Wells Fargo 2012 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

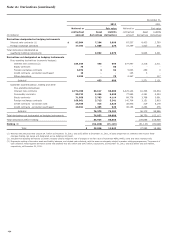

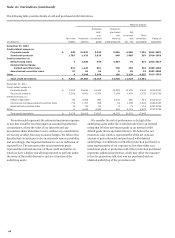

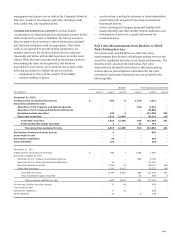

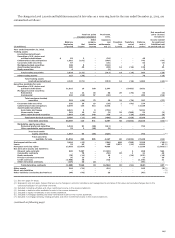

Note 16: Derivatives (continued)

The following table provides details of sold and purchased credit derivatives.

Notional amount

Protection Protection

sold - purchased Net

non- with protection Other

Fair value Protection investment identical sold protection Range of

(in millions) liability sold (A) grade underlyings (B) (A) - (B) purchased maturities

December 31, 2012

Credit default swaps on:

Corporate bonds $ 240 15,845 8,448 9,636 6,209 7,701 2013-2021

Structured products 1,787 2,433 2,039 948 1,485 393 2016-2056

Credit protection on:

Default swap index 4 3,520 348 3,444 76 616 2013-2017

Commercial mortgage-

backed securities index 531 1,249 861 790 459 524 2049-2052

Asset-backed securities index 57 64 64 6 58 92 2037-2046

Other 4 3,344 3,344 106 3,238 4,655 2013-2056

Total credit derivatives $ 2,623 26,455 15,104 14,930 11,525 13,981

December 31, 2011

Credit default swaps on:

Corporate bonds $ 1,002 24,634 14,043 13,329 11,305 9,404 2012-2021

Structured products 3,308 4,691 4,300 2,194 2,497 1,335 2016-2056

Credit protection on:

Default swap index 68 3,006 843 2,341 665 912 2012-2017

Commercial mortgage-backed securities index 713 1,357 458 19 1,338 1,403 2049-2052

Asset-backed securities index 76 83 83 8 75 116 2037-2046

Other 11 4,632 4,090 481 4,151 4,673 2012-2056

Total credit derivatives $ 5,178 38,403 23,817 18,372 20,031 17,843

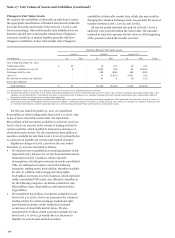

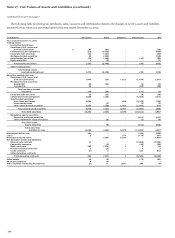

Protection sold represents the estimated maximum exposure

to loss that would be incurred under an assumed hypothetical

circumstance, where the value of our interests and any

associated collateral declines to zero, without any consideration

of recovery or offset from any economic hedges. We believe this

hypothetical circumstance to be an extremely remote possibility

and accordingly, this required disclosure is not an indication of

expected loss. The amounts under non-investment grade

represent the notional amounts of those credit derivatives on

which we have a higher risk of being required to perform under

the terms of the credit derivative and are a function of the

underlying assets.

We consider the risk of performance to be high if the

underlying assets under the credit derivative have an external

rating that is below investment grade or an internal credit

default grade that is equivalent thereto. We believe the net

protection sold, which is representative of the net notional

amount of protection sold and purchased with identical

underlyings, in combination with other protection purchased, is

more representative of our exposure to loss than either non-

investment grade or protection sold. Other protection purchased

represents additional protection, which may offset the exposure

to loss for protection sold, that was not purchased with an

identical underlying of the protection sold.

198