Vodafone 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Vodafone Group Plc Annual Report 2009

Committed facilities

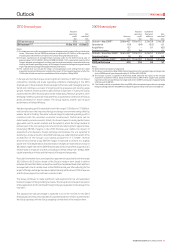

The following table summarises the committed bank facilities available to the Group

at 31 March 2009.

Committed bank facilities Amounts drawn

29 July 2008

US$4.1 billion revolving credit No drawings have been made against this

facility, maturing 28 July 2011 facility. The facility supports the Group’s

commercial paper programmes and may

be used for general corporate purposes,

including acquisitions.

24 June 2005

US$5 billion revolving credit No drawings have been made against this

facility, maturing 22 June 2012 facility. The facility supports the Group’s

commercial paper programmes and may

be used for general corporate purposes,

including acquisitions.

21 December 2005

¥258.5 billion term credit The facility was drawn down in full on

facility, maturing 16 March 2011, 21 December 2005. The facility is

entered into by Vodafone available for general corporate purposes,

Finance K.K. and guaranteed although amounts drawn must be on-lent

by the Company to the Company.

16 November 2006

€0.4 billion loan facility, The facility was drawn down in full on

maturing 14 February 2014 14 February 2007. The facility is available

for financing capital expenditure in the

Group’s Turkish operating company.

28 July 2008

€0.4 billion loan facility, The facility was drawn down in full on

maturing 12 August 2015 12 August 2008. The facility is available for

financing the roll out of a converged fixed

mobile broadband telecommunications

network in Italy.

Under the terms and conditions of the US$9.1 billion committed bank facilities,

lenders have the right, but not the obligation, to cancel their commitments and have

outstanding advances repaid no sooner than 30 days after notification of a change

of control of the Company. This is in addition to the rights of lenders to cancel their

commitment if the Company has committed an event of default; however, it should

be noted that a material adverse change clause does not apply.

The facility agreements provide for certain structural changes that do not affect the

obligations of the Company to be specifically excluded from the definition of a

change of control.

Substantially the same terms and conditions apply in the case of Vodafone Finance

K.K.’s ¥258.5 billion term credit facility, although the change of control provision is

applicable to any guarantor of borrowings under the term credit facility. Additionally,

the facility agreement requires Vodafone Finance K.K. to maintain a positive tangible

net worth at the end of each financial year. As of 31 March 2009, the Company was

the sole guarantor.

The terms and conditions of the €0.4 billion loan facility maturing on 14 February

2014 are similar to those of the US$9.1 billion committed bank facilities, with the

addition that, should the Group’s Turkish operating company spend less than the

equivalent of €0.8 billion on capital expenditure, the Group will be required to repay

the drawn amount of the facility that exceeds 50% of the capital expenditure.

The terms and conditions of the €0.4 billion loan facility maturing 12 August 2015 are

similar to those of the US$9.1 billion committed bank facilities, with the addition that,

should the Group’s Italian operating company spend less than the equivalent of

€1.5 billion on capital expenditure, the Group will be required to repay the drawn

amount of the facility that exceeds 18% of the capital expenditure.

Furthermore, two of the Group’s subsidiary undertakings are funded by external

facilities which are non-recourse to any member of the Group other than the

borrower, due to the level of country risk involved. These facilities may only be used

to fund their operations. At 31 March 2009, Vodafone India had facilities of INR 274.4

billion (£3.8 billion), of which INR 172.7 billion (£2.4 billion) is drawn. Vodafone Egypt

has a partly drawn EGP 2.6 billion (£327 million) syndicated bank facility of EGP 4.0

billion (£497 million) that matures in March 2014.

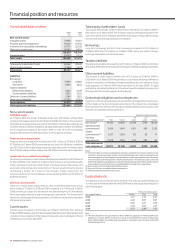

In aggregate, the Group has committed facilities of approximately £13,631 million, of

which £7,963 million was undrawn and £5,668 million was drawn at 31 March 2009.

The Group believes that it has sufficient funding for its expected working capital

requirements for at least the next 12 months. Further details regarding the maturity,

currency and interest rates of the Group’s gross borrowings at 31 March 2009 are

included in note 25 to the consolidated financial statements.

Financial assets and liabilities

Analyses of financial assets and liabilities, including the maturity profile of debt,

currency and interest rate structure, are included in notes 18 and 25 to the

consolidated financial statements. Details of the Group’s treasury management and

policies are included within note 24 to the consolidated financial statements.

Option agreements and similar arrangements

Potential cash outflows

In respect of the Group’s interest in the Verizon Wireless partnership, an option

granted to Price Communications, Inc. by Verizon Communications Inc. was exercised

on 15 August 2006. Under the option agreement, Price Communications, Inc.

exchanged its preferred limited partnership interest in Verizon Wireless of the East

LP for 29.5 million shares of common stock in Verizon Communications Inc. Verizon

Communications Inc. has the right, but not the obligation, to contribute the preferred

interest to the Verizon Wireless partnership, diluting the Group’s interest. However,

the Group also has the right to contribute further capital to the Verizon Wireless

partnership in order to maintain its percentage partnership interest. Such amount, if

contributed, would be US$0.9 billion.

As part of the Vodafone Essar acquisition, the Group acquired less than 50% equity

interests in Telecom Investments India Private Limited (‘TII’) and in Omega Telecom

Holdings Private Limited (‘Omega’), which in turn have a 19.54% and 5.11% indirect

shareholding in Vodafone Essar. The Group was granted call options to acquire 100%

of the shares in two companies which together indirectly own the remaining shares

of TII for, if the market equity of Vodafone Essar at the time of exercise is less than

US$25 billion, an aggregate price of US$431 million plus interest or, if the market

equity value of Vodafone Essar at the time of exercise is greater than US$25 billion,

the fair market value of the shares as agreed between the parties. The Group also has

an option to acquire 100% of the shares in a third company which owns the remaining

shares in Omega. In conjunction with the receipt of these options, the Group also

granted a put option to each of the shareholders of these companies with identical

pricing which, if exercised, would require Vodafone to purchase 100% of the equity

in the respective company. These options can only be exercised in accordance with

Indian law prevailing at the time of exercise.

The Group granted put options exercisable between 8 May 2010 and 8 May 2011 to

members of the Essar group of companies that, if exercised, would allow the Essar

group to sell its 33% shareholding in Vodafone Essar to the Group for US$5 billion or

to sell between US$1 billion and US$5 billion worth of Vodafone Essar shares to the

Group at an independently appraised fair market value.

Off-balance sheet arrangements

The Group does not have any material off-balance sheet arrangements, as defined

in item 5.E.2. of the SEC’s Form 20-F. Please refer to notes 32 and 33 to the

consolidated financial statements for a discussion of the Group’s commitments and

contingent liabilities.

Quantitative and qualitative disclosures about market risk

A discussion of the Group’s financial risk management objectives and policies and

the exposure of the Group to liquidity, market and credit risk is included within note

24 to the consolidated financial statements.

Strategy

•

•

•

Financial position and resources continued