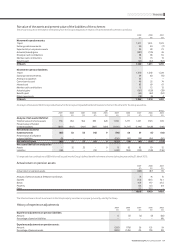

Vodafone 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 Vodafone Group Plc Annual Report 2009

20. Share-based payments continued

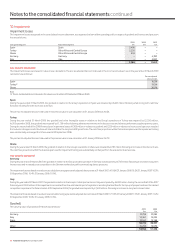

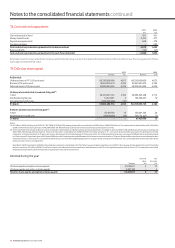

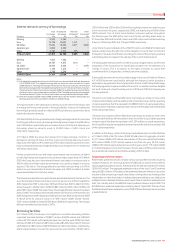

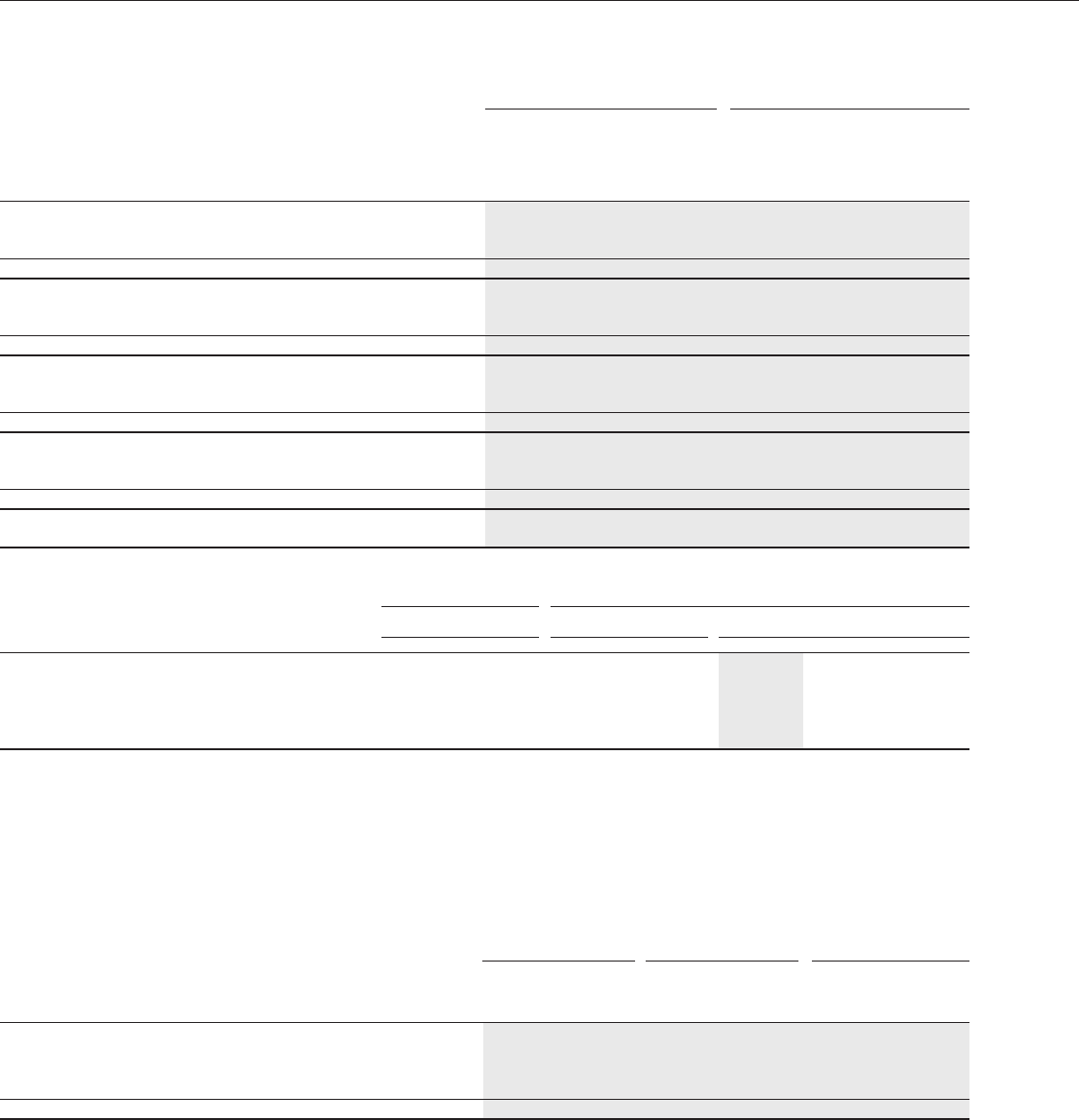

Summary of options outstanding and exercisable at 31 March 2009

Outstanding Exercisable

Weighted Weighted

average average

Weighted remaining Weighted remaining

Outstanding average contractual Exercisable average contractual

shares exercise life shares exercise life

Millions price Months Millions price Months

Vodafone Group savings related and sharesave plan:

