Vodafone 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Vodafone Group Plc Annual Report 2009

Chairman’s statement

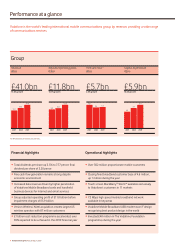

This year your Company has delivered adjusted operating profit of

£11.8 billion and generated £5.7 billion of free cash flow before licence

and spectrum payments, helped by foreign exchange movements and

despite pressure on revenue in challenging economic circumstances.

This has allowed us to buy back £1 billion of shares and pursue a

progressive dividend policy. The Board is recommending a final

dividend of 5.20 pence, making a total for the year of 7.77 pence.

Regrettably, the share price has declined by 17% since the beginning

of the year, from 154.3 pence to 127.5 pence, but has nonetheless

outperformed the FTSE100 which has declined by 24% over the same

period. We have seen continuing growth in proportionate customer

numbers to 303 million at year end, as well as growth in mobile voice

minutes of use and particularly data services.

There is considerable evidence that the economic crisis has had a

significant effect on the environment in which we operate, across our

various markets. Inevitably, during rapid economic decline and rising

unemployment, our customers – enterprise and consumer – are

looking carefully for ways to reduce their expenditure. We have

responded to the pressure on household and business expenses with

pricing plans designed to address customers’ needs.

So the telecommunications sector is not immune from the impact of

the global recession but it has demonstrated a greater degree of

resilience than certain other parts of the economy. The services we

provide have assumed increasing importance in the day to day lives of

our customers. We see this particularly in the way in which our services,

par ticularly data services such as email and internet access, offer new

flexibility in the way people lead their business and personal lives.

When more stable economic conditions return, this new flexibility

should also support more sustainable growth, unlocking important

potential social and ecological benefits.

In addition to the impact of the economic downturn, we continued to

see pricing pressure lead to reductions of around 15% year on year in

Europe. The period of rapid growth in new mobile customers in much

of Europe is now over and we need to adjust our resources accordingly.

We are well on our way to delivering the £1 billion reduction in

operating costs to which we are committed. We will maintain this focus

over the coming year and expect to deliver on our commitment

by the following financial year. Sadly, this involves reducing our

workforce but we nevertheless remain intent that Vodafone should

continue to be a good place to work.

With prudent control of capital expenditure and reductions to

operating expenditure, your Company is positioning itself to benefit

from the re-invigoration of the economy when it comes, driven by

strong cash generation, a sound liquidity position, and the diversity

and geographic distribution of our customer base.

Your Company will continue to promote innovation in products and

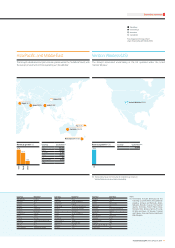

services across the range of our markets. For example, over 6 million

people are now using the Vodafone Money Transfer system (branded

M-PESA in Kenya) in Kenya, Tanzania and Afghanistan. In total, they

are sending approximately US$200 million a month, mostly as small

transactions of less than US$20. With over 4 billion people owning

mobile handsets, we believe that for the majority of the world’s

population, mobile is likely to be the primary means of access to the

internet. Higher speed networks in markets such as South Africa and

Egypt increase the speed and range of internet access. Using

economies of scale to work with handset manufacturers has

allowed approximately eight million customers to gain access to

communications through our ultra low cost handsets during the year,

at the same time helping to make Vodafone the second largest

handset brand in India.

In our developed markets, we will continue to enhance our customers’

communication capability, with innovative products such as netbooks

and laptops with embedded SIM cards to connect directly to higher

speed mobile data networks. We continue to see very strong growth

in mobile data usage, over 100% in our European markets. Our industry

is undergoing an important change away from the predominance of

voice traffic; within a few years most of the traffic on our European

network will be data. We will promote services, particularly for small

and medium enterprises, which increase workforce flexibility and

enable greater efficiency and cost control.

The rapid economic decline has inevitably led to calls for greater

regulation and some have questioned whether an open competition

based economic model is sustainable. We continue to believe that it is.

Your company is driven by strong cash generation, a sound liquidity position and a diverse and

geographically spread customer base.

Sir John Bond

Chairman