Wells Fargo 2012 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

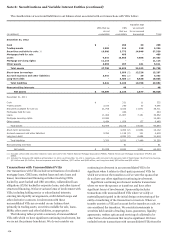

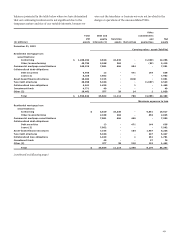

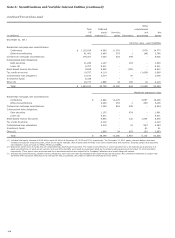

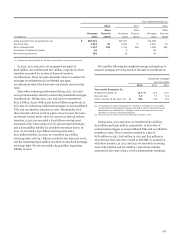

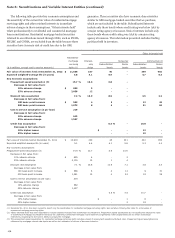

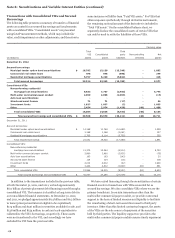

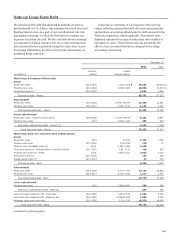

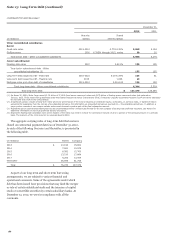

Note 8: Securitizations and Variable Interest Entities (continued)

The following table provides key economic assumptions and

the sensitivity of the current fair value of residential mortgage

servicing rights and other retained interests to immediate

adverse changes in those assumptions. “Other interests held”

relate predominantly to residential and commercial mortgage

loan securitizations. Residential mortgage-backed securities

retained in securitizations issued through GSEs, such as FNMA,

FHLMC and GNMA, are excluded from the table because these

securities have a remote risk of credit loss due to the GSE

guarantee. These securities also have economic characteristics

similar to GSE mortgage-backed securities that we purchase,

which are not included in the table. Subordinated interests

include only those bonds whose credit rating was below AAA by

a major rating agency at issuance. Senior interests include only

those bonds whose credit rating was AAA by a major rating

agency at issuance. The information presented excludes trading

positions held in inventory.

Other interests held

Residential

mortgage Interest- Consumer Commercial (2)

servicing only Subordinated Senior Subordinated Senior

($ in millions, except cost to service amounts) rights (1) strips bonds bonds bonds bonds

Fair value of interests held at December 31, 2012 $ 11,538 187 40 - 249 982

Expected weighted-average life (in years) 4.8 4.1 5.9 - 4.7 5.3

Key economic assumptions:

Prepayment speed assumption (3) 15.7 % 10.6 6.8 -

Decrease in fair value from:

10% adverse change $ 869 5 - -

25% adverse change 2,038 12 - -

Discount rate assumption 7.4 % 16.9 8.9 - 3.5 2.2

Decrease in fair value from:

100 basis point increase $ 562 4 2 - 12 43

200 basis point increase 1,073 8 4 - 21 84

Cost to service assumption ($ per loan) 219

Decrease in fair value from:

10% adverse change 615

25% adverse change 1,537

Credit loss assumption 0.4 % - 10.0 -

Decrease in fair value from:

10% higher losses $ - - 12 -

25% higher losses - - 19 -

Fair value of interests held at December 31, 2011 $ 12,918 230 45 321 240 852

Expected weighted-average life (in years) 5.1 4.6 6.1 5.6 5.3 4.4

Key economic assumptions:

Prepayment speed assumption (3) 14.8 % 10.7 6.9 13.9

Decrease in fair value from:

10% adverse change $ 895 6 - 2

25% adverse change 2,105 15 1 4

Discount rate assumption 7.1 % 15.6 11.9 7.1 3.8 2.4

Decrease in fair value from:

100 basis point increase $ 566 6 2 12 9 31

200 basis point increase 1,081 12 4 24 18 59

Cost to service assumption ($ per loan) 218

Decrease in fair value from:

10% adverse change 582

25% adverse change 1,457

Credit loss assumption 0.5 % 4.5 10.7 -

Decrease in fair value from:

10% higher losses $ - 1 8 -

25% higher losses - 2 18 -

(1) December 31, 2011, has been revised to report only the sensitivities for residential mortgage servicing rights. See narrative following this table for a discussion of

commercial mortgage servicing rights.

(2) “Other interests held” has been expanded to include retained interests from commercial securitizations. Prepayment speed assumptions do not significantly impact the value

of commercial mortgage securitization bonds as the underlying commercial mortgage loans experience significantly lower prepayments due to certain contractual

restrictions, impacting the borrower’s ability to prepay the mortgage.

(3) The prepayment speed assumption for residential mortgage servicing rights includes a blend of prepayment speeds and default rates. Prepayment speed assumptions are

influenced by mortgage interest rate inputs as well as our estimation of drivers of borrower behavior.

176