Wells Fargo 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management

All financial institutions must manage and control a variety of

business risks that can significantly affect their financial

performance. Among the key risks that we must manage are

credit risks, asset/liability interest rate and market risks, and

operational risks. Our Board of Directors (Board) and executive

management have overall and ultimate responsibility for

management of these risks, which they carry out through

committees with specific and well-defined risk management

functions. For example, the Board’s Credit Committee oversees

the annual credit quality plan and lending policies, credit

trends, the allowance for credit loss policy, and high risk

portfolios and concentrations. The Finance Committee

oversees the Company’s major financial risks, including

market, interest rate, and liquidity and funding risks, as well as

equity exposure and fixed income investments, and also

oversees the Company’s capital management and planning

processes. The Audit and Examination Committee oversees

operational, legal and compliance risk, in addition to the

policies and management activities relating to the Company’s

financial reporting. The Risk Committee oversees the

Company’s enterprise-wide risk management framework,

including the strategies, policies, processes and systems used to

identify, assess, measure and manage the major risks facing the

Company. The Risk Committee does not duplicate the risk

oversight of the Board’s other committees, but rather helps

ensure end-to-end ownership of oversight of all risk issues in

one Board committee and enhances the Board’s and

management’s understanding of the Company’s aggregate

enterprise-wide risk appetite.

The Board and its committees work closely with

management in overseeing risk. Each Board committee

receives reports and information regarding risk issues directly

from management and, in some cases, management

committees have been established to inform the risk

management framework and provide governance and advice

regarding risk management functions. These management

committees include the Company’s Operating Committee,

which consists of the Company’s senior executives who report

to the CEO and who meet weekly to, among other things,

discuss strategic, operational and risk issues at the enterprise

level, and the Enterprise Risk Management Committee, which

is chaired by the Company’s Chief Risk Officer and includes

other senior executives responsible for managing risk across

the Company. Management’s corporate risk organization is

headed by the Chief Risk Officer who, among other things,

oversees the Company’s credit, market and operational risks.

The Chief Risk Officer and the Chief Credit, Market and

Operational Risk Officers, who report to the Chief Risk Officer,

work closely with the Board’s Risk, Credit and Audit and

Examination Committees and frequently provide reports to

these and other Board committees and update the committee

chairs and other Board members on risk issues outside of

regular committee meetings, as appropriate. The full Board

receives reports at each of its meetings from the committee

chairs about committee activities, including risk oversight

matters, and receives a quarterly report from the Enterprise

Risk Management Committee regarding current or emerging

risk issues.

Operating Risk Management

Effective management of operational risks, which include risks

relating to management information systems, security systems,

and information security, is also an important focus for

financial institutions such as Wells Fargo. Wells Fargo and

reportedly other financial institutions have been the target of

various denial-of-service or other cyber attacks as part of what

appears to be a coordinated effort to disrupt the operations of

financial institutions and potentially test their cybersecurity in

advance of future and more advanced cyber attacks. To date

Wells Fargo has not experienced any material losses relating to

these or other cyber attacks. Cybersecurity and the continued

development and enhancement of our controls, processes and

systems to protect our networks, computers, software, and data

from attack, damage or unauthorized access remain a priority

for Wells Fargo. See the “Risk Factors” section of this Report

for additional information regarding the risks associated with a

failure or breach of our operational or security systems or

infrastructure, including as a result of cyber attacks.

Credit Risk Management

Loans represent the largest component of assets on our balance

sheet and their related credit risk is among the most significant

risks we manage. We define credit risk as the risk of loss

associated with a borrower or counterparty default (failure to

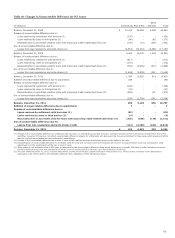

meet obligations in accordance with agreed upon terms). Table

16 presents our total loans outstanding by portfolio segment

and class of financing receivable.

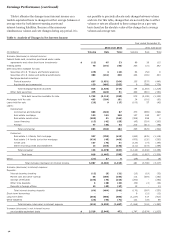

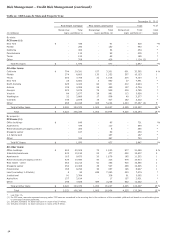

Table 16: Total Loans Outstanding by Portfolio Segment and

Class of Financing Receivable

December 31,

(in millions) 2012 2011

Commercial:

Commercial and industrial $ 187,759 167,216

Real estate mortgage 106,340 105,975

Real estate construction 16,904 19,382

Lease financing 12,424 13,117

Foreign (1) 37,771 39,760

Total commercial 361,198 345,450

Consumer:

Real estate 1-4 family first mortgage 249,900 228,894

Real estate 1-4 family

junior lien mortgage 75,465 85,991

Credit card 24,640 22,836

Other revolving credit and installment 88,371 86,460

Total consumer 438,376 424,181

Total loans $ 799,574 769,631

(1)

Substantially all of our foreign loan portfolio is commercial loans. Loans are

classified as foreign if the borrower’s primary address is outside of the United

States.

50