Wells Fargo 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Asset/Liability Management (continued)

sheet. Additionally, we may enter into separate derivative or

security positions to manage our exposure related to our long or

short security positions. Collectively, income earned on this type

of market-making activity is reflected in the fair value changes of

these positions recorded in net gain (losses) on trading activities.

Economic hedges and other Economic hedges in trading are not

designated in a hedge accounting relationship and exclude

economic hedging related to our asset/liability risk management

and substantially all mortgage banking risk management

activities. Economic hedging activities include the use of trading

securities to economically hedge risk exposures related to non-

trading activities or derivatives to hedge risk exposures related

to trading assets or trading liabilities. Economic hedges are

unrelated to our customer accommodation activities. Other

activities include financial assets held for investment purposes

that we elected to carry at fair value with changes in fair value

recorded to earnings in order to mitigate accounting

measurement mismatches or avoid embedded derivative

accounting complexities.

Proprietary trading Proprietary trading consists of security or

derivative positions executed for our own account based upon

market expectations or to benefit from price differences between

financial instruments and markets. Proprietary trading activity

is expected to be restricted by the Dodd-Frank Act prohibitions

known as the “Volcker Rule,” which has not yet been finalized.

On October 11, 2011, federal banking agencies and the SEC

issued proposed regulations to implement the Volcker Rule. We

believe our definition of proprietary trading is consistent with

the proposed regulations. However, given that final rule-making

is required by various governmental regulatory agencies to

define proprietary trading within the context of the final Volcker

Rule, our definition of proprietary trading may change. We have

reduced or exited certain business activities in anticipation of the

final Volcker Rule. As discussed within this section and the

noninterest income section of our financial results, proprietary

trading activity is not significant to our business or financial

results.

Risk Measurement Value-at-Risk (VaR) is a standardized

approach for monitoring and reporting market risk. We use VaR

metrics complemented with sensitivity analysis and stress

testing in managing and measuring the risk associated with

trading activities.

Value-at-Risk VaR is a statistical risk measure used to estimate

the potential loss from adverse market moves on trading and

other positions carried at fair value. VaR is determined using a

historical simulation approach and measures the worst expected

loss over a given time interval and within a given confidence

interval. We measure and report daily VaR at a 99% confidence

interval based on actual changes in rates and prices over each

trading day in the previous year.

The historical simulation approach is used to identify the

critical risk driver of each trading position with respect to

interest rates, credit spreads, foreign exchange rates, and equity

and commodity prices. The risk drivers for each position are

updated on a daily basis. The historical simulation approach

employs historical scenarios of the risk factors from each trading

day in the previous year, and estimates the value of the portfolio

on the scenarios to obtain a daily net trading revenue

distribution.

The Company calculates VaR for management purposes as

well as for regulatory purposes. The management view of VaR is

used for trading limits and is a wider view of risk compared to

Total Regulatory VaR. Total Regulatory VaR is calculated

according to regulatory rules and is used to calculate market risk

regulatory capital. It includes both General VaR and Specific

Risk VaR. Regulatory General VaR is the risk of loss due to broad

market movements such as movements in interest rates, equity

prices or foreign exchange rates. Specific Risk VaR is the risk of

loss on a position that could result from factors other than broad

market movements and includes event risk, default risk and

idiosyncratic risk.

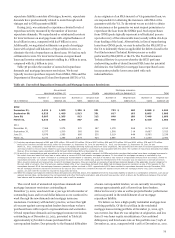

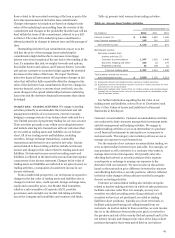

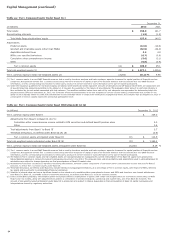

Table 43 below shows the results of the Company’s

Regulatory General VaR measures for 2012.

Table 43: Regulatory General Value-at-Risk (VaR)

Year ended December 31, 2012

Period

(in millions) end Average Low High

Risk Categories

Credit $ 19 23 10 43

Interest rate 13 19 7 41

Equity 5 5 3 12

Commodity 1 2 1 5

Foreign exchange 4 2 - 6

Diversification benefit (24) (1) (27) (1) - -

Total $ 18 24

(1) The period-end VaR and average VaR were less than the sum of the VaR

components described above, which is due to portfolio diversification. The

diversification effect arises because the risks are not perfectly correlated causing

a portfolio of positions to usually be less risky than the sum of the risks of the

positions alone.

84