Vodafone 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 Vodafone Group Plc Annual Report 2009

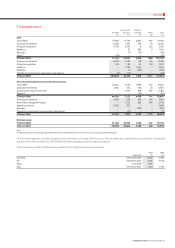

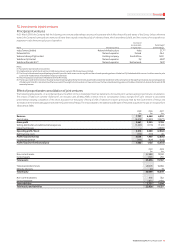

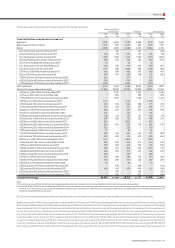

14. Investments in associated undertakings

At 31 March 2009, the Company had the following principal associated undertakings carrying on businesses which affect the profits and assets of the Group. The Company’s

principal associated undertakings all have share capital consisting solely of ordinary shares, unless otherwise stated, and are all indirectly held. The country of incorporation

or registration of all associated undertakings is also their principal place of operation.

Country of

incorporation Percentage(1)

Name Principal activity or registration shareholdings

Cellco Partnership(2) Network operator USA 45.0

Société Française du Radiotéléphone S.A. Network operator France 44.0

Safaricom Limited(3)(4)(5)(6) Network operator Kenya 40.0

Notes:

(1) Rounded to nearest tenth of one percent.

(2) Cellco Partnership trades under the name Verizon Wireless.

(3) The Group also holds two non-voting shares.

(4) Following completion of the share allocation for the public offering of 25% of Safaricom’s shares previously held by the Government of Kenya on 28 May 2008 and termination of the shareholders’

agreement with the Government of Kenya the Group changed the consolidation status of Safaricom from a joint venture to an associated undertaking.

(5) During the year ended 31 March 2009, under an agreement with Mobitelea Ventures Limited, the Group completed the purchase of a 5% indirect equity stake in Safaricom increasing the Group’s

effective interest in Safaricom to 40%.

(6) At 31 March 2009, the fair value of Safaricom Limited was KES 48 billion (£421 million) based on the closing quoted share price on the Nairobi stock exchange.

The Group’s share of the aggregated financial information of equity accounted associated undertakings is set out below. The amounts for the year ended 31 March 2007

include the share of results in Belgacom Mobile S.A. and Swisscom Mobile A.G. up to the date of their disposal on 3 November 2006 and 20 December 2006, respectively

(see note 30). The amounts for the year ended 31 March 2009 include the share of results in Safaricom from 28 May 2008, at which time its consolidation status changed

from being a joint venture to an associated undertaking.

2009 2008 2007

£m £m £m

Revenue 19,307 13,630 12,919

Share of result in associated undertakings 4,091 2,876 2,728

Share of discontinued operations in associated undertakings 57 – –

2009 2008

£m £m

Non-current assets 50,732 25,951

Current assets 4,641 2,546

Share of total assets 55,373 28,497

Non-current liabilities 8,668 1,830

Current liabilities 11,394 3,736

Minority interests 596 386

Share of total liabilities and minority interests 20,658 5,952

Share of equity shareholders’ funds in associated undertakings 34,715 22,545

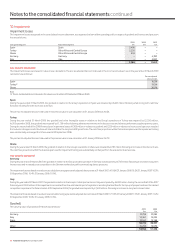

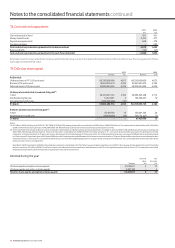

15. Other investments

Other investments comprise the following, all of which are classified as available-for-sale, with the exception of other debt and bonds, which are classified as loans and

receivables, and cash held in restricted deposits.

2009 2008

£m £m

Listed securities:

Equity securities 3,931 4,813

Unlisted securities:

Equity securities 833 949

Public debt and bonds 20 24

Other debt and bonds 2,094 1,352

Cash held in restricted deposits 182 229

7,060 7,367

The fair values of listed securities are based on quoted market prices and include the Group’s 3.2% investment in China Mobile Limited, which is listed on the Hong Kong and

New York stock exchanges and incorporated under the laws of Hong Kong. China Mobile Limited is a mobile network operator and its principal place of operation is China.

Unlisted equity securities include a 26% interest in Bharti Infotel Private Limited, through which the Group has a 4.36% economic interest in Bharti Airtel Limited. Unlisted

equity investments are recorded at fair value where appropriate, or at cost if their fair value cannot be reliably measured as there is no active market upon which they

are traded.

For public debt and bonds and cash held in restricted deposits, the carrying amount approximates fair value.

Other debt and bonds include preferred equity and a subordinated loan received as part of the disposal of Vodafone Japan to SoftBank. The fair value of these instruments

cannot be reliably measured as there is no active market in which these are traded.

Notes to the consolidated nancial statements continued