Wells Fargo 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

comprehensive wealth management services to ultra high net

worth families and individuals as well as their endowments and

foundations. Brokerage serves customers' advisory, brokerage

and financial needs as part of one of the largest full-service

brokerage firms in the United States. Retirement is a national

leader in providing institutional retirement and trust services

(including 401(k) and pension plan record keeping) for

businesses, retail retirement solutions for individuals, and

reinsurance services for the life insurance industry.

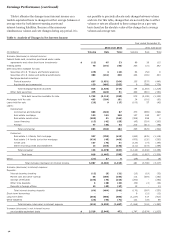

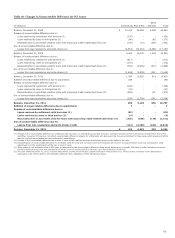

Wealth, Brokerage and Retirement reported net income of

$1.3 billion in 2012, up $47 million, or 4%, from 2011. The prior

year results include the H.D. Vest Financial Services business

that was sold in fourth quarter 2011 at a gain of $153 million.

Revenue of $12.2 billion decreased $17 million from 2011. Net

interest income decreased due to lower interest rates on the loan

and investment portfolios partially offset by the impact of

growth in low-cost core deposits. Average core deposits of

$137.5 billion in 2012 increased 6% from 2011. Noninterest

income increased year over year due to higher asset-based fees

and gains on deferred compensation plan investments (offset in

expense). The increase was partially offset by the 2011 gain on

the sale of H.D. Vest, lower transaction revenue and reduced

securities gains in the brokerage business. Noninterest expense

was flat, including the impact of deferred compensation plan

expense (offset in revenue), for 2012 compared with 2011. The

provision for credit losses decreased $45 million, or 26%, from

2011, due to improved credit quality and lower net charge-offs.

Balance Sheet Analysis

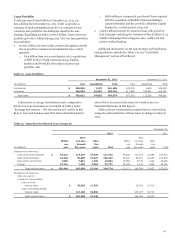

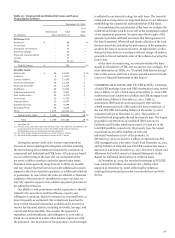

Our total assets grew 8% in 2012 to $1.4 trillion, funded

predominantly by strong deposit growth. Our core deposits grew

$73.1 billion ($67.2 billion on average) or 8% in 2012. The

predominant areas of asset growth were in short-term

investments, which increased $92.9 billion, and loans, which

increased $29.9 billion. The strong loan growth represents core

loan growth of $47.7 billion (including retention of $19.4 billion

of 1-4 family conforming first mortgage production on the

balance sheet), partially offset by the runoff in our non

strategic/liquidating loan portfolio of $17.8 billion. We also

increased securities available for sale by $12.6 billion in 2012.

The strength of our business model produced record earnings

and continued internal capital generation as reflected in our

capital ratios, substantially all of which improved from

December 31, 2011. Tier 1 capital as a percentage of total risk-

weighted assets increased to 11.75%, total capital decreased to

14.63%, Tier 1 leverage increased to 9.47%, and Tier 1 common

equity increased to 10.12% at December 31, 2012, compared with

11.33%, 14.76%, 9.03%, and 9.46%, respectively, at

December 31, 2011.

The following discussion provides additional information

about the major components of our balance sheet. Information

regarding our capital and changes in our asset mix is included in

the “Earnings Performance – Net Interest Income” and “Capital

Management” sections and Note 26 (Regulatory and Agency

Capital Requirements) to Financial Statements in this Report.

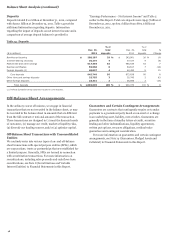

Securities Available for Sale

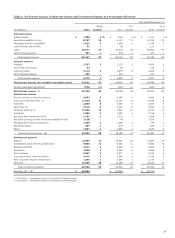

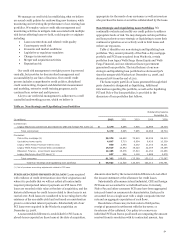

Table 10: Securities Available for Sale – Summary

December 31,

2012 2011

Net Net

unrealized Fair unrealized Fair

(in millions) Cost gain value Cost gain value

Debt securities available for sale $ 220,946 11,468 232,414 212,642 6,554 219,196

Marketable equity securities 2,337 448 2,785 2,929 488 3,417

Total securities available for sale $ 223,283 11,916 235,199 215,571 7,042 222,613

Table 10 presents a summary of our securities available-for-

sale portfolio, which consists of both debt and marketable equity

securities. The total net unrealized gains on securities available

for sale were $11.9 billion at December 31, 2012, up from net

unrealized gains of $7.0 billion at December 31, 2011, due mostly

to a decline in long-term yields and tightening of credit spreads.

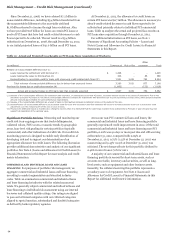

The size and composition of the available-for-sale portfolio is

largely dependent upon the Company’s liquidity and interest rate

risk management objectives. Our business generates assets and

liabilities, such as loans, deposits and long-term debt, which

have different maturities, yields, re-pricing, prepayment

characteristics and other provisions that expose us to interest

rate and liquidity risk. The available-for-sale securities portfolio

consists primarily of liquid, high quality federal agency debt,

privately issued mortgage-backed securities (MBS), securities

issued by U.S. states and political subdivisions and corporate

debt securities. Due to its highly liquid nature, the available-for-

sale portfolio can be used to meet funding needs that arise in the

normal course of business or due to market stress. Changes in

our interest rate risk profile may occur due to changes in overall

economic or market conditions that could influence drivers such

as loan origination demand, prepayment speeds, or deposit

balances and mix. In response, the available-for-sale securities

portfolio can be rebalanced to meet the Company’s interest rate

risk management objectives. In addition to meeting liquidity and

interest rate risk management objectives, the available-for-sale

securities portfolio may provide yield enhancement over other

short-term assets. See the “Risk Management - Asset/Liability

45