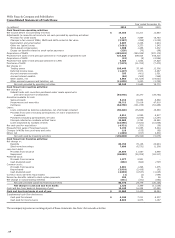

Wells Fargo 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1: Summary of Significant Accounting Policies (continued)

equivalents (for example, stock options, restricted share rights,

convertible debentures and warrants) that are dilutive.

Fair Value of Financial Instruments

We use fair value measurements in our fair value disclosures and

to record certain assets and liabilities at fair value on a recurring

basis, such as trading assets, or on a nonrecurring basis such as

measuring impairment on assets carried at amortized cost.

DETERMINATION OF FAIR VALUE We base our fair values on

the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market

participants at the measurement date. These fair value

measurements are based on exit prices and determined by

maximizing the use of observable inputs. However, for certain

instruments we must utilize unobservable inputs in determining

fair value due to the lack of observable inputs in the market

which requires greater judgment in measuring fair value.

In instances where there is limited or no observable market

data, fair value measurements for assets and liabilities are based

primarily upon our own estimates or combination of our own

estimates and third-party vendor or broker pricing, and the

measurements are often calculated based on current pricing for

products we offer or issue, the economic and competitive

environment, the characteristics of the asset or liability and

other such factors. As with any valuation technique used to

estimate fair value, changes in underlying assumptions used,

including discount rates and estimates of future cash flows,

could significantly affect the results of current or future values.

Accordingly, these fair value estimates may not be realized in an

actual sale or immediate settlement of the asset or liability.

We incorporate lack of liquidity into our fair value

measurement based on the type of asset or liability measured

and the valuation methodology used. For example, for certain

residential MHFS and certain securities where the significant

inputs have become unobservable due to illiquid markets and

vendor or broker pricing is not used, we use a discounted cash

flow technique to measure fair value. This technique

incorporates forecasting of expected cash flows (adjusted for

credit loss assumptions and estimated prepayment speeds)

discounted at an appropriate market discount rate to reflect the

lack of liquidity in the market that a market participant would

consider. For other securities where vendor or broker pricing is

used, we use either unadjusted broker quotes or vendor prices or

vendor or broker prices adjusted by weighting them with

internal discounted cash flow techniques to measure fair value.

These unadjusted vendor or broker prices inherently reflect any

lack of liquidity in the market as the fair value measurement

represents an exit price from a market participant viewpoint.

Where markets are inactive and transactions are not orderly,

transaction or quoted prices for assets or liabilities in inactive

markets may require adjustment due to the uncertainty of

whether the underlying transactions are orderly. For items that

use price quotes in inactive markets, such as certain security

classes within securities available for sale, we analyze the degree

of market inactivity and distressed transactions to determine the

appropriate adjustment to the price quotes.

The methodology used to adjust the quotes involves

weighting the price quotes and results of internal pricing

techniques such as the net present value of future expected cash

flows (with observable inputs, where available) discounted at a

rate of return market participants require. The significant inputs

utilized in the internal pricing techniques, which are estimated

by type of underlying collateral, include credit loss assumptions,

estimated prepayment speeds and discount rates.

The more active and orderly markets for particular security

classes are determined to be, the more weighting is assigned to

price quotes. The less active and orderly markets are determined

to be, the less weighting is assigned to price quotes. We

continually assess the level and volume of market activity in our

investment security classes in determining adjustments, if any,

to price quotes. Given market conditions can change over time,

our determination of which securities markets are considered

active or inactive can change. If we determine a market to be

inactive, the degree to which price quotes require adjustment,

can also change. See Note 17 for further discussion of the

valuation methodologies applied to financial instruments to

determine fair value.

FAIR VALUE HIERARCHY We group our assets and liabilities

measured at fair value in three levels, based on the markets in

which the assets and liabilities are traded and the reliability of

the assumptions used to determine fair value. These levels are:

x Level 1 – Valuation is based upon quoted prices for identical

instruments traded in active markets.

x Level 2 – Valuation is based upon quoted prices for similar

instruments in active markets, quoted prices for identical or

similar instruments in markets that are not active, and

model-based valuation techniques for which all significant

assumptions are observable in the market.

x Level 3 – Valuation is generated from techniques that use

significant assumptions not observable in the market. These

unobservable assumptions reflect estimates of assumptions

that market participants would use in pricing the asset or

liability. Valuation techniques include use of option pricing

models, discounted cash flow models and similar

techniques.

In the determination of the classification of financial

instruments in Level 2 or Level 3 of the fair value hierarchy, we

consider all available information, including observable market

data, indications of market liquidity and orderliness, and our

understanding of the valuation techniques and significant inputs

used. For securities in inactive markets, we use a predetermined

percentage to evaluate the impact of fair value adjustments

derived from weighting both external and internal indications of

value to determine if the instrument is classified as Level 2 or

Level 3. Based upon the specific facts and circumstances of each

instrument or instrument category, we make judgments

regarding the significance of the Level 3 inputs to the

instruments' fair value measurement in its entirety. If Level 3

inputs are considered significant, the instrument is classified as

Level 3.

Derivatives and Hedging Activities

We recognize all derivatives in the balance sheet at fair value. On

the date we enter into a derivative contract, we designate the

derivative as (1) a hedge of the fair value of a recognized asset or

138