Wells Fargo 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

flows related to the associated servicing of the loan as part of the

fair value measurement of derivative loan commitments.

Changes subsequent to inception are based on changes in fair

value of the underlying loan resulting from the exercise of the

commitment and changes in the probability that the loan will not

fund within the terms of the commitment, referred to as a fall-

out factor. The value of the underlying loan commitment is

affected primarily by changes in interest rates and the passage of

time.

Outstanding derivative loan commitments expose us to the

risk that the price of the mortgage loans underlying the

commitments might decline due to increases in mortgage

interest rates from inception of the rate lock to the funding of the

loan. To minimize this risk, we employ forwards and options,

Eurodollar futures and options, and Treasury futures, forwards

and options contracts as economic hedges against the potential

decreases in the values of the loans. We expect that these

derivative financial instruments will experience changes in fair

value that will either fully or partially offset the changes in fair

value of the derivative loan commitments. However, changes in

investor demand, such as concerns about credit risk, can also

cause changes in the spread relationships between underlying

loan value and the derivative financial instruments that cannot

be hedged.

MARKET RISK – TRADING ACTIVITIES We engage in trading

activities primarily to accommodate the investment and risk

management activities of our customers, execute economic

hedging to manage certain of our balance sheet risks and for a

very limited amount of proprietary trading for our own account.

These activities primarily occur within our trading businesses

and include entering into transactions with our customers that

are recorded as trading assets and liabilities on our balance

sheet. All of our trading assets and liabilities, including

securities, foreign exchange transactions, commodity

transactions and derivatives are carried at fair value. Income

earned related to these trading activities include net interest

income and changes in fair value related to trading assets and

liabilities. Net interest income earned on trading assets and

liabilities is reflected in the interest income and interest expense

components of our income statement. Changes in fair value of

trading assets and liabilities are reflected in net gains (losses) on

trading activities, a component of noninterest income in our

income statement.

From a market risk perspective, our net income is exposed to

changes in the fair value of trading assets and liabilities due to

changes in interest rates, credit spreads, foreign exchange rates,

equity and commodity prices. Our Market Risk Committee,

which is a sub-committee of Corporate ALCO, provides

governance and oversight over market risk-taking activities

across the Company and establishes and monitors risk limits.

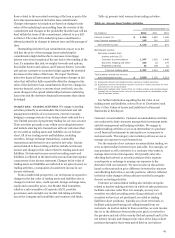

Table 42 presents total revenue from trading activities.

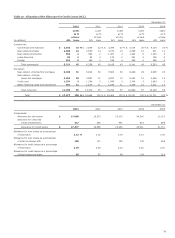

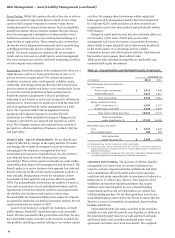

Table 42: Income from Trading Activities

Year ended December 31,

(in millions) 2012 2011 2010

Interest income (1) $ 1,358 1,440 1,098

Less: Interest expense (2) 245 316 227

Net interest income 1,113 1,124 871

Noninterest income:

Net gains (losses) from

trading activities (3):

Customer accommodation 1,347 1,029 1,448

Economic hedging and other 345 (1) 178

Proprietary trading 15 (14) 22

Total net trading gains 1,707 1,014 1,648

Total trading-related net interest

and noninterest income $ 2,820 2,138 2,519

(1) Represents interest and dividend income earned on trading securities.

(2) Represents interest and dividend expense incurred on trading securities we have

sold but have not yet purchased.

(3) Represents realized gains (losses) from our trading activity and unrealized gains

(losses) due to changes in fair value of our trading positions, attributable to the

type of business activity.

For further information regarding the fair value of our

trading assets and liabilities, refer to Note 16 (Derivatives) and

Note 17 (Fair Values of Assets and Liabilities) to Financial

Statements in this Report.

Customer accommodation Customer accommodation activities

are conducted to help customers manage their investment needs

and risk management and hedging activities. We engage in

market-making activities or act as an intermediary to purchase

or sell financial instruments in anticipation or in response to

customer needs. This category also includes positions we use to

manage our exposure to such transactions.

For the majority of our customer accommodation trading, we

serve as intermediary between buyer and seller. For example, we

may purchase or sell a derivative to a customer who wants to

manage interest rate risk exposure. We typically enter into

offsetting derivative(s) or security positions with a separate

counterparty or exchange to manage our exposure to the

derivative with our customer. We earn income on this activity

based on the transaction price difference between the customer

and offsetting derivative or security positions, which is reflected

in the fair value changes of the positions recorded in net gains

(losses) on trading activities.

Customer accommodation trading also includes net gains

related to market-making activities in which we take positions to

facilitate customer order flow. For example, we may own

securities recorded as trading assets (long positions) or sold

securities we have not yet purchased, recorded as trading

liabilities (short positions), typically on a short-term basis, to

facilitate anticipated buying and selling demand from our

customers. As market-maker in these securities, we earn income

due (1) to the difference between the price paid or received for

the purchase and sale of the security (bid-ask spread) and (2) the

net interest income and change in fair value of the long or short

positions during the short-term period held on our balance

83