Wells Fargo 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

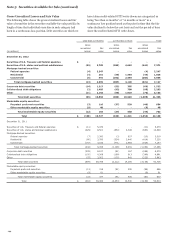

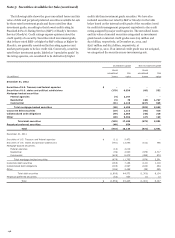

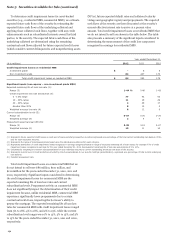

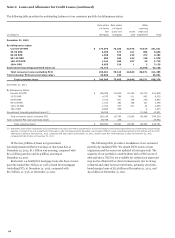

Note 5: Securities Available for Sale (continued)

The following table shows the gross unrealized losses and fair

value of debt and perpetual preferred securities available for sale

by those rated investment grade and those rated less than

investment grade, according to their lowest credit rating by

Standard & Poor’s Rating Services (S&P) or Moody’s Investors

Service (Moody’s). Credit ratings express opinions about the

credit quality of a security. Securities rated investment grade,

that is those rated BBB- or higher by S&P or Baa3 or higher by

Moody’s, are generally considered by the rating agencies and

market participants to be low credit risk. Conversely, securities

rated below investment grade, labeled as “speculative grade” by

the rating agencies, are considered to be distinctively higher

credit risk than investment grade securities. We have also

included securities not rated by S&P or Moody’s in the table

below based on the internal credit grade of the securities (used

for credit risk management purposes) equivalent to the credit

rating assigned by major credit agencies. The unrealized losses

and fair value of unrated securities categorized as investment

grade based on internal credit grades were $19 million and

$2.0 billion, respectively, at December 31, 2012, and

$207 million and $6.2 billion, respectively, at

December 31, 2011. If an internal credit grade was not assigned,

we categorized the security as non-investment grade.

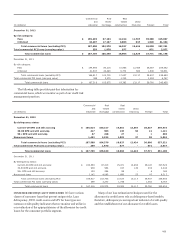

Investment grade Non-investment grade

Gross Gross

unrealized Fair unrealized Fair

(in millions) losses value losses value

December 31, 2012

Securities of U.S. Treasury and federal agencies $ - - - -

Securities of U.S. states and political subdivisions (378) 6,839 (66) 532

Mortgage-backed securities:

Federal agencies (4) 2,247 - -

Residential (3) 78 (46) 1,747

Commercial (31) 2,110 (237) 945

Total mortgage-backed securities (38) 4,435 (283) 2,692

Corporate debt securities (19) 1,112 (50) 410

Collateralized debt obligations (49) 2,065 (46) 218

Other (49) 3,034 (27) 129

Total debt securities (533) 17,485 (472) 3,981

Perpetual preferred securities (40) 654 - -

Total $ (573) 18,139 (472) 3,981

December 31, 2011

Securities of U.S. Treasury and federal agencies $ (11) 5,473 - -

Securities of U.S. states and political subdivisions (781) 12,093 (102) 756

Mortgage-backed securities:

Federal agencies (10) 3,019 - -

Residential (39) 2,503 (375) 4,717

Commercial (429) 6,273 (499) 874

Total mortgage-backed securities (478) 11,795 (874) 5,591

Corporate debt securities (165) 7,156 (121) 1,118

Collateralized debt obligations (185) 4,597 (164) 284

Other (186) 3,458 (39) 385

Total debt securities (1,806) 44,572 (1,300) 8,134

Perpetual preferred securities (53) 833 (1) 13

Total $ (1,859) 45,405 (1,301) 8,147

146