Vodafone 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance

Vodafone Group Plc Annual Report 2009 27

Europe(1)

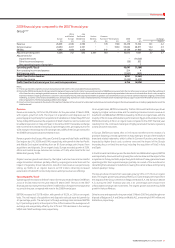

Germany Italy Spain UK Other Eliminations Europe % change

£m £m £m £m £m £m £m £ Organic

Year ended 31 March 2009

Revenue 7,847 5,547 5,812 5,392 5,329 (293) 29,634 13.6 (2.1)

Service revenue 7,535 5,347 5,356 4,912 5,029 (293) 27,886 14 .1 (1.7)

EBITDA 3,058 2,424 1,897 1,219 1,824 − 10,422 7.6 ( 7.0)

Adjusted operating profit 1,728 1,734 1,323 235 1,611 − 6,631 6.8 (8.2)

EBITDA margin 39.0% 43.7% 32.6% 22.6% 34.2% 35.2%

Year ended 31 March 2008

Revenue 6,866 4,435 5,063 5,424 4,583 (290) 26,081

Service revenue 6,551 4,273 4,646 4,952 4,295 (287) 24,430

EBITDA 2,667 2,158 1,806 1,431 1,628 − 9,690

Adjusted operating profit 1,490 1,573 1,282 431 1,430 – 6,206

EBITDA margin 38.8% 48.7% 35.7% 26.4% 35.5% 37.2%

Note:

(1) The Group revised its segment structure during the year. See note 3 to the consolidated financial statements.

Revenue increased by 13.6%, with favourable euro exchange rate movements

contributing 14.3 percentage points of growth and mergers and acquisitions activity,

primarily Tele2, contributing a further 1.4 percentage point benefit. The organic

decline in revenue of 2.1% was a result of a 1.7% decrease in service revenue and a

decline in equipment revenue, reflecting lower volumes.

The impact of merger and acquisition activity and foreign exchange movements on

revenue, service revenue, EBITDA and adjusted operating profit are shown below:

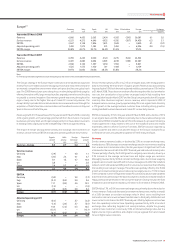

Organic M&A Foreign Reported

growth activity exchange growth

% pps pps %

Revenue – Europe (2.1) 1.4 14.3 13.6

Service revenue

Germany (2.5) (0.1) 17.6 15.0

Italy 1.2 4.7 19.2 25.1

Spain (4.9) 2.5 17.7 15.3

UK (1.1) 0.3 − (0.8)

Other (1.2) 0.4 17.9 17.1

Europe (1.7) 1.4 14.4 14.1

EBITDA

Germany (2.7) (0.2) 17.6 14.7

Italy (6.4) 1.2 17.5 12.3

Spain (10.5) (0.5) 16.0 5.0

UK (15.3) 0.5 − (14.8)

Other (4.9) (0.1) 17.0 12.0

Europe (7.0) 0.2 14.4 7.6

Adjusted operating profit

Germany (1.2) (0.4) 17.6 16.0

Italy (6.5) (0.5) 17.2 10.2

Spain (10.6) (1.9) 15.7 3.2

UK (47.1) 1.6 − (45.5)

Other (5.3) 1.1 16.9 12.7

Europe (8.2) (0.3) 15.3 6.8

Service revenue declined by 1.7% on an organic basis, reflecting a gradual

deterioration over the year and a 3.3% decrease in the fourth quarter, with favourable

trends in Italy more than offset by deteriorating trends in other markets, in particular

Spain and Greece. The impact of the economic slowdown in Europe on voice and

messaging revenue, including from roaming, ongoing competitive pricing pressures

and lower termination rates were not fully compensated by increased usage arising

from new tariffs and promotions and strong growth in data revenue.

EBITDA increased by 7.6%, with favourable euro exchange rate movements

contributing 14.4 percentage points of growth and a 0.2 percentage point benefit

from business acquisitions. The EBITDA margin declined 2.0 percentage points year

on year, primarily driven by the downward revenue trend, the growth of lower margin

fixed line operations, a brand royalty provision release included in the prior year in

Italy and restructuring charges in a number of markets, which more than offset

customer and operating cost savings.

Germany

The 2.5% organic decline in service revenue was consistent with the prior year,

benefiting from higher penetration of the new SuperFlat tariff portfolio. Data revenue

growth remained strong, reflecting increased penetration of PC connectivity services

in the customer base. Fixed line revenue declined during the year, but grew 2.1% at

constant exchange rates in the fourth quarter, as the customer base has now largely

migrated to new, lower priced tariffs. The fixed broadband customer base increased

by 15.9% during the year to 3.1 million at 31 March 2009, with an additional 154,000

wholesale fixed broadband customers. On 19 May 2008, the Group acquired a 26.4%

interest in Arcor, following which the Group owns 100% of Arcor. The integration of

the mobile business and the fixed line operations has progressed, with cost savings

being realised according to plan.

EBITDA margin remained broadly stable at 39.0%, reflecting an improvement in the

mobile margin which was offset by a decline in the fixed line margin, with the former

due to a reduction in prepaid subsidies and an increase in the number of SIM only

contracts. Operating expenses were also broadly stable with the prior year as a

current year restructuring charge of €35 million (£32 million) was more than offset

by non-recurring adjustments, including favourable legal settlements.

Italy

Organic service revenue growth was 1.2%, reflecting targeted demand stimulation

initiatives, ARPU enhancing initiatives and strong growth in data revenue due to

increased penetration of mobile PC connectivity devices, email enabled devices and

mobile internet services. Organic fixed line revenue growth was 3.7%, supported by

278,000 fixed broadband customer net additions during the year as well as the

benefit from the launch of Vodafone Station during the summer of 2008 and the

continued good performance of Tele2.