Wells Fargo 2012 Annual Report Download - page 204

Download and view the complete annual report

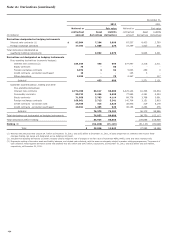

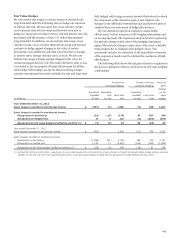

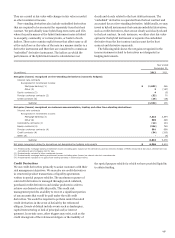

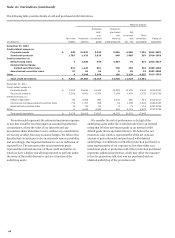

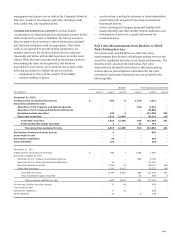

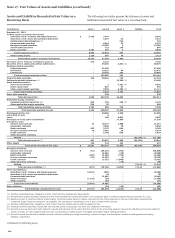

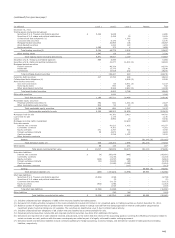

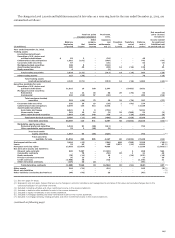

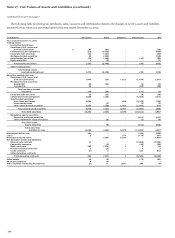

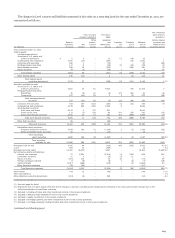

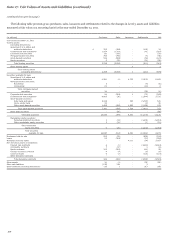

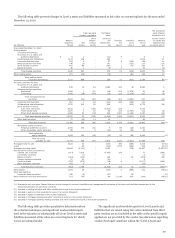

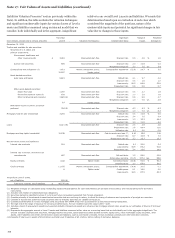

Please find page 204 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 17: Fair Values of Assets and Liabilities (continued)

qualitative assessments of the viability of the investee, evaluation

of the financial statements of the investee and prospects for its

future. Public equity investments are valued using quoted

market prices and discounts are only applied when there are

trading restrictions that are an attribute of the investment. We

estimate the fair value of investments in non-public securities

using metrics such as security prices of comparable public

companies, acquisition prices for similar companies and original

investment purchase price multiples, while also incorporating a

portfolio company's financial performance and specific factors.

For investments in private equity funds, we use the NAV

provided by the fund sponsor as an appropriate measure of fair

value. In some cases, such NAVs require adjustments based on

certain unobservable inputs.

Liabilities

DEPOSIT LIABILITIES

Deposit liabilities are carried at historical

cost. The fair value of deposits with no stated maturity, such as

noninterest-bearing demand deposits, interest-bearing checking,

and market rate and other savings, is equal to the amount

payable on demand at the measurement date. The fair value of

other time deposits is calculated based on the discounted value

of contractual cash flows. The discount rate is estimated using

the rates currently offered for like wholesale deposits with

similar remaining maturities.

SHORT-TERM FINANCIAL LIABILITIES Short-term financial

liabilities are carried at historical cost and include federal funds

purchased and securities sold under repurchase agreements,

commercial paper and other short-term borrowings. The

carrying amount is a reasonable estimate of fair value because of

the relatively short time between the origination of the

instrument and its expected realization.

OTHER LIABILITIES Other liabilities recorded at fair value on a

recurring basis, excluding derivative liabilities (see the

“Derivatives” section for derivative liabilities), includes primarily

short sale liabilities. Short sale liabilities are predominantly

classified as either Level 1 or Level 2, generally dependent upon

whether the underlying securities have readily obtainable quoted

prices in active exchange markets.

LONG-TERM DEBT Long-term debt is generally carried at

amortized cost. For disclosure, we are required to estimate the

fair value of long-term debt. Generally, the discounted cash flow

method is used to estimate the fair value of our long-term debt.

Contractual cash flows are discounted using rates currently

offered for new notes with similar remaining maturities and, as

such, these discount rates include our current spread levels.

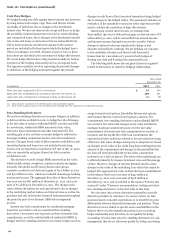

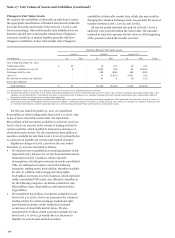

Level 3 Asset and Liability Valuation Processes

We generally determine fair value of our Level 3 assets and

liabilities by using internally developed models and, to a lesser

extent, prices obtained from third-party pricing services or

brokers (collectively, vendors). Our valuation processes vary

depending on which approach is utilized.

INTERNAL MODEL VALUATIONS Our internally developed

models primarily consist of discounted cash flow techniques. Use

of such techniques requires determining relevant inputs, some of

which are unobservable. Unobservable inputs are generally

derived from historic performance of similar assets or

determined from previous market trades in similar instruments.

These unobservable inputs usually consist of discount rates,

default rates, loss severity upon default, volatilities, correlations

and prepayment rates, which are inherent within our Level 3

instruments. Such inputs can be correlated to similar portfolios

with known historic experience or recent trades where particular

unobservable inputs may be implied; but due to the nature of

various inputs being reflected within a particular trade, the value

of each input is considered unobservable. We attempt to

correlate each unobservable input to historic experience and

other third party data where available.

Internal valuation models are subject to review prescribed

within our model risk management policies and procedures

which includes model validation. The purpose of model

validation includes ensuring the model is appropriate for its

intended use and the appropriate controls exist to help mitigate

risk of invalid valuations. Model validation assesses the

adequacy and appropriateness of the model, including reviewing

its key components such as inputs, processing components, logic

or theory, output results and supporting model documentation.

Validation also includes ensuring significant unobservable

model inputs are appropriate given observable market

transactions or other market data within the same or similar

asset classes. This ensures modeled approaches are appropriate

given similar product valuation techniques and are in line with

their intended purpose.

We have ongoing monitoring procedures in place for our

Level 3 assets and liabilities that use such internal valuation

models. These procedures, which are designed to provide

reasonable assurance that models continue to perform as

expected after approved, include:

ongoing analysis and benchmarking to market transactions

and other independent market data (including pricing

vendors, if available);

back-testing of modeled fair values to actual realized

transactions; and

review of modeled valuation results against expectations,

including review of significant or unusual value fluctuations.

We update model inputs and methodologies periodically to

reflect these monitoring procedures. Additionally, procedures

and controls are in place to ensure existing models are subject to

periodic reviews, and we perform full model revalidations as

necessary.

All internal valuation models are subject to ongoing review

by business-unit-level management. More complex models are

subject to additional oversight by a corporate-level risk

management department. Corporate oversight responsibilities

include evaluating adequacy of business unit risk management

programs, maintaining company-wide model validation policies

and standards and reporting the results of these activities to

management and our Enterprise Risk Management Committee

(ERMC). The ERMC, which consists of senior executive

202