Wells Fargo 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Asset/Liability Management (continued)

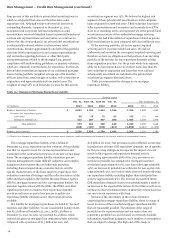

Stress Testing While VaR captures the risk of loss due to adverse

changes in markets using recent historical data, stress testing

captures the Company’s exposure to extreme events. Stress

testing measures the impacts from extreme, but low probability

market movements. Stress scenarios estimate the risk of losses

based on management’s assumptions of abnormal but severe

market movements such as severe credit spread widening or a

large decline in equity prices. These scenarios also assume that

the market moves happen instantaneously and no repositioning

or hedging activity takes place to mitigate losses as events

unfold. The stress scenarios are updated with recent market

trends and are reviewed on a daily basis by senior management.

The stress scenarios are used for desk level monitoring as well as

overall company-wide estimates.

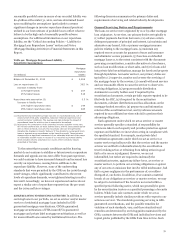

Sensitivities Sensitivity analysis is the estimated risk of loss for a

single measure such as a 1 basis point increase in rates or a 1

percent decrease in equity prices. We conduct and monitor

sensitivity on interest rates, credit spreads, volatility, equity,

commodity, and foreign exchange. Because VaR is based upon

previous moves in market risk factors over recent periods, it may

not provide accurate predictions of future market moves.

Sensitivity analysis complements VaR as it provides an

indication of risk relative to each factor irrespective of historical

market moves. Sensitivities are monitored at both the desk level

and at an aggregated level by senior management on a daily

basis. Our corporate market risk management function

aggregates all Company exposures to monitor the risk

sensitivities are within established tolerances. Changes to the

Company’s sensitivities are analyzed and reported on a daily

basis. The Company monitors risk exposure from a variety of

perspectives, which include line of business, product, risk type

and legal entity.

MARKET RISK – EQUITY INVESTMENTS We are directly and

indirectly affected by changes in the equity markets. We make

and manage direct equity investments in start-up businesses,

emerging growth companies, management buy-outs,

acquisitions and corporate recapitalizations. We also invest in

non-affiliated funds that make similar private equity

investments. These private equity investments are made within

capital allocations approved by management and the Board. The

Board’s policy is to review business developments, key risks and

historical returns for the private equity investment portfolio at

least annually. Management reviews the valuations of these

investments at least quarterly and assesses them for possible

OTTI. For nonmarketable investments, the analysis is based on

facts and circumstances of each individual investment and the

expectations for that investment’s cash flows and capital needs,

the viability of its business model and our exit strategy.

Nonmarketable investments include private equity investments

accounted for under the cost method and equity method. Private

equity investments are subject to OTTI.

As part of our business to support our customers, we trade

public equities, listed/OTC equity derivatives and convertible

bonds. We have parameters that govern these activities. We also

have marketable equity securities in the securities available-for-

sale portfolio, including securities relating to our venture capital

activities. We manage these investments within capital risk

limits approved by management and the Board and monitored

by Corporate ALCO. Gains and losses on these securities are

recognized in net income when realized and periodically include

OTTI charges.

Changes in equity market prices may also indirectly affect our

net income by (1) the value of third party assets under

management and, hence, fee income, (2) particular borrowers,

whose ability to repay principal and/or interest may be affected

by the stock market, or (3) brokerage activity, related

commission income and other business activities. Each business

line monitors and manages these indirect risks.

