Wells Fargo 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.as the impact will be recognized over a period of years in the

form of lower interest income as qualified borrowers benefit

from reduced interest rates on loans refinanced under the

Refinance Program. The impact of this forgone interest income

on our future net interest margin is anticipated to be modestly

adverse and will be influenced by the overall mortgage interest

rate environment. The Refinance Program also affects our fair

value for these loans. The estimated reduction of the fair value of

our loans for the Refinance Program is approximately

$1.0 billion to $1.2 billion, based upon the range of loans we

estimate will be refinanced.

The expectations discussed above about the volume of loans

that we are refinancing, the resulting reduction in our lifetime

and annual interest income, and the reductions in fair value of

loans for the Refinance Program exceed the amounts that would

result from just meeting our minimum commitments under the

Program due to the significantly higher than expected response

we have received from our customers, which was partially driven

by product changes and the decision to hold interest rates

consistent with the prevailing market environment.

Although the Refinance Program relates to borrowers in good

standing as to their payment history who are not experiencing

financial difficulty, we evaluate each borrower to confirm their

ability to repay their mortgage obligation. This evaluation

includes reviewing key credit and underwriting policy metrics to

validate that these borrowers are not experiencing financial

difficulty and therefore, actions taken under the Refinance

Program are not generally be considered a TDR. To the extent

we determine that an eligible borrower is experiencing financial

difficulty, we generally consider alternative modification

programs that are intended for loans that may be classified and

accounted for as a TDR.

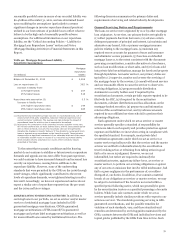

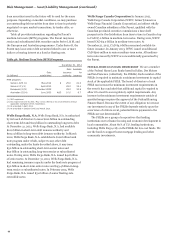

Independent Foreclosure Review (IFR) Settlement

On January 7, 2013, we announced that, along with nine

other mortgage servicers, we entered into term sheets with the

OCC and the FRB that provide the parties will enter into

amendments to the Consent Orders, which would end our IFR

programs created by Article VII of an April 2011 Interagency

Consent Order and replace it with an accelerated remediation

process. The amendments to the Consent Orders have not yet

been entered into with the OCC or FRB.

In aggregate, the servicers have agreed to make direct, cash

payments of $3.3 billion and to provide $5.2 billion in additional

assistance, such as loan modifications, to consumers. Our

portion of the cash settlement is $766 million, which is based on

the proportionate share of Wells Fargo-serviced loans in the

overall IFR population. We fully accrued the cash portion of the

settlement in 2012, along with other remediation-related costs.

We also committed to foreclosure prevention actions which

include first and second lien modifications and short

sales/deeds-in-lieu of foreclosure on $1.2 billion of loans. We

anticipate meeting this commitment primarily through first lien

modification and short sale activities. We are required to meet

this commitment within two years of signing the agreement and

we anticipate that we will be able to meet our commitment

within the required timelines. This commitment did not result in

any charge as we believe that this commitment is covered

through the existing allowance for credit losses and the

nonaccretable difference relating to the purchased credit-

impaired loan portfolios. With this settlement, after incurring

some trailing expenses in the first quarter of 2013, we will no

longer incur costs associated with the independent foreclosure

reviews, which approximated $125 million per quarter during

2012 for external consultants and additional staffing.

79