Wells Fargo 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

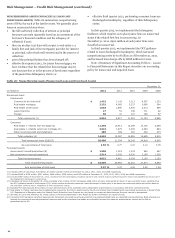

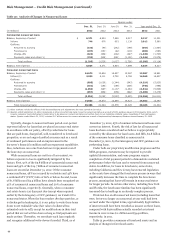

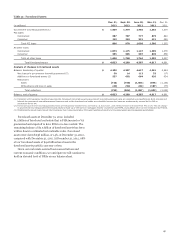

Risk Management – Credit Risk Management (continued)

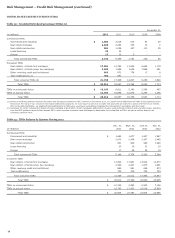

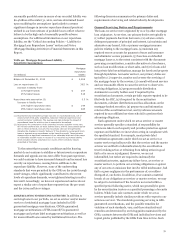

TROUBLED DEBT RESTRUCTURINGS (TDRs)

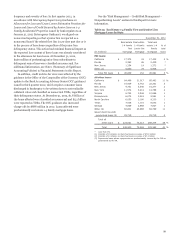

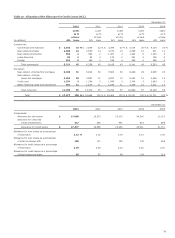

Table 32: Troubled Debt Restructurings (TDRs) (1)

December 31,

(in millions) 2012 2011 2010 2009 2008

Commercial TDRs

Commercial and industrial $ 1,683 2,026 613 82 28

Real estate mortgage 2,625 2,262 725 73 2

Real estate construction 801 1,008 407 110 35

Lease financing 20 33 - - -

Foreign 17 20 6 - -

Total commercial TDRs 5,146 5,349 1,751 265 65

Consumer TDRs

Real estate 1-4 family first mortgage 17,804 13,799 11,603 6,685 1,179

Real estate 1-4 family junior lien mortgage 2,390 1,986 1,626 1,566 461

Other revolving credit and installment 869 872 778 17 8

Trial modifications (1) 705 651 - - -

Total consumer TDRs (2) 21,768 17,308 14,007 8,268 1,648

Total TDRs $ 26,914 22,657 15,758 8,533 1,713

TDRs on nonaccrual status $ 10,149 6,811 5,185 2,289 467

TDRs on accrual status 16,765 15,846 10,573 6,244 1,246

Total TDRs $ 26,914 22,657 15,758 8,533 1,713

(1) Based on clarifying guidance from the Securities and Exchange Commission (SEC) received in December 2011, we classify trial modifications as TDRs at the beginning of the

trial period. For many of our consumer real estate modification programs, we may require a borrower to make trial payments generally for a period of three to four months.

Prior to the SEC clarification, we classified trial modifications as TDRs once a borrower successfully completed the trial period in accordance with the terms.

(2) December 31, 2012, includes $5.2 billion of loans, consisting of $4.5 billion of first mortgages, $506 million of junior liens and $140 million of auto and other loans, resulting

from the OCC guidance issued in third quarter 2012, which requires consumer loans discharged in bankruptcy to be classified as TDRs, as well as written down to net

realizable collateral value.

