Vodafone 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vittorio Colao

Chief Executive

6 Vodafone Group Plc Annual Report 2009

These results demonstrate the benet of the rapid action we took to address the current

economic conditions and highlight the benets of our geographic diversity.

Chief Executive’s review

Financial review of the year

These financial results reflect the benefits of the actions we took to

adjust to the deteriorating economic environment, in particular with

respect to costs. We achieved results in line with all of the guidance

ranges we issued in November 2008 and also generated free cash flow

in line with the initial guidance range we established in May 2008,

before the extent of the downturn became apparent.

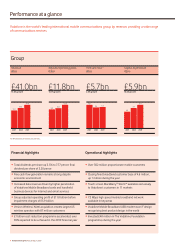

During the year, Group revenue increased by 15.6% to £41.0 billion and

by 1.3% on a pro forma basis, including India, which was acquired in

May 2007. The Group’s EBITDA margin declined by 1.8 percentage

points, in line with the first half and our expectations, one third of

which was due to the impact of acquisitions and disposals, foreign

exchange and business mix. Group adjusted operating profit increased

by 16.7% to £11.8 billion, with a growing contribution from Verizon

Wireless and foreign currency benefits offsetting weaker performance

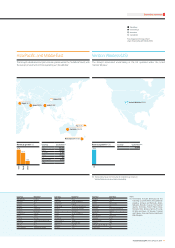

in Europe. At year end, Vodafone had 303 million proportionate mobile

customers worldwide.

Cash generation remained robust, with free cash flow of £5.7 billion

before licence and spectrum payments, up around 3%, with foreign

currency benefits being offset by the deferral of a £0.2 billion dividend

from Verizon Wireless, which was received in April 2009.

The economic downturn is affecting Vodafone in several ways. In our

more mature European and Central European operations, voice and

messaging revenue has declined, primarily driven by lower growth in

usage and continued double digit price declines. Roaming revenue fell

due to lower business and leisure travel. Enterprise revenue growth

slowed as our business customers reduced activity and headcount.

Double digit data revenue growth continued, as we actively market

increasingly attractive network speeds, handsets and services into an

under penetrated market. In contrast to Europe, results in Africa and

India remained robust driven by continued but lower GDP growth and

increasing penetration.

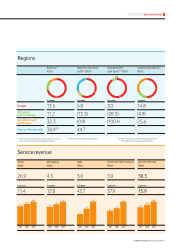

In Europe, organic service revenue declined by 1.7% reflecting the

economy and a strongly competitive environment. Ongoing price

pressures and lower volume growth in our core voice products are still

being substantially offset by good growth in data. Europe EBITDA

margins, including Common Functions, which substantially support

our European operations, declined by 1.1 percentage points, driven by

an increasing contribution from lower margin fixed broadband. Mobile

contribution margins remained stable. Operating free cash flow before

licence and spectrum payments was strong at £7.6 billion.

In Africa and Central Europe, organic revenue grew by 3.9%, with

double digit revenue growth at Vodacom being offset by weakness in

Turkey. After the year end, we completed our transaction with Telkom

in South Africa and increased our ownership of Vodacom to 65%.

EBITDA margins declined by around three percentage points, driven

substantially by lower profitability in Turkey where, having appointed

new management in early 2009, we will continue to implement our

turnaround plan with a primary focus on network quality, distribution

and competitive offers.

In Asia Pacific and Middle East, revenue increased by 19% on a pro

forma basis, reflecting a strong contribution from India where revenue

grew by 33% on a pro forma basis. During the 2009 financial year we

added 24.6 million customers in India and ended the year with the

highest rate of net additions in the market. In Egypt, revenue increased

by 11.9% at constant exchange rates and EBITDA margins remained

broadly flat. The EBITDA margin in the region declined by 3.7 percentage

points, reflecting lower margins in India caused by the pricing

environment, the impact of our IT outsourcing agreement and

investment in new circles.

Verizon Wireless posted another set of strong results. Organic service

revenue growth was 10.5%, driven by increased customer penetration

and data. In January 2009, Verizon Wireless completed its acquisition

of Alltel which is expected to generate cost synergies with a net

present value of over US$9 billion and makes Verizon Wireless the

largest US mobile company with 87 million customers. During the

year, we have deepened our commercial relationship with Verizon

Wireless, which now contributes 30% of our adjusted operating profit,

with joint initiatives around LTE technology, enterprise customers and

BlackBerry devices.

The Group invested £5.9 billion in capital expenditure, including

£1.4 billion in India to drive growth. Capital intensity in Europe was

slightly above our 10% target as we took advantage of our strong cash

generation to accelerate investment in broadband and higher speed

capability on our networks in order to continue to support our strategy

and improve our customers’ experience.

The Group incurred impairment charges of £5.9 billion in the financial

year, the majority of which related to Spain.

Adjusted earnings per share increased by 37.4% to 17.17 pence,

benefiting from a favourable foreign exchange environment and a one

off tax benefit. Excluding these factors, adjusted earnings per share

rose by around 3%.

In line with the Group’s progressive dividend policy, dividends per

share have increased by 3.5% to 7.77 pence, reflecting the underlying

earnings and cash performance of the Group.

Strategy

We have made good progres s in implementing the st rateg y announced

in November 2008.

Drive operational performance

To enhance commercial value, we are developing and launching ser vices

which deliver more value in return for a wider commitment from

customers. In Germany, we have extended our SuperFlat tariff family to

Dividends per share

(pence)

2008 20092007

6.76

7.51 7.77