Wells Fargo 2012 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

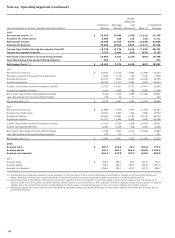

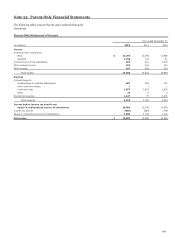

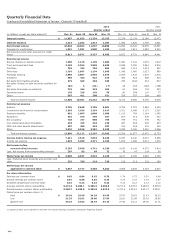

Note 24: Operating Segments (continued)

Wealth,

Brokerage

Community Wholesale and Consolidated

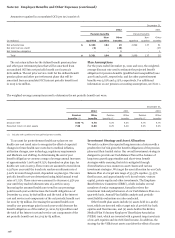

(income/expense in millions, average balances in billions) Banking Banking Retirement Other (1) Company

2012

Net interest income (2) $ 29,045 12,648 2,768 (1,231) 43,230

Provision for credit losses 6,835 286 125 (29) 7,217

Noninterest income 24,360 11,444 9,392 (2,340) 42,856

Noninterest expense 30,840 12,082 9,893 (2,417) 50,398

Income (loss) before income tax expense (benefit) 15,730 11,724 2,142 (1,125) 28,471

Income tax expense (benefit) 4,774 3,943 814 (428) 9,103

Net income (loss) before noncontrolling interests 10,956 7,781 1,328 (697) 19,368

Less: Net income from noncontrolling interests 464 7 - - 471

Net income (loss) (3) $ 10,492 7,774 1,328 (697) 18,897

2011

Net interest income (2) $ 29,657 11,616 2,844 (1,354) 42,763

Provision (reversal of provision) for credit losses 7,976 (110) 170 (137) 7,899

Noninterest income 21,124 9,952 9,333 (2,224) 38,185

Noninterest expense 29,252 11,177 9,934 (970) 49,393

Income (loss) before income tax expense (benefit) 13,553 10,501 2,073 (2,471) 23,656

Income tax expense (benefit) 4,104 3,495 785 (939) 7,445

Net income (loss) before noncontrolling interests 9,449 7,006 1,288 (1,532) 16,211

Less: Net income from noncontrolling interests 316 19 7 - 342

Net income (loss) (3) $ 9,133 6,987 1,281 (1,532) 15,869

2010

Net interest income (2) $ 31,885 11,474 2,707 (1,309) 44,757

Provision for credit losses 13,807 1,920 334 (308) 15,753

Noninterest income 22,604 10,951 9,023 (2,125) 40,453

Noninterest expense 30,071 11,269 9,768 (652) 50,456

Income (loss) before income tax expense (benefit) 10,611 9,236 1,628 (2,474) 19,001

Income tax expense (benefit) 3,347 3,315 616 (940) 6,338

Net income (loss) before noncontrolling interests 7,264 5,921 1,012 (1,534) 12,663

Less: Net income from noncontrolling interests 274 20 7 - 301

Net income (loss) (3) $ 6,990 5,901 1,005 (1,534) 12,362

2012

Average loans $ 487.1 273.8 42.7 (28.4) 775.2

Average assets 761.1 481.7 164.6 (65.8) 1,341.6

Average core deposits 591.2 227.0 137.5 (61.8) 893.9

2011

Average loans $ 496.3 249.1 43.0 (31.3) 757.1

Average assets 752.3 428.1 155.2 (65.3) 1,270.3

Average core deposits 556.3 202.1 130.0 (61.7) 826.7

(1) Includes Wachovia integration expenses, through completion in the first quarter of 2012, and the elimination of items that are included in both Community Banking and

Wealth, Brokerage and Retirement, largely representing services and products for wealth management customers provided in Community Banking stores.

(2) Net interest income is the difference between interest earned on assets and the cost of liabilities to fund those assets. Interest earned includes actual interest earned on

segment assets and, if the segment has excess liabilities, interest credits for providing funding to other segments. The cost of liabilities includes interest expense on segment

liabilities and, if the segment does not have enough liabilities to fund its assets, a funding charge based on the cost of excess liabilities from another segment.

(3) Represents segment net income (loss) for Community Banking; Wholesale Banking; and Wealth, Brokerage and Retirement segments and Wells Fargo net income for the

consolidated company.

238