Wells Fargo 2012 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 15: Legal Actions (continued)

high to low order in which the Banks post debit card transactions

to consumer deposit accounts. There are currently several such

cases pending against Wells Fargo Bank (including the Wachovia

Bank cases to which Wells Fargo succeeded), most of which have

been consolidated in multi-district litigation proceedings in the

U.S. District Court for the Southern District of Florida. The bank

defendants moved to compel these cases to arbitration under

recent Supreme Court authority. On November 22, 2011, the

Judge denied the motion. The Banks appealed the decision to

the U.S. Court of Appeals for the Eleventh Circuit. On October

26, 2012, the Eleventh Circuit affirmed the District Court’s

denial of the motion.

On August 10, 2010, the U.S. District Court for the Northern

District of California issued an order in Gutierrez v. Wells Fargo

Bank, N.A., a case that was not consolidated in the multi-district

proceedings, enjoining the Bank’s use of the high to low posting

method for debit card transactions with respect to the plaintiff

class of California depositors, directing that the Bank establish a

different posting methodology and ordering remediation of

approximately $203 million. On October 26, 2010, a final

judgment was entered in Gutierrez. On October 28, 2010, Wells

Fargo appealed to the U.S. Court of Appeals for the Ninth

Circuit. On December 26, 2012, the Ninth Circuit reversed the

order requiring Wells Fargo to change its order of posting and

vacated the portion of the order granting remediation of

approximately $203 million on the grounds of federal pre-

emption. The Ninth Circuit affirmed the District Court’s finding

that Wells Fargo violated a California state law prohibition on

fraudulent representations and remanded the case to the District

Court for further proceedings.

SECURITIES LENDING LITIGATION Wells Fargo Bank, N.A. is

involved in several separate pending actions brought by

securities lending customers of Wells Fargo and Wachovia Bank

in various courts. In general, each of the cases alleges that Wells

Fargo violated fiduciary and contractual duties by investing

collateral for loaned securities in investments that suffered

losses. In addition, on March 27, 2012, a class of Wells Fargo

securities lending customers was certified in a case captioned

City of Farmington Hills Employees Retirement System v. Wells

Fargo Bank, N.A., which is pending in the U.S. District Court for

the District of Minnesota. Wells Fargo sought interlocutory

review of the class certification in the U.S. Court of Appeals for

the Eighth Circuit. The Eighth Circuit declined such review on

May 7, 2012.

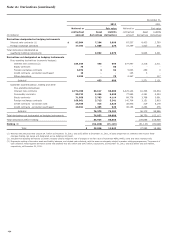

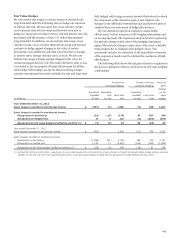

OUTLOOK When establishing a liability for contingent litigation

losses, the Company determines a range of potential losses for

each matter that is both probable and estimable, and records the

amount it considers to be the best estimate within the range. The

high end of the range of reasonably possible potential litigation

losses in excess of the Company’s liability for probable and

estimable losses was $1.0 billion as of December 31, 2012. For

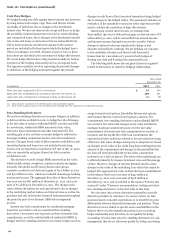

these matters and others where an unfavorable outcome is

reasonably possible but not probable, there may be a range of

possible losses in excess of the established liability that cannot

be estimated. Based on information currently available, advice of

counsel, available insurance coverage and established reserves,

Wells Fargo believes that the eventual outcome of the actions

against Wells Fargo and/or its subsidiaries, including the

matters described above, will not, individually or in the

aggregate, have a material adverse effect on Wells Fargo’s

consolidated financial position. However, in the event of

unexpected future developments, it is possible that the ultimate

resolution of those matters, if unfavorable, may be material to

Wells Fargo’s results of operations for any particular period.

192