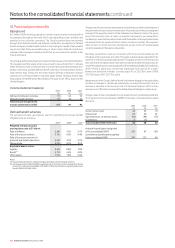

Vodafone 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 Vodafone Group Plc Annual Report 2009

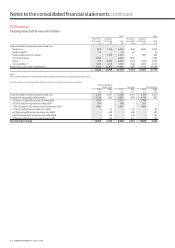

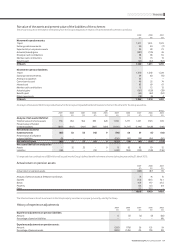

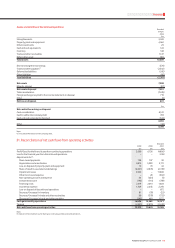

27. Provisions

Asset

retirement Other

obligations provisions Total

£m £m £m

1 April 2007 159 404 563

Exchange movements 27 36 63

Arising on acquisition 11 2 13

Amounts capitalised in the year 27 − 27

Amounts charged to the income statement − 224 224

Utilised in the year − payments (6) (77) (83)

Amounts released to the income statement − (117) (117)

Other (10) (18) (28)

31 March 2008 208 454 662

Exchange movements 34 75 109

Amounts capitalised in the year 111 − 111

Amounts charged to the income statement − 194 194

Utilised in the year − payments (4) (106) (110)

Amounts released to the income statement − (72) (72)

Other 12 − 12

31 March 2009 361 545 906

Provisions have been analysed between current and non-current as follows:

2009 2008

£m £m

Current liabilities 373 356

Non-current liabilities 533 306

906 662

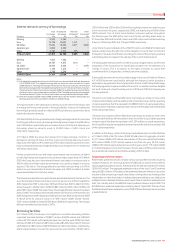

Asset retirement obligations

In the course of the Group’s activities, a number of sites and other assets are utilised which are expected to have costs associated with exiting and ceasing their use.

The associated cash outflows are generally expected to occur at the dates of exit of the assets to which they relate, which are long term in nature.

Other provisions

Included within other provisions are provisions for legal and regulatory disputes and amounts provided for property and restructuring costs. The Group is involved in a

number of legal and other disputes, including notification of possible claims. The directors of the Company, after taking legal advice, have established provisions after taking

into account the facts of each case. The timing of cash outflows associated with legal claims cannot be reasonably determined. For a discussion of certain legal issues

potentially affecting the Group, refer to note 33 “Contingent liabilities”. The associated cash outflows for restructuring costs are substantially short term in nature. The timing

of the cash flows associated with property is dependent upon the remaining term of the associated lease.

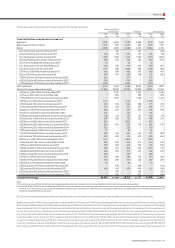

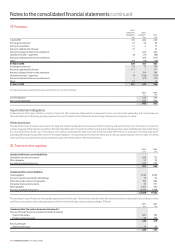

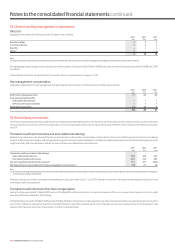

28. Trade and other payables

2009 2008

£m £m

Included within non-current liabilities:

Derivative financial instruments 398 173

Other payables 91 99

Accruals and deferred income 322 373

811 645

Included within current liabilities:

Trade payables 3,160 2,963

Amounts owed to associated undertakings 18 22

Other taxes and social security payable 762 666

Derivative financial instruments 37 371

Other payables 1,163 442

Accruals and deferred income 8,258 7,498

13,398 11,962

The carrying amounts of trade and other payables approximate their fair value. The fair values of the derivative financial instruments are calculated by discounting the future

cash flows to net present values using appropriate market interest and foreign currency rates prevailing at 31 March.

2009 2008

£m £m

Included within “Derivative financial instruments”:

Fair value through the income statement (held for trading):

Interest rate swaps 381 160

Foreign exchange swaps 37 358

418 518

Fair value hedges:

Interest rate swaps 17 26

435 544

Notes to the consolidated nancial statements continued