Wells Fargo 2012 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

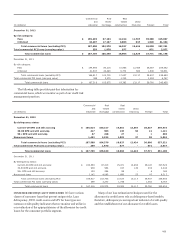

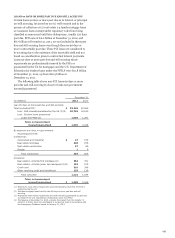

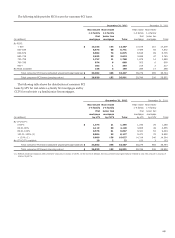

Commitments to lend additional funds on loans whose terms

have been modified in a TDR amounted to $421 million at

December 31, 2012, and $3.8 billion at December 31, 2011.

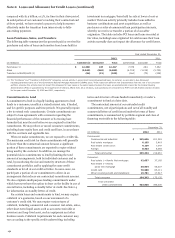

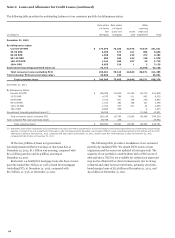

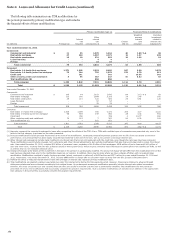

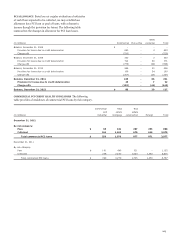

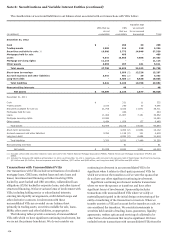

The following tables provide the average recorded investment

in impaired loans and the amount of interest income recognized

on impaired loans by portfolio segment and class.

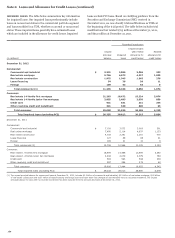

Year ended December 31,

2012 2011 2010

Average Recognized Average Recognized Average Recognized

recorded interest recorded interest recorded interest

(in millions) investment income investment income investment income

Commercial:

Commercial and industrial $ 2,281 111 3,282 105 4,098 64

Real estate mortgage 4,821 119 5,308 80 4,598 41

Real estate construction 1,818 61 2,481 70 3,203 28

Lease financing 57 1 80 - 166 -

Foreign 36 1 29 - 47 -

Total commercial 9,013 293 11,180 255 12,112 133

Consumer:

Real estate 1-4 family first mortgage 15,750 803 13,592 700 9,221 494

Real estate 1-4 family

junior lien mortgage 2,193 80 1,962 76 1,443 55

Credit card 572 63 594 21 360 13

Other revolving credit and installment 324 44 270 27 132 3

Total consumer 18,839 990 16,418 824 11,156 565

Total impaired loans (excluding PCI) $ 27,852 1,283 $ 27,598 1,079 $ 23,268 698

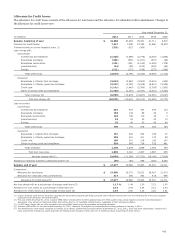

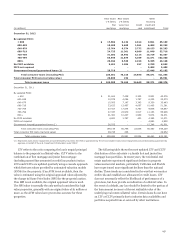

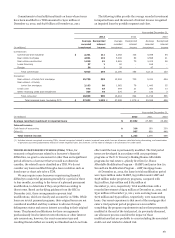

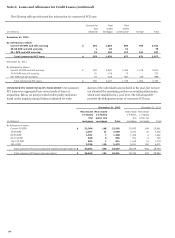

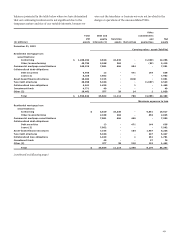

Year ended December 31,

(in millions) 2012 2011 2010

Average recorded investment in impaired loans $ 27,852 27,598 23,268

Interest income:

Cash basis of accounting $ 316 180 250

Other (1) 967 899 448

Total interest income $ 1,283 1,079 698

(1) Includes interest recognized on accruing TDRs, interest recognized related to certain impaired loans which have an allowance calculated using discounting, and amortization

of purchase accounting adjustments related to certain impaired loans. See footnote 1 to the table of changes in the allowance for credit losses.

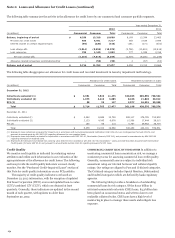

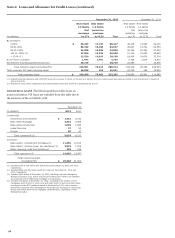

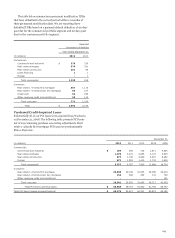

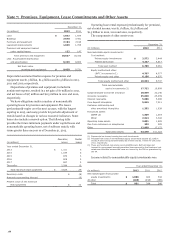

TROUBLED DEBT RESTRUCTURINGS (TDRs) When, for

economic or legal reasons related to a borrower’s financial

difficulties, we grant a concession for other than an insignificant

period of time to a borrower that we would not otherwise

consider, the related loan is classified as a TDR. We do not

consider any loans modified through a loan resolution such as

foreclosure or short sale to be a TDR.

We may require some borrowers experiencing financial

difficulty to make trial payments generally for a period of three

to four months, according to the terms of a planned permanent

modification, to determine if they can perform according to

those terms. Based on clarifying guidance from the SEC in

December 2011, these arrangements represent trial

modifications, which we classify and account for as TDRs. While

loans are in trial payment programs, their original terms are not

considered modified and they continue to advance through

delinquency status and accrue interest according to their original

terms. The planned modifications for these arrangements

predominantly involve interest rate reductions or other interest

rate concessions, however, the exact concession type and

resulting financial effect are usually not finalized and do not take

effect until the loan is permanently modified. The trial period

terms are developed in accordance with our proprietary

programs or the U.S. Treasury’s Making Homes Affordable

programs for real estate 1-4 family first lien (i.e. Home

Affordable Modification Program – HAMP) and junior lien (i.e.

Second Lien Modification Program – 2MP) mortgage loans.

At December 31, 2012, the loans in trial modification period

were $402 million under HAMP, $45 million under 2MP and

$258 million under proprietary programs, compared with

$421 million, $46 million and $184 million at

December 31, 2011, respectively. Trial modifications with a

recorded investment of $429 million at December 31, 2012, and

$310 million at December 31, 2011, were accruing loans and

$276 million and $341 million, respectively, were nonaccruing

loans. Our recent experience is that most of the mortgages that

enter a trial payment period program are successful in

completing the program requirements and are then permanently

modified at the end of the trial period. As previously discussed,

our allowance process considers the impact of those

modifications that are probable to occur including the associated

credit cost and related re-default risk.

161