Vodafone 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Vodafone Group Plc Annual Report 2009

Operating results continued

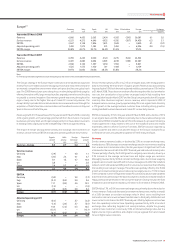

Italy

Service revenue increased by 0.6%, as a 7.4% fall in voice revenue was offset by 17.3%

and 39.8% increases in messaging and data revenue, respectively, all at constant

exchange rates, as well as the contribution from the Tele2 acquisition in the second

half of the year. On an organic basis, service revenue fell by 2.0%. The regulatory

cancellation of top up fees and reduction in termination rates led to the fall in voice

revenue but were partially mitigated by a 21.5% rise in outgoing voice usage,

benefiting from a 23.2% increase in average consumer and business contract

customers, successful promotions and initiatives driving usage within the Vodafone

network, and elasticity arising from the top up fee removal. The success of targeted

promotions and tariff options contributed to the 31.8% growth in messaging volumes,

while the increase in data revenue was driven by the 108.0% growth in registered

mobile PC connectivity devices.

EBITDA increased by 0.4%, but decreased by 3.2% on an organic basis, primarily as a

result of the fall in voice revenue due to the regulatory cancellation of top up fees.

Direct costs decreased by 0.3% on an organic basis, reflecting the growth in outgoing

voice minute volumes, offset by a higher proportion of calls and messages to

Vodafone customers and lower prepaid airtime commissions. Customer costs rose

by 13.7% on an organic basis due to the investment in the business and higher value

consumer contract segments. Operating expenses fell on an organic basis by 19.7%

as a result of the release of the provision for brand royalty payments following

agreement of revised terms.

Spain

Spain delivered service revenue growth of 9.7%, with 6.7% growth in voice revenue

and 31.1% growth in data revenue, all at constant exchange rates, as well as the

contribution from the Tele2 acquisition in the second half of the year. Organic growth

in service revenue was 8.1%, with lower organic growth of 5.8% in the second half of

the year resulting from a slowing average customer base growth rate in an

increasingly competitive market. Outgoing voice and messaging revenue benefited

from the 9.1% growth in the average customer base and an increase in usage and

volumes of 14.1% and 12.7%, respectively, driven by various usage stimulation

initiatives. A 101.1% increase in registered mobile PC connectivity devices led to

the increase in data revenue.

Spain generated growth of 15.3% in EBITDA, or 11.1% on an organic basis, due to the

increase in service revenue, partially offset by a 4.5% rise in organic customer costs

driven by the higher volume of upgrades and cost per contract upgrade as well as a

reduction in gross additions. The proportion of contract customers within the total

closing customer base increased by 3.2 percentage points to 58.0%. Direct costs

increased by 5.6% on an organic basis as the benefit from termination rate cuts was

more than offset by the higher volumes of outgoing voice minutes. Operating

expenses increased by 0.4% on an organic basis but fell as a percentage of service

revenue as a result of good cost control.

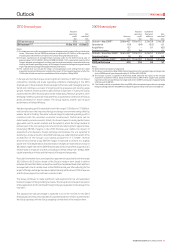

UK

The UK recorded service revenue grow th of 5.8% , with an 8.9% increase in the average

customer base, following the success of the new tariff initiatives introduced in

September 2006. Sustained market performance and increased penetration of

18 month contracts, which led to lower contract churn for the year, contributed

to the growth in the customer base. Voice revenue remained stable as the lower

prices were offset by a 16.6% increase in total usage. Messaging revenue increased

by 21.7% following a 36.7% rise in usage, driven by the higher take up of messaging

bundles. Growth of 28.5% was achieved in data revenue due to improved service

offerings for business customers and the benefit of higher registered mobile PC

connectivity devices.

Although service revenue grew by 5.8%, EBITDA fell by 1.9% as a result of the rise

in total costs, partially offset by a £30 million VAT refund. Direct costs increased by

12.4% due to the 20.0% growth in outgoing mobile minutes, reflecting growth in the

customer base and larger bundled offers and cost of sales associated with the

growing managed solutions business and investment in content based data services.

The UK business continued to invest in acquiring new customers in a highly

competitive market, leading to a 6.3% increase in customer costs. Operating

expenses increased by 8.5%, although remained stable as a percentage of service

revenue, with the increase due to a rise in commercial operating costs in support

of sales channels and customer care activities and a £35 million charge for the

restructuring programmes announced in March 2008.

Other Europe

Other Europe had service revenue growth of 6.9%, or 2.4% on an organic basis,

with strong organic growth in data revenue of 41.3%. Portugal and the Netherlands

delivered service revenue growth of 7.2% and 9.0%, respectively, at constant

exchange rates, as both benefited from strong customer growth. These were mostly

offset by a 6.2% decline in service revenue in Greece at constant exchange rates,

which arose from the impact of termination rate cuts in June 2007 and the cessation

of a national roaming agreement in April 2007.

In Other Europe, EBITDA grew by 6.4%, or 2.9% on an organic basis, largely driven by

the 3.0% rise in revenue at constant exchange rates, but offset by increased customer

costs. The growth in EBITDA was primarily driven by increases in Portugal and the

Netherlands of 12.3% and 7.9%, respectively, at constant exchange rates, resulting

from the growth in service revenue, as well as good cost control in Portugal. These

were partially offset by the 4.4% fall at constant exchange rates in Greece, where

results were affected by a decline in service revenue, increased retention and

marketing costs and a regulatory fine.

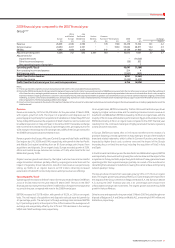

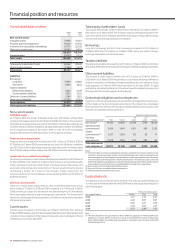

Africa and Central Europe(1)

Africa and

Central

Vodacom Other(2) Europe % change

£m £m £m £ Organic(2)

Year ended 31 March 2008

Revenue 1,609 3,337 4,946 20.8 13.6

Service revenue 1,398 3,219 4,617 21.0 13.2

EBITDA 586 1,083 1,669 17.1 15 .6

Adjusted operating profit 365 387 752 33.1 18. 0

EBITDA margin 36.4% 32.5% 33.7%

Year ended 31 March 2007

Revenue 1,478 2,616 4,094

Service revenue 1,287 2,528 3,815

EBITDA 532 893 1,425

Adjusted operating profit 327 238 565

EBITDA margin 36.0% 34.1% 34.8%

Notes:

(1) The Group revised its segment structure during the year. See note 3 to the consolidated

financial statements.

(2) On 1 October 2007, Romania rebased all of its tariffs and changed its functional currency from

US dollars to euros. In calculating all constant exchange r ate and organic metrics w hich include

Romania, previous US dollar amounts have been translated into euros at the 1 October 2007

US$/euro exchange rate.

Vodafone has continued to execute on its strategy to deliver strong growth in

emerging markets during the 2008 financial year, with good performances in Turkey,

acquired in May 2006, and Romania. The Group began to differentiate itself in its

emerging markets, with initiatives such as the Vodafone M-PESA/Vodafone Money

Transfer service.

Revenue growth for the year ended 31 March 2008 was 20.8% for the region, or

13.6% on an organic basis, with the key driver of organic growth being the increase in

service revenue of 21.0%, or 13.2% on an organic basis.

EBITDA increased by 17.1% for the year ended 31 March 2008, or 15.6% on an organic

basis, due to strong performances in Vodacom and Romania.