Wells Fargo 2012 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

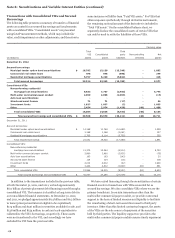

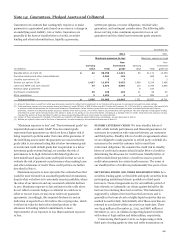

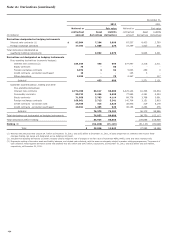

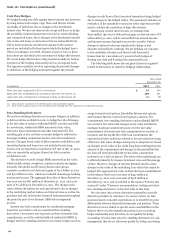

Note 14: Guarantees, Pledged Assets and Collateral

Guarantees are contracts that contingently require us to make

payments to a guaranteed party based on an event or a change in

an underlying asset, liability, rate or index. Guarantees are

generally in the form of standby letters of credit, securities

lending and other indemnifications, liquidity agreements,

written put options, recourse obligations, residual value

guarantees, and contingent consideration. The following table

shows carrying value, maximum exposure to loss on our

guarantees and the related non-investment grade amounts.

December 31,

2012 2011

Maximum exposure to loss Maximum exposure to loss

Non- Non-

Carrying investment Carrying investment

(in millions) value Total grade value Total grade (1)

Standby letters of credit (2) $ 42 39,759 11,331 85 41,171 13,250

Securities lending and other indemnifications - 2,541 118 - 669 62

Liquidity agreements (3) - 3 3 - 2 2

Written put options (3)(4) 1,427 11,874 3,953 1,469 8,224 2,466

Loans and MHFS sold with recourse 99 5,873 3,905 102 5,784 3,850

Residual value guarantees - - - 8 197 -

Contingent consideration 35 129 129 31 98 97

Other guarantees 3 1,421 4 6 552 4

Total guarantees $ 1,606 61,600 19,443 1,701 56,697 19,731

(1) Amounts have been revised from what was previously reported to reflect better alignment of our internal rating process to external noninvestment grade ratings.

(2) Total maximum exposure to loss includes direct pay letters of credit (DPLCs) of $18.5 billion and $19.7 billion at December 31, 2012 and 2011, respectively. We issue DPLCs

to provide credit enhancements for certain bond issuances. Beneficiaries (bond trustees) may draw upon these instruments to make scheduled principal and interest

payments, redeem all outstanding bonds because a default event has occurred, or for other reasons as permitted by the agreement. We also originate multipurpose lending

commitments under which borrowers have the option to draw on the facility in one of several forms, including as a standby letter of credit. Total maximum exposure to loss

includes the portion of these facilities for which we have issued standby letters of credit under the commitments.

(3) Certain of these agreements included in this table are related to off-balance sheet entities and, accordingly, are also disclosed in Note 8.

(4) Written put options, which are in the form of derivatives, are also included in the derivative disclosures in Note 16.

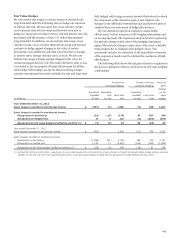

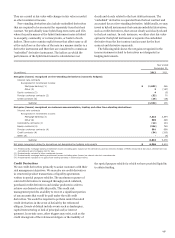

“Maximum exposure to loss” and “Non-investment grade” are

required disclosures under GAAP. Non-investment grade

represents those guarantees on which we have a higher risk of

being required to perform under the terms of the guarantee. If

the underlying assets under the guarantee are non-investment

grade (that is, an external rating that is below investment grade

or an internal credit default grade that is equivalent to a below

investment grade external rating), we consider the risk of

performance to be high. Internal credit default grades are

determined based upon the same credit policies that we use to

evaluate the risk of payment or performance when making loans

and other extensions of credit. These credit policies are further

described in Note 6.

Maximum exposure to loss represents the estimated loss that

would be incurred under an assumed hypothetical circumstance,

despite what we believe is its extremely remote possibility, where

the value of our interests and any associated collateral declines

to zero. Maximum exposure to loss estimates in the table above

do not reflect economic hedges or collateral we could use to

offset or recover losses we may incur under our guarantee

agreements. Accordingly, this required disclosure is not an

indication of expected loss. We believe the carrying value, which

is either fair value for derivative related products or the

allowance for lending related commitments, is more

representative of our exposure to loss than maximum exposure

to loss.

STANDBY LETTERS OF CREDIT We issue standby letters of

credit, which include performance and financial guarantees, for

customers in connection with contracts between our customers

and third parties. Standby letters of credit are agreements where

we are obligated to make payment to a third party on behalf of a

customer in the event the customer fails to meet their

contractual obligations. We consider the credit risk in standby

letters of credit and commercial and similar letters of credit in

determining the allowance for credit losses. Standby letters of

credit include direct pay letters of credit we issue to provide

credit enhancements for certain bond issuances. The terms of

our standby letters of credit are predominantly five years or less.

SECURITIES LENDING AND OTHER INDEMNIFICATIONS As a

securities lending agent, we lend debt and equity securities from

participating institutional clients’ portfolios to third-party

borrowers. These arrangements are for an indefinite period of

time whereby we indemnify our clients against default by the

borrower in returning these lent securities. This indemnity is

supported by collateral received from the borrowers and is

generally in the form of cash or highly liquid securities that are

marked to market daily. Substantially all of these securities are

returned to our clients within one year from trade date. There

was $443 million at December 31, 2012, and $687 million at

December 31, 2011, in collateral supporting loaned securities

with values of $436 million and $669 million, respectively.

Commencing third quarter 2012, we began using certain

third party clearing agents to clear and settle transactions on

187