-government insured/guaranteed loans.

(5) Includes the impact on prepayment rate of expected defaults for the government insured/guaranteed loans, which impacts the frequency and timing of early resolution of

loans.

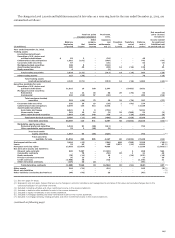

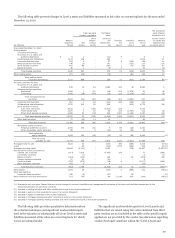

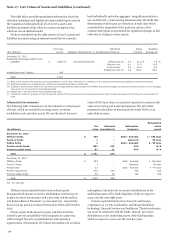

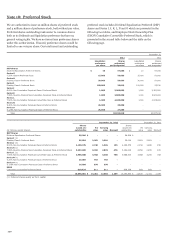

Alternative Investments

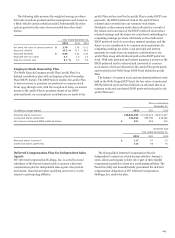

The following table summarizes our investments in various types

of funds, which are included in trading assets, securities

available for sale and other assets. We use the funds’ net asset

values (NAVs) per share as a practical expedient to measure fair

value on recurring and nonrecurring bases. The fair values

presented in the table are based upon the funds’ NAVs or an

equivalent measure.

Redemption

Fair Unfunded Redemption notice

(in millions) value commitments frequency period

December 31, 2012

Offshore funds $ 379 - Daily - Annually 1 - 180 days

Funds of funds 1 - Quarterly 90 days

Hedge funds 2 - Daily - Annually 5 - 95 days

Private equity funds 807 195 N/A N/A

Venture capital funds 82 21 N/A N/A

Total $ 1,271 216

December 31, 2011

Offshore funds $ 352 - Daily - Annually 1 - 180 days

Funds of funds 1 - Quarterly 90 days

Hedge funds 22 - Daily - Annually 5 - 95 days

Private equity funds 976 240 N/A N/A

Venture capital funds 83 28 N/A N/A

Total $ 1,434 268

N/A - Not applicable

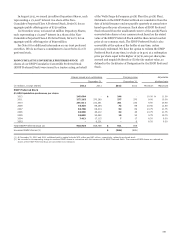

Offshore funds primarily invest in investment grade

European fixed-income securities. Redemption restrictions are

in place for these investments with a fair value of $189 million

and $200 million at December 31, 2012 and 2011, respectively,

due to lock-up provisions that will remain in effect until October

2015.

Private equity funds invest in equity and debt securities

issued by private and publicly-held companies in connection

with leveraged buyouts, recapitalizations and expansion

opportunities. Substantially all of these investments do not allow

redemptions. Alternatively, we receive distributions as the

underlying assets of the funds liquidate, which we expect to

occur over the next eight years.

Venture capital funds invest in domestic and foreign

companies in a variety of industries, including information

technology, financial services and healthcare. These investments

can never be redeemed with the funds. Instead, we receive

distributions as the underlying assets of the fund liquidate,

which we expect to occur over the next five years.

216