Wells Fargo 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

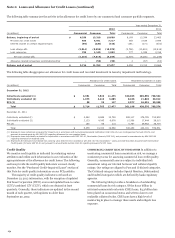

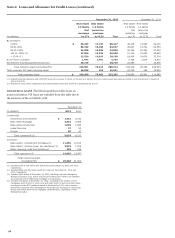

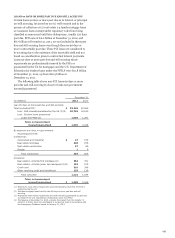

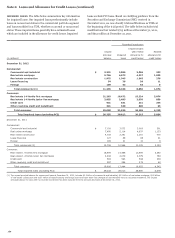

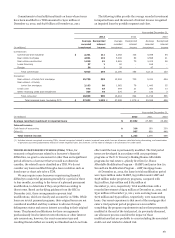

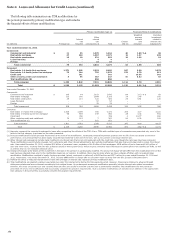

Note 6: Loans and Allowance for Credit Losses (continued)

ACCRETABLE YIELD The excess of cash flows expected to be

collected over the carrying value of PCI loans is referred to as the

accretable yield and is recognized in interest income using an

effective yield method over the remaining life of the loan, or

pools of loans. The accretable yield is affected by:

x changes in interest rate indices for variable rate PCI loans –

expected future cash flows are based on the variable rates in

effect at the time of the regular evaluations of cash flows

expected to be collected;

x changes in prepayment assumptions – prepayments affect

the estimated life of PCI loans which may change the

amount of interest income, and possibly principal, expected

to be collected; and

x changes in the expected principal and interest payments

over the estimated life – updates to expected cash flows are

driven by the credit outlook and actions taken with

borrowers. Changes in expected future cash flows from loan

modifications are included in the regular evaluations of cash

flows expected to be collected.

During 2012, our expectation of cash flows was favorably

impacted by lower expected defaults and losses as a result of

observed strengthening in housing prices and the impact of our

modification efforts. These factors favorably impacted

probability of default and loss severity, reducing our expected

loss on PCI loans, primarily Pick-a-Pay, and increasing the

estimated weighted-average remaining life of the PCI portfolios

and resulting expected interest to be collected. Accordingly, we

increased accretable yield for $1.1 billion of transfers out of

nonaccretable difference for the increase in principal expected to

be collected, and by $3.6 billion for the increase in interest

income expected to be collected.

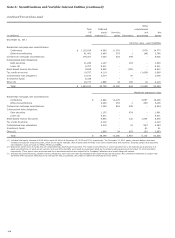

The change in the accretable yield related to PCI loans is

presented in the following table.

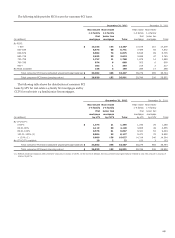

Year ended December 31,

(in millions) 2012 2011 2010 2009

Total, beginning of year $ 15,961 16,714 14,559 10,447

Addition of accretable yield due to acquisitions 3 128 - -

Accretion into interest income (1) (2,152) (2,206) (2,392) (2,601)

Accretion into noninterest income due to sales (2) (5) (189) (43) (5)

Reclassification from nonaccretable difference for loans with improving credit-related cash flows 1,141 373 3,399 441

Changes in expected cash flows that do not affect nonaccretable difference (3) 3,600 1,141 1,191 6,277

Total, end of year $ 18,548 15,961 16,714 14,559

(1) Includes accretable yield released as a result of settlements with borrowers, which is included in interest income.

(2) Includes accretable yield released as a result of sales to third parties, which is included in noninterest income.

(3) Represents changes in cash flows expected to be collected due to the impact of modifications, changes in prepayment assumptions and changes in interest rates on variable

rate PCI loans.

164