Wells Fargo 2012 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

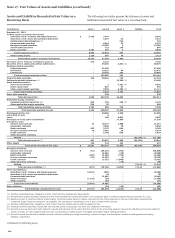

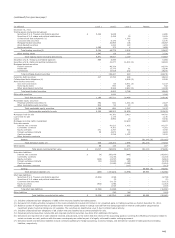

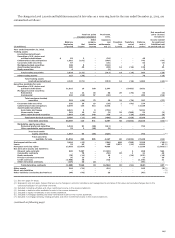

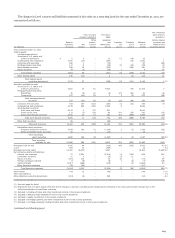

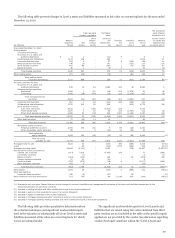

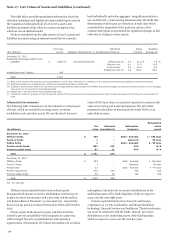

The valuation techniques used for our Level 3 assets and

liabilities, as presented in the previous table, are described as

follows:

x Discounted cash flow - Discounted cash flow valuation

techniques generally consist of developing an estimate of

future cash flows that are expected to occur over the life of

an instrument and then discounting those cash flows at a

rate of return that results in the fair value amount.

x Option model - Option model valuation techniques are

generally used for instruments in which the holder has a

contingent right or obligation based on the occurrence of a

future event, such as the price of a referenced asset going

above or below a predetermined strike price. Option models

estimate the likelihood of the specified event occurring by

incorporating assumptions such as volatility estimates, price

of the underlying instrument and expected rate of return.

x Market comparable pricing - Market comparable pricing

valuation techniques are used to determine the fair value of

certain instruments by incorporating known inputs such as

recent transaction prices, pending transactions, or prices of

other similar investments which require significant

adjustment to reflect differences in instrument

characteristics.

x Vendor-priced – Prices obtained from third party pricing

vendors or brokers that are used to record the fair value of

the asset or liability, of which the related valuation

technique and significant unobservable inputs are not

provided.

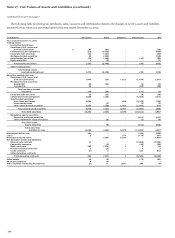

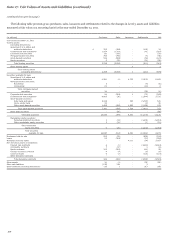

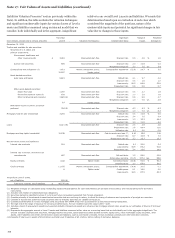

Significant unobservable inputs presented in the previous

table are those we consider significant to the fair value of the

Level 3 asset or liability. We consider unobservable inputs to be

significant, if by their exclusion, the fair value of the Level 3 asset

or liability would be impacted by a predetermined percentage

change or based on qualitative factors such as nature of the

instrument, type of valuation technique used, and the

significance of the unobservable inputs relative to other inputs

used within the valuation. Following is a description of the

significant unobservable inputs provided in the table.

x Comparability adjustment – is an adjustment made to

observed market data such as a transaction price in order to

reflect dissimilarities in underlying collateral, issuer, rating,

or other factors used within a market valuation approach,

expressed as a percentage of an observed price.

x Correlation factor - is the likelihood of one instrument

changing in price relative to another based on an

established relationship expressed as a percentage of

relative change in price over a period over time.

x Cost to service - is the expected cost per loan of servicing a

portfolio of loans which includes estimates for

unreimbursed expenses (including delinquency and

foreclosure costs) that may occur as a result of servicing

such loan portfolios.

x Credit spread – is the portion of the interest rate in excess of

a benchmark interest rate, such as LIBOR or U.S. Treasury

rates, that when applied to an investment captures changes

in the obligor’s creditworthiness.

x Default rate – is an estimate of the likelihood of not

collecting contractual amounts owed expressed as a

constant default rate (CDR).

x Discount rate – is a rate of return used to present value the

future expected cash flow to arrive at the fair value of an

instrument. The discount rate consists of a benchmark rate

component and a risk premium component. The benchmark

rate component, for example, LIBOR or U.S. Treasury rates,

is generally observable within the market and is necessary to

appropriately reflect the time value of money. The risk

premium component reflects the amount of compensation

market participants require due to the uncertainty inherent

in the instruments’ cash flows resulting from risks such as

credit and liquidity.

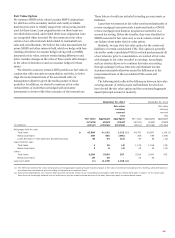

x Fall-out factor - is the expected percentage of loans

associated with our interest rate lock commitment portfolio

that are likely of not funding.

x Initial-value servicing - is the estimated value of the

underlying loan, including the value attributable to the

embedded servicing right, expressed in basis points of

outstanding unpaid principal balance.

x Loss severity – is the percentage of contractual cash flows

lost in the event of a default.

x Prepayment rate – is the estimated rate at which forecasted

prepayments of principal of the related loan or debt

instrument are expected to occur, expressed as a constant

prepayment rate (CPR).

x Utilization rate – is the estimated rate in which incremental

portions of existing reverse mortgage credit lines are

expected to be drawn by borrowers, expressed as an

annualized rate.

x Volatility factor – is the extent of change in price an item is

estimated to fluctuate over a specified period of time

expressed as a percentage of relative change in price over a

period over time.

x Weighted average life – is the weighted average number of

years an investment is expected to remain outstanding,

based on its expected cash flows reflecting the estimated

date the issuer will call or extend the maturity of the

instrument or otherwise reflecting an estimate of the timing

of an instrument’s cash flows whose timing is not

contractually fixed.

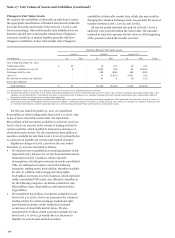

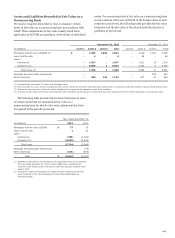

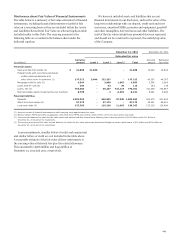

Significant Recurring Level 3 Fair Value Asset and

Liability Input Sensitivity

We generally use discounted cash flow or similar internal

modeling techniques to determine the fair value of our Level 3

assets and liabilities. Use of these techniques requires

determination of relevant inputs and assumptions, some of

which represent significant unobservable inputs as indicated in

the preceding table. Accordingly, changes in these unobservable

inputs may have a significant impact on fair value.

Certain of these unobservable inputs will (in isolation) have a

directionally consistent impact on the fair value of the

instrument for a given change in that input. Alternatively, the

fair value of the instrument may move in an opposite direction

for a given change in another input. Where multiple inputs are

used within the valuation technique of an asset or liability, a

213