Wells Fargo 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

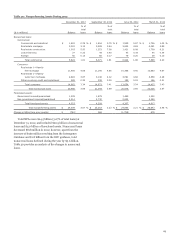

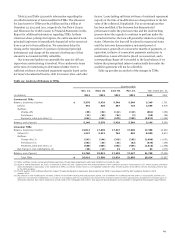

We monitor the number of borrowers paying the minimum

amount due on a monthly basis. In December 2012,

approximately 44% of our borrowers with a home equity

outstanding balance paid only the minimum amount due; 93%

paid the minimum or more.

The home equity liquidating portfolio includes home equity

loans generated through third party channels, including

correspondent loans. This liquidating portfolio represents less

than 1% of our total loans outstanding at December 31, 2012,

and contains some of the highest risk in our home equity

portfolio, with a loss rate of 9.03% compared with 3.03% for the

core (non-liquidating) home equity portfolio at

December 31, 2012.

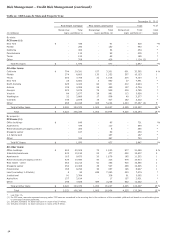

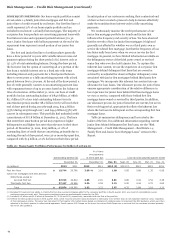

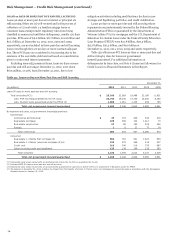

Table 27 shows the credit attributes of the core and

liquidating home equity portfolios and lists the top five states by

outstanding balance. California loans represent the largest state

concentration in each of these portfolios. The decrease in

outstanding balances primarily reflects loan paydowns and

charge-offs. As of December 31, 2012, 34% of the outstanding

balance of the core home equity portfolio was associated with

loans that had a combined loan to value (CLTV) ratio in excess of

100%. CLTV means the ratio of the total loan balance of first

mortgages and junior lien mortgages (including unused line

amounts for credit line products) to property collateral

value. The unsecured portion of the outstanding balances of

these loans (the outstanding amount that was in excess of the

most recent property collateral value) totaled 15% of the core

home equity portfolio at December 31, 2012.

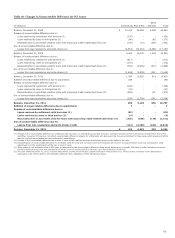

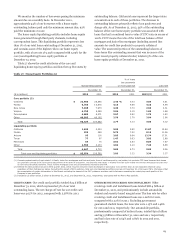

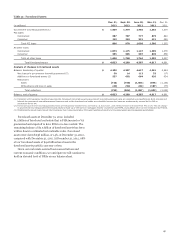

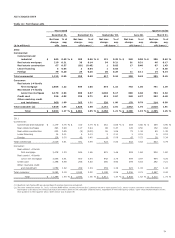

Table 27: Home Equity Portfolios (1)

% of loans

two payments

Outstanding balance or more past due Loss rate

December 31, December 31, December 31,

($ in millions) 2012 2011 2012 2011 2012 (2) 2011

Core portfolio (3)

California $ 22,900 25,555 2.46 % 3.03 3.59 3.61

Florida 9,763 10,870 4.15 4.99 4.10 4.99

New Jersey 7,338 7,973 3.43 3.73 2.50 2.31

Virginia 4,758 5,248 2.04 2.15 1.83 1.68

Pennsylvania 4,683 5,071 2.67 2.82 1.72 1.40

Other 40,985 46,165 2.59 2.79 2.84 2.66

Total 90,427 100,882 2.77 3.13 3.03 3.02

Liquidating portfolio

California 1,633 2,024 3.99 5.50 11.87 12.64

Florida 223 265 5.79 7.02 8.15 11.56

Arizona 95 116 3.85 6.64 12.74 17.51

Texas 77 97 1.47 0.93 3.02 2.89

Minnesota 64 75 3.62 2.83 8.84 7.67

Other 2,555 3,133 3.62 4.13 7.33 6.88

Total 4,647 5,710 3.82 4.73 9.03 9.36

Total core and liquidating portfolios $ 95,074 106,592 2.82 3.22 3.34 3.37

(1) Consists predominantly of real estate 1-4 family junior lien mortgages and first and junior lines of credit secured by real estate, but excludes PCI loans because their losses

are generally covered by PCI accounting adjustment at the date of acquisition, and excludes real estate 1-4 family first lien open-ended line reverse mortgages because they

do not have scheduled payments. These reverse mortgage loans are predominantly insured by the FHA.

(2) Reflects the OCC guidance issued in third quarter 2012, which requires consumer loans discharged in bankruptcy to be written down to net realizable collateral value,

regardless of their delinquency status. Excluding the impact of OCC guidance, total core and liquidating portfolio loss rate at December 31, 2012 was 2.76%. We believe that

the presentation of certain information in this Report excluding the impact of the OCC guidance provides useful disclosure regarding the underlying credit quality of the

Company’s loan portfolios.

(3) Includes $1.3 billion and $1.5 billion at December 31, 2012, and December 31, 2011, respectively, associated with the Pick-a-Pay portfolio.

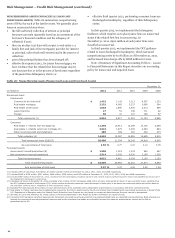

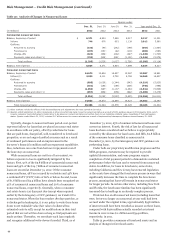

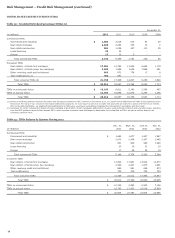

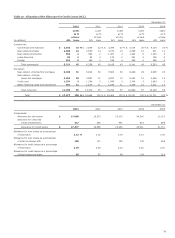

CREDIT CARDS Our credit card portfolio totaled $24.6 billion at

December 31, 2012, which represented 3% of our total

outstanding loans. The net charge-off rate for our credit card

loans was 4.02% for 2012, compared with 5.58% for 2011.

OTHER REVOLVING CREDIT AND INSTALLMENT Other

revolving credit and installment loans totaled $88.4 billion at

December 31, 2012, and predominantly include automobile,

student and security-based margin loans. The loss rate for other

revolving credit and installment loans was 1.00% for 2012,

compared with 1.22% for 2011. Excluding government

guaranteed student loans, the loss rates were 1.15% and 1.46%

for 2012 and 2011, respectively. Our automobile portfolio,

predominantly composed of indirect loans, totaled $46.0 billion

and $43.5 billion at December 31, 2012 and 2011, respectively,

and had a loss rate of 0.64% and 0.82% in 2012 and 2011,

respectively.

63