Vodafone 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Vodafone Group Plc Annual Report 2009

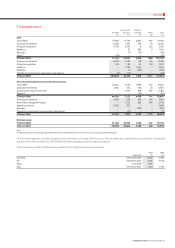

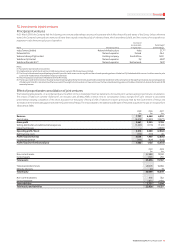

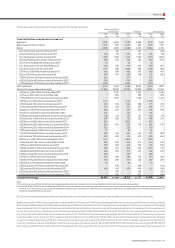

18. Cash and cash equivalents

2009 2008

£m £m

Cash at bank and in hand 811 451

Money market funds 3,419 477

Repurchase agreements 648 478

Commercial paper – 293

Cash and cash equivalents as presented in the balance sheet 4,878 1,699

Bank overdrafts (32) (47)

Cash and cash equivalents as presented in the cash flow statement 4,846 1,652

Bank balances and money market funds comprise cash held by the Group on a short term basis with original maturity of three months or less. The carrying amount of these

assets approximates their fair value.

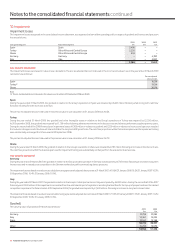

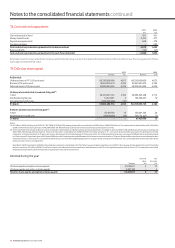

19. Called up share capital

2009 2008

Number £m Number £m

Authorised:

Ordinary shares of 113/7 US cents each 68,250,000,000 4,875 68,250,000,000 4,875

B shares of 15 pence each 38,563,935,574 5,784 38,563,935,574 5,784

Deferred shares of 15 pence each 28,036,064,426 4,206 28,036,064,426 4,206

Ordinary shares allotted, issued and fully paid(1):

1 April 58,255,055,725 4,182 58,085,695,298 4,172

Allotted during the year 51,227,991 3 169,360,427 10

Cancelled during the year (500,000,000) (32) – –

31 March 57,806,283,716 4,153 58,255,055,725 4,182

B shares allotted, issued and fully paid(2):

1 April 87,429,138 13 132,001,365 20

Redeemed during the year (87,429,138) (13) (44,572,227) (7)

31 March – – 87,429,138 13

Notes:

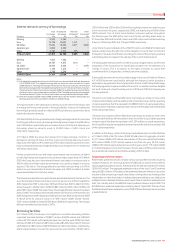

(1) At 31 March 2009, the Group held 5,322,411,101 (2008: 5,132,496,335) treasury shares with a nominal value of £382 million (2008: £368 million). The market value of shares held was £6,533 million

(2008: £7,745 million). During the year, 41,146,589 (2008: 101,466,161) treasury shares were reissued under Group share option schemes.

(2) On 31 July 2006, the Company undertook a return of capital to shareholders via a B share scheme and associated share consolidation. A total of 66,271,035,240 B shares were issued on that day, and

66,271,035,240 existing ordinary shares of 10 US cents each were consolidated into 57,987,155,835 new ordinary shares of 113/7 cents each. B shareholders were given the alternatives of initial

redemption or future redemption at 15 pence per share or the payment of an initial dividend of 15 pence per share. The initial redemption took place on 4 August 2006 with future redemption dates

on 5 February and 5 August each year until 5 August 2008 when the Company redeemed all B shares still in issue at their nominal value of 15 pence. B shareholders that chose future redemption were

entitled to receive a continuing non-cumulative dividend of 75 per cent of sterling LIBOR payable semi-annually in arrear until they were redeemed. The continuing B share dividend is shown within

financing costs in the income statement.

By 31 March 2009, total capital of £9,026 million had been returned to shareholders, £5,735 million by way of capital redemption and £3,291 million by way of initial dividend (note 21). During the

period, a transfer of £15 million (2008: £7 million) in respect of the B shares has been made from retained losses (note 23) to the capital redemption reserve (note 21). The redemptions and initial

dividend are shown within cash flows from financing activities in the cash flow statement.

Allotted during the year

Nominal Net

value proceeds

Number £m £m

UK share awards and option scheme awards 49,130,811 3 72

US share awards and option scheme awards 2,097,180 – 5

Total for share awards and option scheme awards 51,227,991 3 77

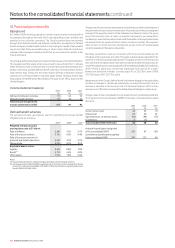

Notes to the consolidated nancial statements continued