Wells Fargo 2012 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

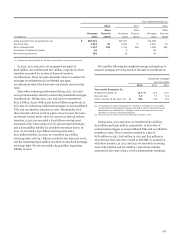

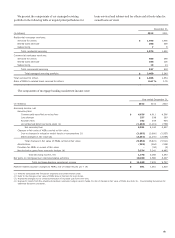

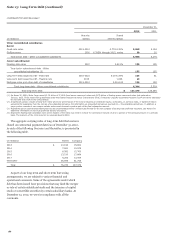

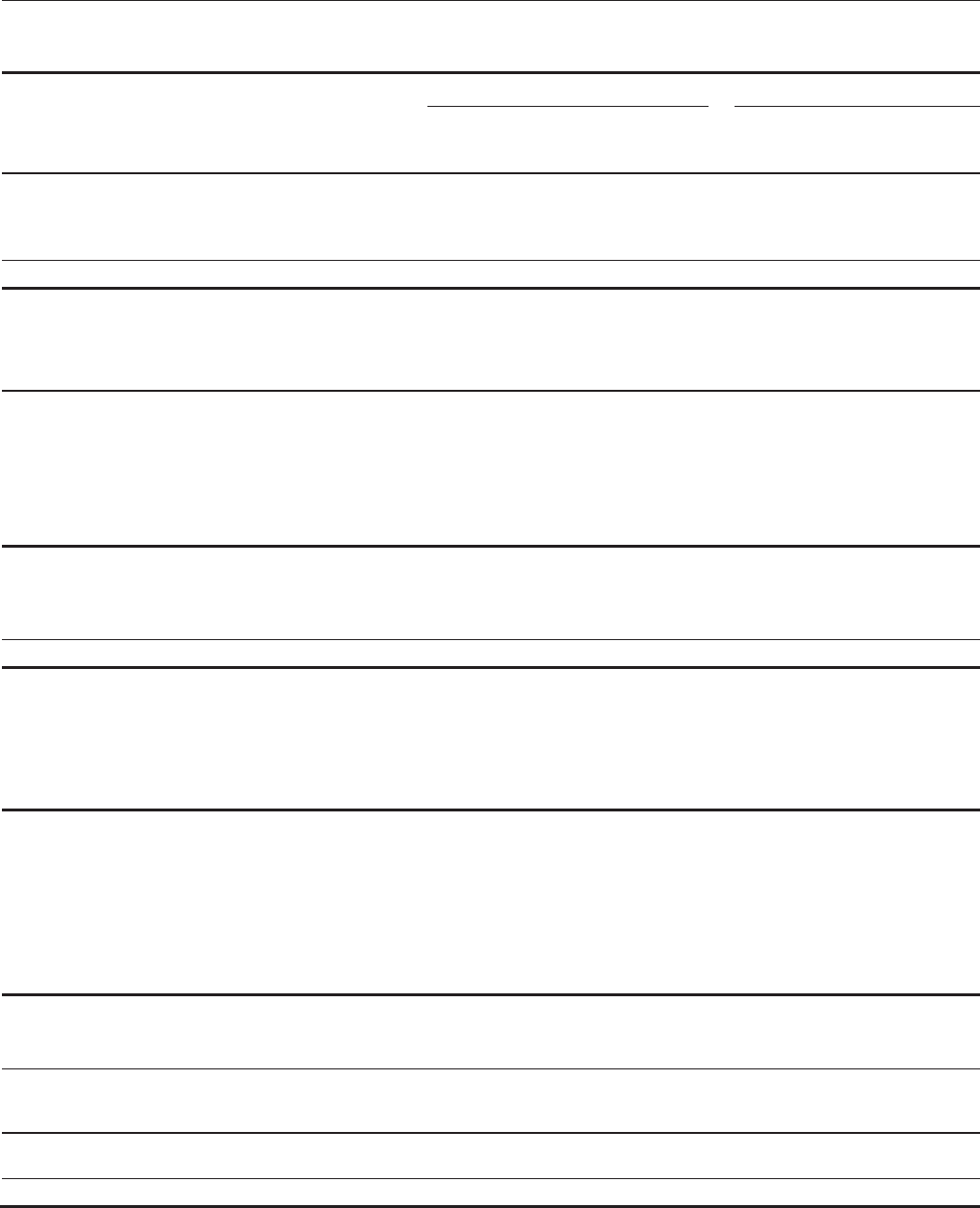

Note 10: Intangible Assets

The gross carrying value of intangible assets and accumulated amortization was:

December 31, 2012 December 31, 2011

Gross Net Gross Net

carrying Accumulated carrying carrying Accumulated carrying

(in millions) value amortization value value amortization value

Amortized intangible assets (1):

MSRs (2) $ 2,317 (1,157) 1,160 2,383 (975) 1,408

Core deposit intangibles 12,836 (6,921) 5,915 15,079 (7,768) 7,311

Customer relationship and other intangibles 3,147 (1,795) 1,352 3,158 (1,519) 1,639

Total amortized intangible assets $ 18,300 (9,873) 8,427 20,620 (10,262) 10,358

Unamortized intangible assets:

MSRs (carried at fair value) (2) $ 11,538 12,603

Goodwill 25,637 25,115

Trademark 14 14

(1) Excludes fully amortized intangible assets.

(2) See Note 9 for additional information on MSRs.

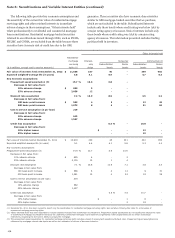

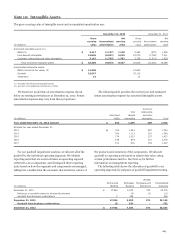

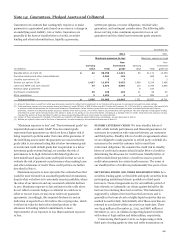

We based our projections of amortization expense shown

below on existing asset balances at December 31, 2012. Future

amortization expense may vary from these projections.

The following table provides the current year and estimated

future amortization expense for amortized intangible assets.

Customer

Core relationship

Amortized deposit and other

(in millions) MSRs intangibles intangibles Total

Year ended December 31, 2012 (actual) $ 233 1,396 286 1,915

Estimate for year ended December 31,

2013 $ 235 1,241 267 1,743

2014 204 1,113 251 1,568

2015 178 1,022 227 1,427

2016 145 919 212 1,276

2017 101 851 195 1,147

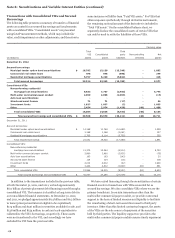

For our goodwill impairment analysis, we allocate all of the

goodwill to the individual operating segments. We identify

reporting units that are one level below an operating segment

(referred to as a component), and distinguish these reporting

units based on how the segments and components are managed,

taking into consideration the economic characteristics, nature of

the products and customers of the components. We allocate

goodwill to reporting units based on relative fair value, using

certain performance metrics. See Note 24 for further

information on management reporting.

The following table shows the allocation of goodwill to our

operating segments for purposes of goodwill impairment testing.

Wealth,

Community Wholesale Brokerage and Consolidated

(in millions) Banking Banking Retirement Company

December 31, 2010 $ 17,922 6,475 373 24,770

Reduction in goodwill related to divested businesses - (9) (2) (11)

Goodwill from business combinations 2 354 - 356

December 31, 2011 17,924 6,820 371 25,115

Goodwill from business combinations (2) 524 - 522

December 31, 2012 $ 17,922 7,344 371 25,637

183