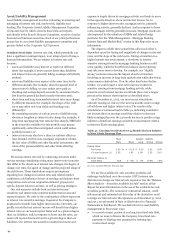

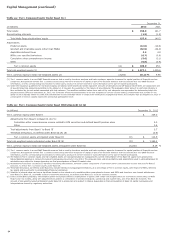

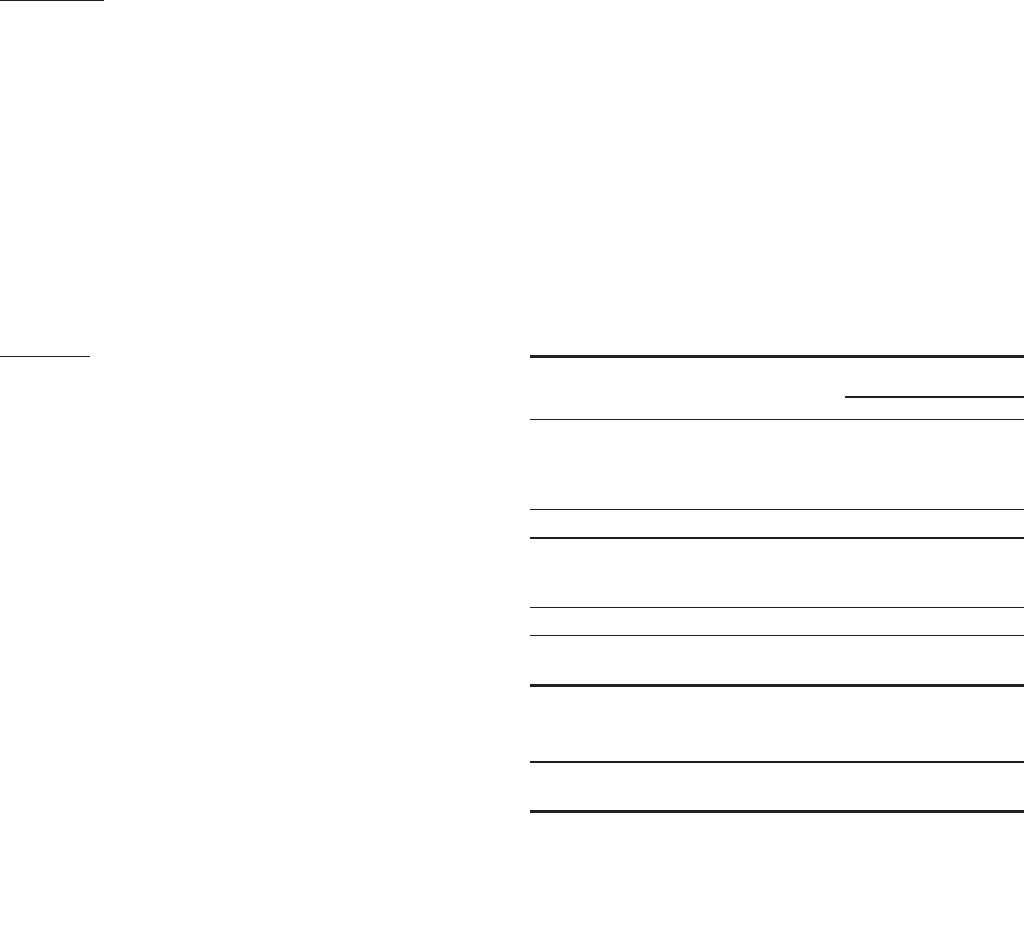

Table 46 provides information regarding our marketable and

nonmarketable equity investments.

Table 46: Nonmarketable and Marketable Equity Investments

December 31,

(in millions) 2012 2011

Nonmarketable equity investments:

Cost method:

Private equity investments $ 2,572 3,444

Federal bank stock 4,227 4,617

Total cost method 6,799 8,061

Equity method and other:

LIHTC investments (1) 4,767 4,077

Private equity and other 6,156 4,670

Total equity method and other 10,923 8,747

Total nonmarketable

equity investments (2) $ 17,722 16,808

Marketable equity securities:

Cost $ 2,337 2,929

Net unrealized gains 448 488

Total marketable

equity securities (3) $ 2,785 3,417

(1) Represents low income housing tax credit investments.

(2) Included in other assets on the balance sheet. See Note 7 (Premises, Equipment,

Lease Commitments and Other Assets) to Financial Statements in this Report for

additional information.

(3) Included in securities available for sale. See Note 5 (Securities Available for Sale)

to Financial Statements in this Report for additional information.

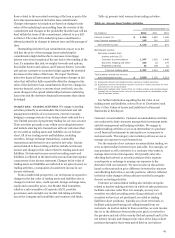

LIQUIDITY AND FUNDING The objective of effective liquidity

management is to ensure that we can meet customer loan

requests, customer deposit maturities/withdrawals and other

cash commitments efficiently under both normal operating

conditions and under unpredictable circumstances of industry or

market stress. To achieve this objective, the Corporate ALCO

establishes and monitors liquidity guidelines that require

sufficient asset-based liquidity to cover potential funding

requirements and to avoid over-dependence on volatile, less

reliable funding markets. We set these guidelines for both the

consolidated balance sheet and for the Parent to ensure that the

Parent is a source of strength for its regulated, deposit-taking

banking subsidiaries.

Unencumbered debt and equity securities in the securities

available-for-sale portfolio provide asset liquidity, in addition to

the immediately liquid resources of cash and due from banks

and federal funds sold, securities purchased under resale

agreements and other short-term investments. The weighted-

86