Wells Fargo 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

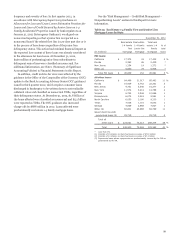

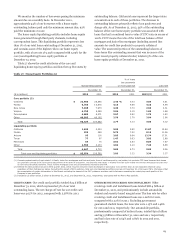

FOREIGN LOANS AND EUROPEAN EXPOSURE We classify

loans as foreign if the borrower’s primary address is outside of

the United States. At December 31, 2012, foreign loans totaled

$37.8 billion, representing approximately 5% of our total

consolidated loans outstanding and approximately 3% of our

total assets.

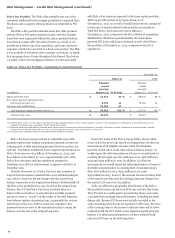

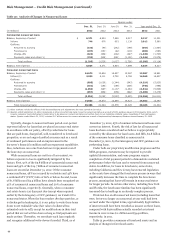

Our foreign country risk monitoring process incorporates

frequent dialogue with our foreign financial institution

customers, counterparties and with regulatory agencies,

enhanced by centralized monitoring of macroeconomic and

capital markets conditions. We establish exposure limits for

each country through a centralized oversight process based on

the needs of our customers, and in consideration of relevant

economic, political, social, legal, and transfer risks. We monitor

exposures closely and adjust our limits in response to changing

conditions.

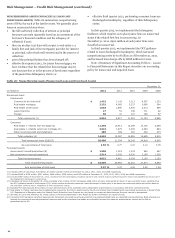

We evaluate our individual country risk exposure on an

ultimate country of risk basis which is normally based on the

country of residence of the guarantor or collateral location. Our

largest foreign country exposure on an ultimate risk basis was

the United Kingdom, which amounted to approximately

$15.9 billion, or 1% of our total assets, and included $2.3

billion of sovereign claims. Our United Kingdom sovereign

claims arise primarily from deposits we have placed with the

Bank of England pursuant to regulatory requirements in

support of our London branch.

At December 31, 2012, our Eurozone exposure, including

cross-border claims on an ultimate risk basis, and foreign

exchange and derivative products, aggregated approximately

$10.5 billion, including $232 million of sovereign claims,

compared with approximately $11.4 billion at

December 31, 2011, which included $364 million of sovereign

claims. Our Eurozone exposure is relatively small compared to

our overall credit risk exposure and is diverse by country, type,

and counterparty.

We conduct periodic stress tests of our significant country

risk exposures, analyzing the direct and indirect impacts on the

risk of loss from various macroeconomic and capital markets

scenarios. We do not have significant exposure to foreign

country risks because our foreign portfolio is relatively small.

However, we have identified exposure to increased loss from

U.S. borrowers associated with the potential impact of a

European downturn on the U.S. economy. We mitigate these

potential impacts on the risk of loss through our normal risk

management processes which include active monitoring and, if

necessary, the application of aggressive loss mitigation

strategies.

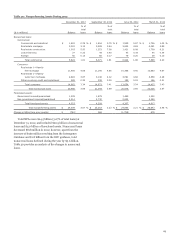

Table 22 provides information regarding our exposures to

European sovereign entities and institutions located within

such countries, including cross-border claims on an ultimate

risk basis, and foreign exchange and derivative products.

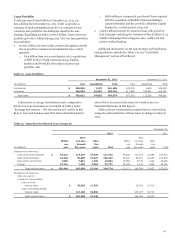

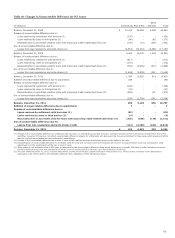

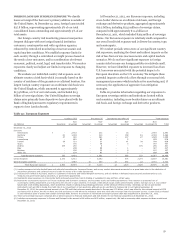

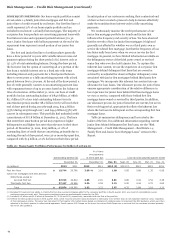

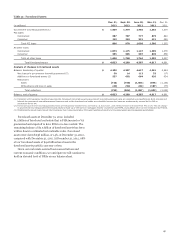

Table 22: European Exposure

Lending (1)(2) Securities (3) Derivatives and other (4) Total exposure

Non- Non- Non- Non-

(in millions) Sovereign sovereign Sovereign sovereign Sovereign sovereign Sovereign sovereign (5) Total

December 31, 2012

Eurozone

Netherlands $ - 2,542 - 334 - 18 - 2,894 2,894

Germany 61 1,934 - 210 - 159 61 2,303 2,364

France 27 920 - 461 - 147 27 1,528 1,555

Luxembourg - 891 - 82 - 5 - 978 978

Ireland 39 721 - 37 - 41 39 799 838

Spain - 735 - 59 - 3 - 797 797

Austria 105 250 - 6 - - 105 256 361

Italy - 238 - 88 - 1 - 327 327

Belgium - 156 - 32 - 9 - 197 197

Other (6) - 104 - 82 - 2 - 188 188

Total Eurozone exposure 232 8,491 - 1,391 - 385 232 10,267 10,499

United Kingdom 2,274 6,541 - 6,492 - 574 2,274 13,607 15,881

Other European countries - 3,887 10 250 12 564 22 4,701 4,723

Total European exposure $ 2,506 18,919 10 8,133 12 1,523 2,528 28,575 31,103

(1) Lending exposure includes funded loans and unfunded commitments, leveraged leases, and money market placements presented on a gross basis prior to the deduction of

impairment allowance and collateral received under the terms of the credit agreements.

(2) Includes $871 million in PCI loans, largely to customers in Germany and United Kingdom territories, and $2.4 billion in defeased leases secured predominantly by U.S.

Treasury and government agency securities, or government guaranteed.

(3) Represents issuer exposure on cross-border debt and equity securities, held in trading or available-for-sale portfolio, at fair value.

(4) Represents counterparty exposure on foreign exchange and derivative contracts, and securities resale and lending agreements. This exposure is presented net of

counterparty netting adjustments and reduced by the amount of cash collateral. It includes credit default swaps (CDS) predominantly used to manage our U.S. and London-

based cash credit trading businesses, which sometimes results in selling and purchasing protection on the identical reference entity. Generally, we do not use market

instruments such as CDS to hedge the credit risk of our investment or loan positions, although we do use them to manage risk in our trading businesses. At

December 31, 2012, the gross notional amount of our CDS sold that reference assets domiciled in Europe was $7.5 billion, which was offset by the notional amount of CDS

purchased of $7.6 billion. We did not have any CDS purchased or sold where the reference asset was solely the sovereign debt of a European country. Certain CDS purchased

or sold reference pools of assets that contain sovereign debt, however the amount of referenced sovereign European debt was insignificant at December 31, 2012.

(5) Total non-sovereign exposure comprises $13.1 billion exposure to financial institutions and $15.5 billion to non-financial corporations at December 31, 2012.

(6) Includes non-sovereign exposure to Greece and Portugal in the amount of $6 million and $30 million, respectively. We had no sovereign debt exposure to these countries at

December 31, 2012.

57