Wells Fargo 2012 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

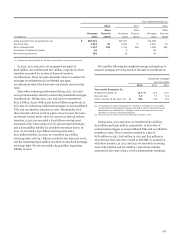

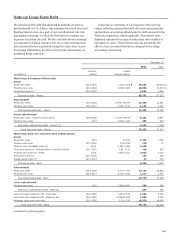

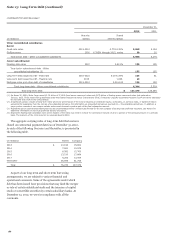

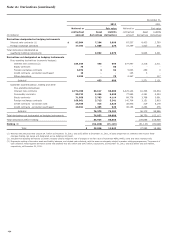

Note 13: Long-Term Debt

We issue long-term debt denominated in multiple currencies,

predominantly in U.S. dollars. Our issuances have both fixed and

floating interest rates. As a part of our overall interest rate risk

management strategy, we often use derivatives to manage our

exposure to interest rate risk. We also use derivatives to manage

our exposure to foreign currency risk. As a result, the long-term

debt presented below is primarily hedged in a fair value or cash

flow hedge relationship. See Note 16 for further information on

qualifying hedge contracts.

Following is a summary of our long-term debt carrying

values, reflecting unamortized debt discounts and premiums,

and purchase accounting adjustments for debt assumed in the

Wachovia acquisition, where applicable. The interest rates

displayed represent the range of contractual rates in effect at

December 31, 2012. These interest rates do not include the

effects of any associated derivatives designated in a hedge

accounting relationship.

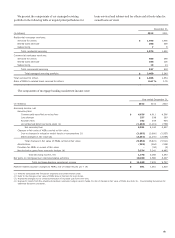

December 31,

2012 2011

Maturity Stated

(in millions) date(s) interest rate(s)

Wells Fargo & Company (Parent only)

Senior

Fixed-rate notes 2013-2035 1.25-6.75% $ 44,623 38,002 (1)

Floating-rate notes 2013-2048 0.059-3.480 10,996 17,872 (1)

Structured notes (2) 2013-2052 3,633 1,359

Total senior debt - Parent 59,252 57,233

Subordinated

Fixed-rate notes 2013-2035 4.375-7.574% 11,340 12,041

Floating-rate notes 2015-2016 0.653-0.710 1,165 1,141

Total subordinated debt - Parent 12,505 13,182

Junior subordinated

Fixed-rate notes - hybrid trust securities 2029-2068 5.625-7.950% 4,221 6,951

Floating-rate notes 2027 0.840-1.340 255 247

Total junior subordinated debt - Parent (3) 4,476 7,198

Total long-term debt - Parent 76,233 77,613

Wells Fargo Bank, N.A. and other bank entities (Bank)

Senior

Fixed-rate notes 2013 6.00% 1,331 1,326

Floating-rate notes 2017-2040 0.06-0.53 170 72

Floating-rate extendible notes (4) 2014 0.359-0.380 4,450 -

Fixed-rate advances - Federal Home Loan Bank (FHLB) 2013-2031 3.83 - 8.17 216 500

Floating-rate advances - FHLB 2013 0.403-0.411 2,002 2,101

Structured notes (2) 2013-2025 163 238

Capital leases (Note 7) 2013-2023 12 116

Total senior debt - Bank 8,344 4,353

Subordinated

Fixed-rate notes 2013-2038 4.75-7.74% 14,153 15,882

Floating-rate notes 2014-2017 0.520-3.652 1,617 1,976

Total subordinated debt - Bank 15,770 17,858

Junior subordinated

Floating-rate notes 2027 0.88-0.99% 294 286

Total junior subordinated debt - Bank (3) 294 286

Long-term debt issued by VIE - Fixed rate 2013-2052 0.00-7.00% 1,542 2,103

Long-term debt issued by VIE - Floating rate 2020-2052 0.339-31.835 1,826 2,748

Mortgage notes and other debt 2013-2062 0.00-12.50 16,976 14,854

Total long-term debt - Bank 44,752 42,202

(continued on following page)

185