Wells Fargo 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

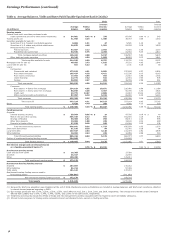

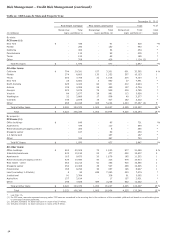

Balance Sheet Analysis (continued)

Deposits

Deposits totaled $1.0 trillion at December 31, 2012, compared

with $920.1 billion at December 31, 2011. Table 14 provides

additional information regarding deposits. Information

regarding the impact of deposits on net interest income and a

comparison of average deposit balances is provided in

“Earnings Performance – Net Interest Income” and Table 5

earlier in this Report. Total core deposits were $945.7 billion at

December 31, 2012, up $73.1 billion from $872.6 billion at

December 31, 2011.

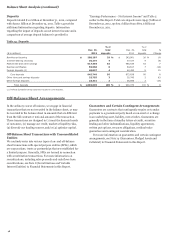

Table 14: Deposits

% o

f

% o

f

Dec. 31, total Dec. 31, total %

($ in millions) 2012 deposits 2011 deposits Change

Noninterest-bearing $ 288,207 29 % $ 243,961 26 % 18

Interest-bearing checking 35,275 4 37,027 4 (5)

Market rate and other savings 517,464 52 485,534 53 7

Savings certificates 55,966 6 63,617 7 (12)

Foreign deposits (1) 48,837 4 42,490 5 15

Core deposits 945,749 95 872,629 95 8

Other time and savings deposits 33,755 3 20,745 2 63

Other foreign deposits 23,331 2 26,696 3 (13)

Total deposits $ 1,002,835 100 % $ 920,070 100 % 9

(1) Reflects Eurodollar sweep balances included in core deposits.

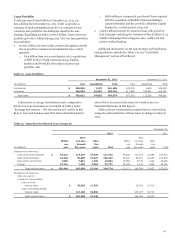

Off-Balance Sheet Arrangements

In the ordinary course of business, we engage in financial

transactions that are not recorded in the balance sheet, or may

be recorded in the balance sheet in amounts that are different

from the full contract or notional amount of the transaction.

These transactions are designed to (1) meet the financial needs

of customers, (2) manage our credit, market or liquidity risks,

(3) diversify our funding sources, and/or (4) optimize capital.

Off-Balance Sheet Transactions with Unconsolidated

Entities

We routinely enter into various types of on- and off-balance

sheet transactions with special purpose entities (SPEs), which

are corporations, trusts or partnerships that are established for

a limited purpose. Generally, SPEs are formed in connection

with securitization transactions. For more information on

securitizations, including sales proceeds and cash flows from

securitizations, see Note 8 (Securitizations and Variable

Interest Entities) to Financial Statements in this Report.

Guarantees and Certain Contingent Arrangements

Guarantees are contracts that contingently require us to make

payments to a guaranteed party based on an event or a change

in an underlying asset, liability, rate or index. Guarantees are

generally in the form of standby letters of credit, securities

lending and other indemnifications, liquidity agreements,

written put options, recourse obligations, residual value

guarantees and contingent consideration.

For more information on guarantees and certain contingent

arrangements, see Note 14 (Guarantees, Pledged Assets and

Collateral) to Financial Statements in this Report.

48