£0.01 – £1.00 9 £0.92 17 – – –

£1.01 – £2.00 13 £1.24 37 – – –

22 £1.11 29 – – –

Vodafone Group executive plans:

£1.01 – £2.00 9 £1.58 28 9 £1.58 28

£2.01 – £3.00 20 £2.76 13 20 £2.76 13

29 £2.39 18 29 £2.39 18

Vodafone Group 1999 long term stock incentive plan:

£0.01 – £1.00 62 £0.90 39 62 £0.90 39

£1.01 – £2.00 219 £1.46 58 148 £1.48 41

281 £1.34 54 210 £1.31 40

Other share option plans:

£1.01 – £2.00 1 £1.14 35 1 £1.14 35

Greater than £3.01 1 £2.47 31 1 £2.47 31

2 £1.77 33 2 £1.77 33

Vodafone Group 1999 long term stock incentive plan:

$10.01 – $30.00 1 $15.37 43 1 $15.05 42

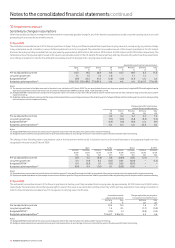

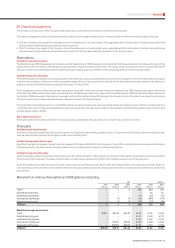

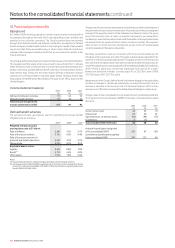

Fair value of options granted

ADS options Ordinary share options

Board of directors and

Other(1) Executive Committee(1) Other

2008 2007 2008 2007 2009 2008 2007

Expected life of option (years) 4-5 5-6 4-5 5-6 3-5 4-5 5-7

Expected share price volatility 25.5-33.5% 27.3-28.3% 25.7-27.7% 24.0-27.7% 30.9-31.0% 25.5-33.5% 25.5-28.3%

Dividend yield 3.8-4.2% 5.1-5.5% 4.0-4.4% 4.8-5.5% 5.04% 3.8-4.2% 5.1-6.1%

Risk free rates 4.4-5.7% 4.8% 5.5% 4.7-4.9% 4.9% 4.4-5.7% 4.6-4.9%

Exercise price(2) £1.67-1.76 £1.15 £1.68 £1.15-1.36 £1.21 £1.67-1.76 £1.14-1.16

Notes:

(1) There were no options granted in the year ended 31 March 2009.

(2) In the years ended 31 March 2008 and 31 March 2007, there was more than one option grant.

The fair value of options granted is estimated at the date of grant using a lattice-based option valuation model, which incorporates ranges of assumptions for inputs as

disclosed above. Certain options granted to the Board of directors and Executive Committee have a market based performance condition attached and as a result the

assumptions are disclosed separately.

Share awards

Movements in non-vested shares during the year ended 31 March 2009 are as follows:

Global allshare plan Other Total

Weighted Weighted Weighted

average fair average fair average fair

value at value at value at

Millions grant date Millions grant date Millions grant date

1 April 2008 34 £1.30 213 £1.16 247 £1.18

Granted 17 £1.32 155 £1.05 172 £1.08

Vested (16) £1.04 (58) £1.15 (74) £1.13

Forfeited (3) £1.38 (22) £1.07 (25) £1.10

31 March 2009 32 £1.43 288 £1.11 320 £1.15

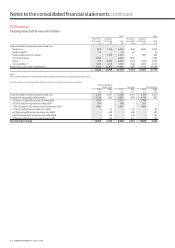

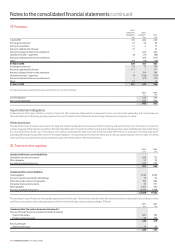

Other information

The weighted average grant date fair value of options granted during the 2009 financial year was £0.39 (2008: £0.34, 2007: £0.22).

The total fair value of shares vested during the year ended 31 March 2009 was £84 million (2008: £75 million, 2007: £41 million).

The compensation cost included in the consolidated income statement in respect of share options and share plans for continuing operations was £128 million (2008: £107 million,

2007: £93 million), which is comprised entirely of equity-settled transactions.

The average share price for the year ended 31 March 2009 was 136 pence.

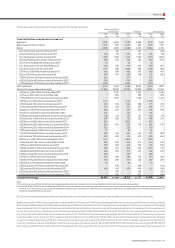

Notes to the consolidated nancial statements continued