Wells Fargo 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

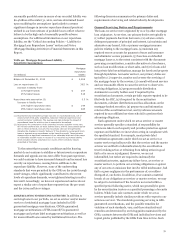

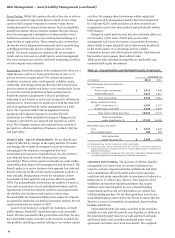

reasonably possible losses in excess of our recorded liability was

$2.4 billion at December 31, 2012, and was determined based

upon modifying the assumptions (particularly to assume

significant changes in investor repurchase demand practices)

utilized in our best estimate of probable loss to reflect what we

believe to be the high end of reasonably possible adverse

assumptions. For additional information on our repurchase

liability, see the “Critical Accounting Policies – Liability for

Mortgage Loan Repurchase Losses” section and Note 9

(Mortgage Banking Activities) to Financial Statements in this

Report.

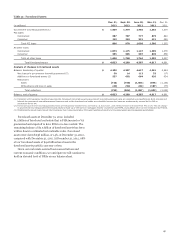

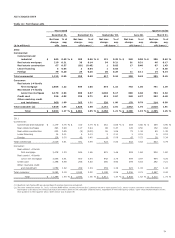

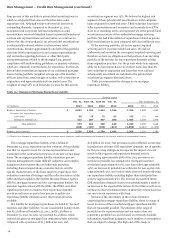

Table 40: Mortgage Repurchase Liability –

Sensitivity/Assumptions

Mortgage

repurchase

(in millions) liability

Balance at December 31, 2012 $ 2,206

Loss on repurchases (1) 39.5 %

Increase in liability from:

10% higher losses $ 207

25% higher losses 518

Repurchase rate assumption (2) 0.5 %

Increase in liability from:

10% higher repurchase rates $ 194

25% higher repurchase rates 485

(1) Represents total estimated average loss rate on repurchased loans, net of

recovery from third party originators, based on historical experience and

current economic conditions. The average loss rate includes the impact of

repurchased loans for which no loss is expected to be realized.

(2) Represents the combination of the estimated investor audit/file review rate,

the investor demand rate on those audited loans, and the unsuccessful appeal

rate on those demands. As such, the repurchase rate can be significantly

impacted by changes in investor behavior if they decide to review/audit more

loans or demand more repurchases on the loans they audit. These behavior

changes drive a significant component of our estimated high end of the range

of reasonably possible losses in excess of our recorded repurchase liability,

which includes adverse assumptions in excess of the sensitivity ranges

presented in this table.

To the extent that economic conditions and the housing

market do not continue to stabilize or future investor repurchase

demands and appeals success rates differ from past experience,

we could continue to have increased demands and increased loss

severity on repurchases, causing future additions to the

repurchase liability. However, some of the underwriting

standards that were permitted by the GSEs on the 2006 through

2008 vintages, which significantly contributed to the recent

levels of repurchase demands, were tightened starting in mid to

late 2008. Accordingly, we have not experienced and we do not

expect a similar rate of repurchase requests from the pre-2006

and the 2009 and later vintages.

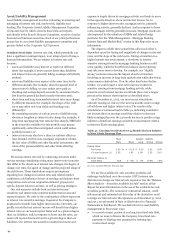

RISKS RELATING TO SERVICING ACTIVITIES In addition to

servicing loans in our portfolio, we act as servicer and/or master

servicer of residential mortgage loans included in GSE-

guaranteed mortgage securitizations, GNMA-guaranteed

mortgage securitizations of FHA-insured/VA-guaranteed

mortgages and private label mortgage securitizations, as well as

for unsecuritized loans owned by institutional investors. The

following discussion summarizes the primary duties and

requirements of servicing and related industry developments.

General Servicing Duties and Requirements

The loans we service were originated by us or by other mortgage

loan originators. As servicer, our primary duties are typically to

(1) collect payments due from borrowers, (2) advance certain

delinquent payments of principal and interest, (3) maintain and

administer any hazard, title or primary mortgage insurance

policies relating to the mortgage loans, (4) maintain any

required escrow accounts for payment of taxes and insurance

and administer escrow payments, (5) foreclose on defaulted

mortgage loans or, to the extent consistent with the documents

governing a securitization, consider alternatives to foreclosure,

such as loan modifications or short sales, and (6) for loans sold

into private label securitizations, manage the foreclosed property

through liquidation. As master servicer, our primary duties are

typically to (1) supervise, monitor and oversee the servicing of

the mortgage loans by the servicer, (2) consult with each servicer

and use reasonable efforts to cause the servicer to observe its

servicing obligations, (3) prepare monthly distribution

statements to security holders and, if required by the

securitization documents, certain periodic reports required to be

filed with the SEC, (4) if required by the securitization

documents, calculate distributions and loss allocations on the

mortgage-backed securities, (5) prepare tax and information

returns of the securitization trust, and (6) advance amounts

required by non-affiliated servicers who fail to perform their

advancing obligations.

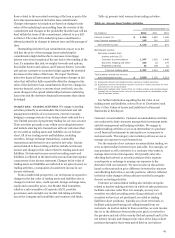

Each agreement under which we act as servicer or master

servicer generally specifies a standard of responsibility for

actions we take in such capacity and provides protection against

expenses and liabilities we incur when acting in compliance with

the specified standard. For example, most private label

securitization agreements under which we act as servicer or

master servicer typically provide that the servicer and the master

servicer are entitled to indemnification by the securitization

trust for taking action or refraining from taking action in good

faith or for errors in judgment. However, we are not

indemnified, but rather are required to indemnify the

securitization trustee, against any failure by us, as servicer or

master servicer, to perform our servicing obligations or against

any of our acts or omissions that involve wilful misfeasance, bad

faith or gross negligence in the performance of, or reckless

disregard of, our duties. In addition, if we commit a material

breach of our obligations as servicer or master servicer, we may

be subject to termination if the breach is not cured within a

specified period following notice, which can generally be given

by the securitization trustee or a specified percentage of security

holders. Whole loan sale contracts under which we act as

servicer generally include similar provisions with respect to our

actions as servicer. The standards governing servicing in GSE-

guaranteed securitizations, and the possible remedies for

violations of such standards, vary, and those standards and

remedies are determined by servicing guides maintained by the

GSEs, contracts between the GSEs and individual servicers and

topical guides published by the GSEs from time to time. Such

77