Vodafone 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2009 119

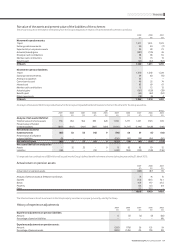

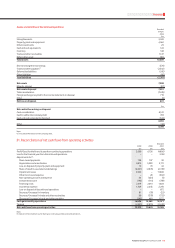

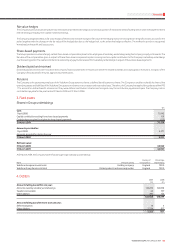

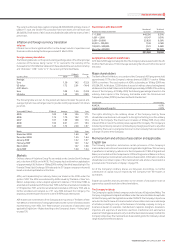

39. Change in accounting policy

During the year, the Group changed its accounting policy with respect to the acquisition of minority interests in subsidiaries. The Group now applies the economic entity

method, under which such transactions are accounted for as transactions between shareholders and there is no remeasurement to fair value of net assets acquired that

were previously attributable to minority shareholders. Prior to this change in policy, the Group applied the parent company method to such transactions, and assets

attributable to minority interests immediately prior to the respective acquisition, including goodwill and other acquired intangible assets, were remeasured to fair value at

the date of acquisition.

The Group believes the new policy is preferable as it more closely aligns the accounting for these transactions with the treatment of minority interest as a component of

equity and will aid comparability.

The impact of this voluntary change in accounting policy on the consolidated financial statements is primarily to reduce goodwill and acquired intangible assets and related

income statement amounts arising on such transactions. This change did not result in a material impact on the current year or any years included within these consolidated

financial statements. The impact on each line item of the primary financial statements since the Group’s adoption of IFRS is shown in the table below:

As reported Adjustments Restated

2007 2006 2005 2007 2006 2005 2007 2006 2005

£m £m £m £m £m £m £m £m £m

Consolidated income statement

(Loss)/profit for the financial year from

discontinued operations (491) (4,588) 1,102 75 1,690 80 (416) (2,898) 1,182

(Loss)/profit for the financial year (5,297) (21,821) 6,518 75 1,690 80 (5,222) (20,131) 6,598

Attributable to equity shareholders (5,426) (21,916) 6,410 75 1,690 80 (5,351) (20,226) 6,490

Basic (loss)/earnings per share

(Loss)/profit from discontinued operations (0.90)p (7.35)p 1.56p 0.14p 2.70p 0.12p (0.76)p (4.65)p 1.68p

(Loss)/profit for the financial year (9.84)p (35.01)p 9.68p 0.14p 2.70p 0.12p (9.70)p (32.31)p 9.80p

Diluted (loss)/earnings per share

(Loss)/profit from discontinued operations (0.90)p (7.35)p 1.56p 0.14p 2.70p 0.12p (0.76)p (4.65)p 1.68p

(Loss)/profit for the financial year (9.84)p (35.01)p 9.65p 0.14p 2.70p 0.12p (9.70)p (32.31)p 9.77p

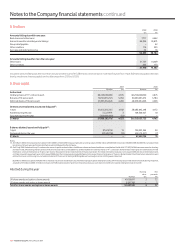

Consolidated statement of recognised

income and expense

Foreign exchange gains transferred

to the consolidated income statement 838 36 − (75) − − 763 36 −

Net (loss)/gain recognised directly in equity (808) 2,317 1,515 (75) − − (883) 2,317 1,515

(Loss)/profit for the financial year (5,297) (21,821) 6,518 75 1,690 80 (5,222) (20,131) 6,598

Total recognised income and expense

relating to the year (6,105) (19,504) 8,033 − 1,690 80 (6,105) (17,814) 8,113

Attributable to equity shareholders (6,210) (19,607) 7,958 − 1,690 80 (6,210) (17,917) 8,038

Consolidated balance sheet

Total assets 109,617 126,738 147,197 − (236) (1,979) 109,617 126,502 145,218

Total equity 67,293 85,312 113,648 − − (1,690) 67,293 85,312 111,958

Total equity shareholders’ funds 67,067 85,425 113,800 − − (1,690) 67,067 85,425 112,110