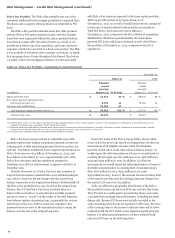

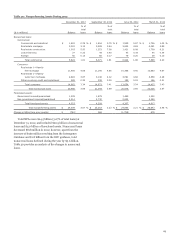

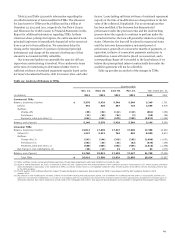

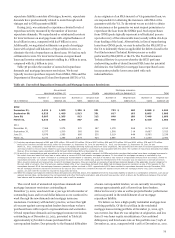

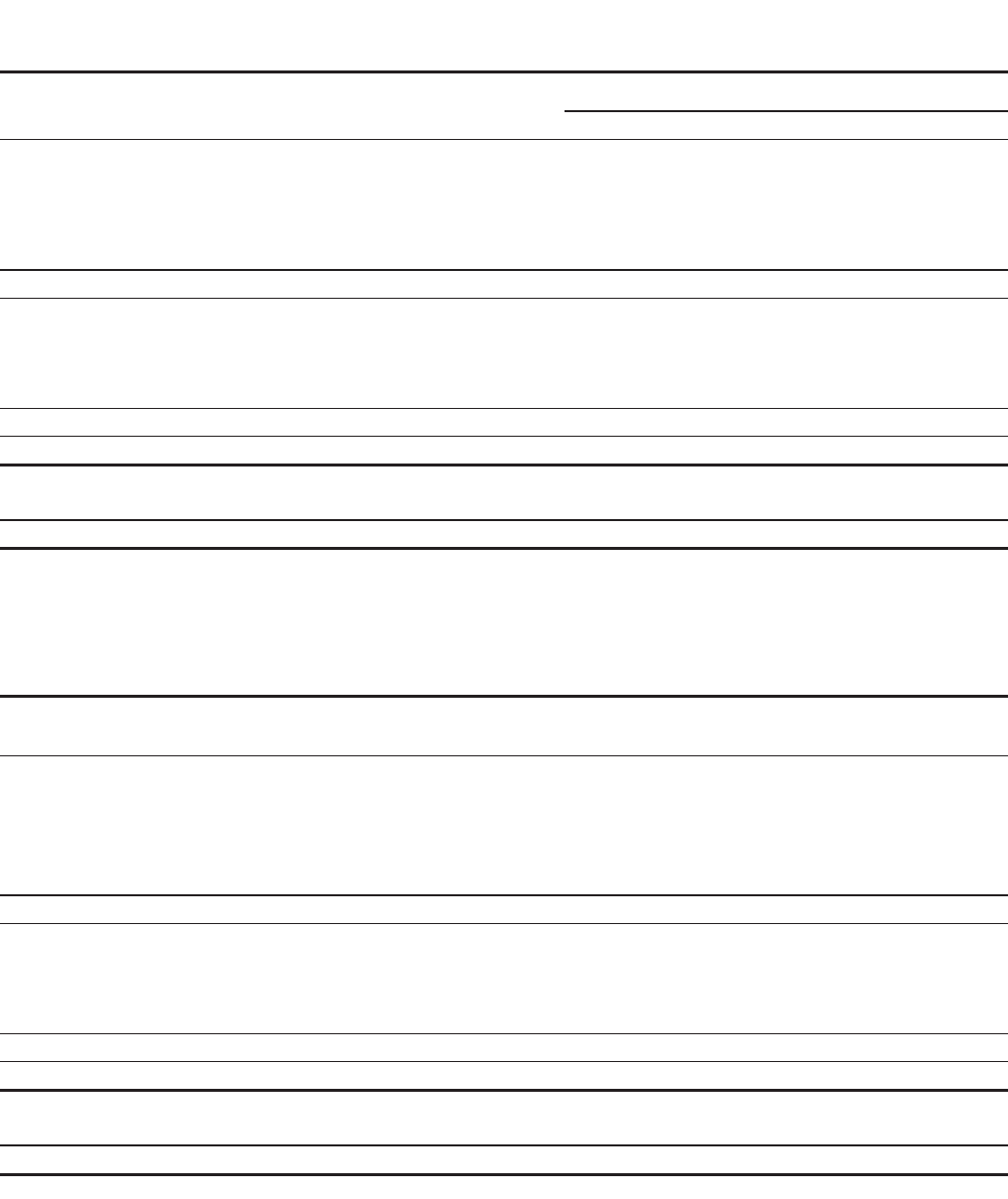

Table 33: TDRs Balance by Quarter During 2012

Dec. 31, Sept. 30, June 30, Mar. 31,

(in millions) 2012 2012 2012 2012

Commercial TDRs

Commercial and industrial $ 1,683 1,877 1,937 1,967

Real estate mortgage 2,625 2,498 2,457 2,485

Real estate construction 801 949 980 1,048

Lease financing 20 26 27 29

Foreign 17 28 28 19

Total commercial TDRs 5,146 5,378 5,429 5,548

Consumer TDRs

Real estate 1-4 family first mortgage 17,804 17,861 13,919 13,870

Real estate 1-4 family junior lien mortgage 2,390 2,437 1,975 1,981

Other revolving credit and installment 869 981 856 873

Trial modifications 705 733 745 723

Total consumer TDRs 21,768 22,012 17,495 17,447

Total TDRs $ 26,914 27,390 22,924 22,995

TDRs on nonaccrual status $ 10,149 9,990 6,900 7,136

TDRs on accrual status 16,765 17,400 16,024 15,859

Total TDRs $ 26,914 27,390 22,924 22,995

68