Wells Fargo 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

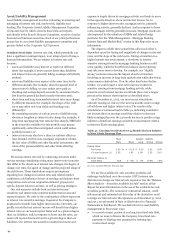

Risk Management – Credit Risk Management (continued)

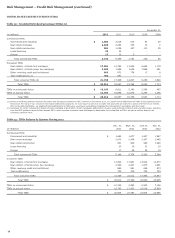

Four percent of this portfolio is private label securitizations for

which we originated the loans and therefore have some

repurchase risk. Although we have observed an increase in

outstanding demands, compared to December 31, 2011,

associated with our private label securitizations as some

investors have reviewed defaulted loans for potential breaches of

our loan sale representations and warranties, we continue to

believe the risk of repurchase in our private label securitizations

is substantially reduced, relative to other private label

securitizations, because approximately one-half of this portfolio

of private label securitizations do not contain representations

and warranties regarding borrower or other third party

misrepresentations related to the mortgage loan, general

compliance with underwriting guidelines, or property valuation,

which are commonly asserted bases for repurchase. For this 4%

private label securitization segment of our residential mortgage

loan servicing portfolio (weighted average age of 86 months),

58% are loans from 2005 vintages or earlier; 78% were prime at

origination; and approximately 64% are jumbo loans. The

weighted-average LTV as of December 31, 2012 for this private

securitization segment was 75%. We believe the highest risk

segment of these private label securitizations is the subprime

loans originated in 2006 and 2007. These subprime loans have

seller representations and warranties and currently have LTVs

close to or exceeding 100%, and represent 9% of the private label

securitization portion of the residential mortgage servicing

portfolio. We had $180 million of repurchases related to private

label securitizations in 2012 compared with $110 million in 2011.

Of the servicing portfolio, 4% is non-agency acquired

servicing and 1% is private whole loan sales. We did not

underwrite and securitize the non-agency acquired servicing and

therefore we have no obligation on that portion of our servicing

portfolio to the investor for any repurchase demands arising

from origination practices. For the private whole loan segment,

while we do have repurchase risk on these loans, less than 2%

were subprime at origination and loans that were sold and

subsequently securitized are included in the private label

securitization segment discussed above.

Table 39 summarizes the changes in our mortgage

repurchase liability.

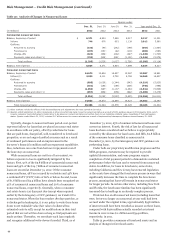

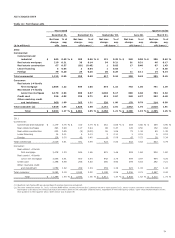

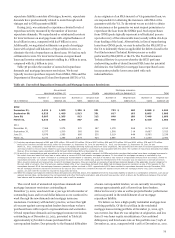

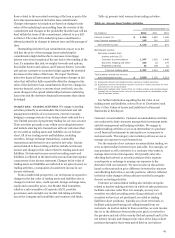

Table 39: Changes in Mortgage Repurchase Liability

Quarter ended

Dec. 31, Sept. 30, June 30, Mar. 31, Year ended Dec. 31,

(in millions) 2012 2012 2012 2012 2012 2011 2010

Balance, beginning of period $ 2,033 1,764 1,444 1,326 1,326 1,289 1,033

Provision for repurchase losses:

Loan sales 66 75 72 62 275 101 144

Change in estimate (1) 313 387 597 368 1,665 1,184 1,474

Total additions 379 462 669 430 1,940 1,285 1,618

Losses (206) (193) (349) (312) (1,060) (1,248) (1,362)

Balance, end of period $ 2,206 2,033 1,764 1,444 2,206 1,326 1,289

(1) Results from changes in investor demand and mortgage insurer practices, credit deterioration and changes in the financial stability of correspondent lenders.

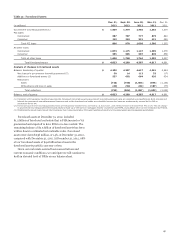

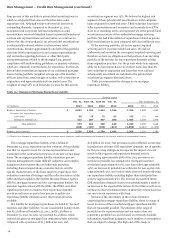

The mortgage repurchase liability of $2.2 billion at

December 31, 2012, represents our best estimate of the probable

loss that we expect to incur for various representations and

warranties in the contractual provisions of our sales of mortgage

loans. The mortgage repurchase liability estimation process

requires management to make difficult, subjective and complex

judgments about matters that are inherently uncertain,

including demand expectations, economic factors, and the

specific characteristics of the loans subject to repurchase. Our

evaluation considers all vintages and the collective actions of the

GSEs and their regulator, the Federal Housing Finance Agency

(FHFA), mortgage insurers and our correspondent lenders. We

maintain regular contact with the GSEs, the FHFA, and other

significant investors to monitor their repurchase demand

practices and issues as part of our process to update our

repurchase liability estimate as new information becomes

available.

Our liability for mortgage repurchases, included in “Accrued

expenses and other liabilities” in our consolidated balance sheet,

was $2.2 billion at December 31, 2012, and $1.3 billion at

December 31, 2011. In 2012, we provided $1.9 billion, which

reduced net gains on mortgage loan origination/sales activities,

compared with a provision of $1.3 billion for 2011 and

$1.6 billion for 2010. Our provision in 2012 reflected an increase

in projections of future GSE repurchase demands, net of appeals,

for the pre-2009 vintages to incorporate the impact of recent

trends in file requests and repurchase demand activity

(comprising approximately 58% of the 2012 provision), an

increase in probable loss estimates for mortgage insurance

rescissions (approximately 10%), new loan sales (approximately

14%), an increase in probable loss estimates for non-agency risk

(approximately 9%), and various other observed trends affecting

our repurchase liability including higher than anticipated loss

severity (approximately 9%). The increase in projected future

GSE repurchase demands in 2012 was predominantly a result of

an increase in the expected file reviews by the GSEs as well as an

increase in observed demand rates on these file reviews based on

our most recent experience with them.

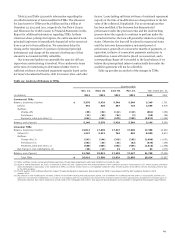

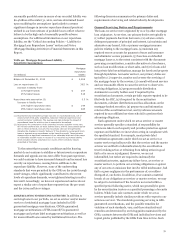

Because of the uncertainty in the various estimates

underlying the mortgage repurchase liability, there is a range of

losses in excess of the recorded mortgage repurchase liability

that are reasonably possible. The estimate of the range of

possible loss for representations and warranties does not

represent a probable loss, and is based on currently available

information, significant judgment, and a number of assumptions

that are subject to change. The high end of this range of

76