Vodafone 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 Vodafone Group Plc Annual Report 2009

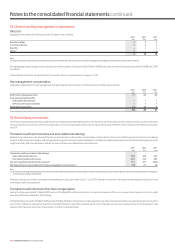

Notes to the consolidated nancial statements continued

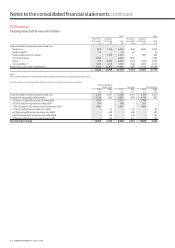

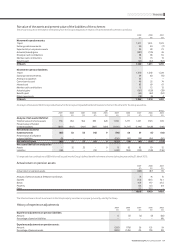

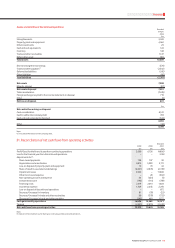

32. Commitments

Operating lease commitments

The Group has entered into commercial leases on certain properties, network infrastructure, motor vehicles and items of equipment. The leases have various terms,

escalation clauses, purchase options and renewal rights, none of which are individually significant to the Group.

Future minimum lease payments under non-cancellable operating leases comprise:

2009 2008

£m £m

Within one year 1,041 837

In more than one year but less than two years 812 606

In more than two years but less than three years 639 475

In more than three years but less than four years 539 415

In more than four years but less than five years 450 356

In more than five years 2,135 1,752

5,616 4,441

The total of future minimum sublease payments expected to be received under non-cancellable subleases is £197 million (2008: £154 million).

Capital and other nancial commitments

Company and subsidiaries Share of joint ventures Group

2009 2008 2009 2008 2009 2008

£m £m £m £m £m £m

Contracts placed for future capital expenditure not provided in the

financial statements(1) 1,706 1,477 401 143 2,107 1,620

Note:

(1) Commitment includes contracts placed for property, plant and equipment and intangible assets.

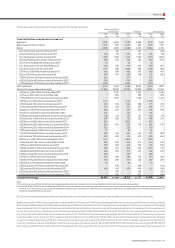

33. Contingent liabilities

2009 2008

£m £m

Performance bonds 157 111

Credit guarantees – third party indebtedness 61 29

Other guarantees and contingent liabilities 445 372

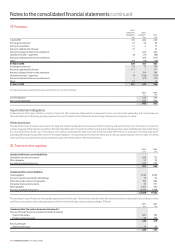

Performance bonds

Performance bonds require the Group to make payments to third parties in the event that the Group does not perform what is expected of it under the terms of any

related contracts.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities, including those in respect of the Group’s associated undertakings and investments.

Other guarantees and contingent liabilities

Other guarantees principally comprise commitments to the Spanish tax authorities of £229 million (2008: £197 million).

The Group also enters into lease arrangements in the normal course of business, which are principally in respect of land, buildings and equipment. Further details on the

minimum lease payments due under non-cancellable operating lease arrangements can be found in note 32.

Legal proceedings

The Company and its subsidiaries are currently, and may be from time to time, involved in a number of legal proceedings, including inquiries from or discussions with

governmental authorities, that are incidental to their operations. However, save as disclosed below, the Company and its subsidiaries are not involved currently in any legal

or arbitration proceedings (including any governmental proceedings which are pending or known to be contemplated) which may have, or have had in the 12 months

preceding the date of this report, a significant effect on the financial position or profitability of the Company and its subsidiaries. With the exception of the Vodafone 2 enquiry,

due to inherent uncertainties, no accurate quantification of any cost, or timing of such cost, which may arise from any of the legal proceedings outlined below can

be made.

The Company is one of a number of co-defendants in four actions filed in 2001 and 2002 in the Superior Court of the District of Columbia in the United States alleging

personal injury, including brain cancer, from mobile phone use. The Company is not aware that the health risks alleged in such personal injury claims have been substantiated

and is vigorously defending such claims. In August 2007, the court dismissed all four actions against the Company on the basis of the federal pre-emption doctrine. The

plaintiffs have appealed this dismissal.

A subsidiary of the Company, Vodafone 2, is responding to an enquiry (‘the Vodafone 2 enquiry’) by HMRC with regard to the UK tax treatment of its Luxembourg holding company,

Vodafone Investments Luxembourg SARL (‘VIL’), under the Controlled Foreign Companies section of the UK’s Income and Corporation Taxes Act 1988 (‘the CFC Regime’) relating

to the tax treatment of profits earned by the holding company for the accounting period ended 31 March 2001. Vodafone 2’s position is that it is not liable for corporation tax in

the UK under the CFC Regime in respect of VIL. Vodafone 2 asserts, inter alia, that the CFC Regime is contrary to EU law and has made an application to the Special Commissioners

of HMRC for closure of the Vodafone 2 enquiry. In May 2005, the Special Commissioners referred certain questions relating to the compatibility of the CFC Regime with EU law

to the European Court of Justice (the ‘ECJ’) for determination (‘the Vodafone 2 reference’). HMRC subsequently appealed against the decision of the Special Commissioners to

make the Vodafone 2 reference but its appeal was rejected by both the High Court and Court of Appeal.