Vodafone 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

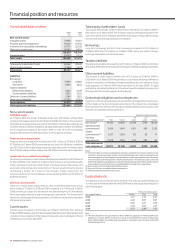

42 Vodafone Group Plc Annual Report 2009

SFR, the Group’s associated undertaking in France. Similarly, the Group does not have

existing obligations under shareholders’ agreements to pay dividends to minority

interest partners of Group subsidiaries or joint ventures, except as specified below.

Included in the dividends received from associated undertakings and investments is

an amount of £333 million (2008: £414 million) received from Verizon Wireless. Until

April 2005, Verizon Wireless’ distributions were determined by the terms of the

partnership agreement distribution policy and comprised income distributions and

tax distributions. Since April 2005, tax distributions have continued. Current

projections forecast that tax distributions will not be sufficient to cover the US tax

liabilities arising from the Group’s partnership interest in Verizon Wireless until 2015.

However, the tax distributions are expected to be sufficient to cover the net tax

liabilities of the Group’s US holding company.

Following the announcement of Verizon Wireless’ acquisition of Alltel, certain

additional tax distributions were agreed. Under the terms of the partnership

agreement, the Verizon Wireless board has no obligation to effect additional

distributions above the level of the tax distributions. However, the Verizon Wireless

board has agreed that it will review distributions from Verizon Wireless on an annual

basis. When considering whether distributions will be made each year, the Verizon

Wireless board will take into account its debt position, the relationship between debt

levels and maturities and overall market conditions in the context of the five year

business plan. It is expected that Verizon Wireless’ free cash flow will be deployed in

servicing and reducing debt for the foreseeable future. Together with Verizon

Communications Inc., the Group agreed to delay a US$250 million gross tax

distribution to April 2009. Both shareholders benefited by enabling Verizon Wireless

to minimise arrangement and duration fees applicable to the bridge facility drawn to

acquire Alltel.

During the year ended 31 March 2009, cash dividends totalling £303 million (2008:

£450 million) were received from SFR in accordance with the shareholders’

agreement. Following SFR’s purchase of Neuf Cegetel, it was agreed that SFR would

partially fund debt repayments by a reduction in dividends between 2009 and 2011,

inclusive. The amount of dividends received fell by 32.7% from the prior year, which

is in line with this agreement.

Verizon Communications Inc. has an indirect 23.1% shareholding in Vodafone Italy

and, under the shareholders’ agreement, the shareholders have agreed to take steps

to cause Vodafone Italy to pay dividends at least annually, provided that such

dividends will not impair the financial condition or prospects of Vodafone Italy

including, without limitation, its credit standing. During the 2009 financial year,

Vodafone Italy paid a dividend net of withholding tax of €424.1 million to Verizon

Communications Inc., which was declared in the previous financial year. On 27 April

2009, Vodafone Italy declared and paid a dividend of €1.3 billion, of which €0.3 billion

was received by Verizon Communications Inc. net of withholding tax.

The Vodafone Essar shareholders’ agreement provides for the payment of

dividends to minority partners under certain circumstances but not before

May 2011.

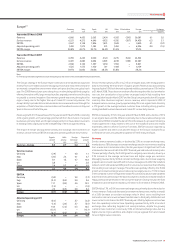

Acquisitions and disposals

The Group invested a net £1,240 million(1) in acquisition and disposal activities,

including the purchase and disposal of investments, in the year ended 31 March 2009.

An analysis of the significant transactions in the 2009 financial year, including

changes to the Group’s effective shareholding, is shown in the table below.

Further details of the acquisitions are provided in note 29 to the consolidated

financial statements.

£m

Arcor (26.4%)(2) 366

Ghana Telecommunications (70.0%) 486

Polkomtel (4.8%) 171

Gateway Communications (50%)(3) 185

Other net acquisitions and disposals, including investments 32

Total 1,240

Notes:

(1) Amounts are shown net of cash and cash equivalents acquired or disposed.

(2) This acquisition has been accounted for as a transaction between shareholders. Accordingly, the

dif fe ren ce bet ween the cash cons ideratio n paid and the car ryi ng value of net asset s at tr ib utable

to minority interests has been accounted for as a charge to retained losses.

(3) Acquisition undertaken by Vodacom, which at 31 March 2009 was 50% owned by the Group.

On 19 May 2008, the Group acquired 26.4% of Arcor previously held by minority

interests for cash consideration of €460 million (£366 million). Following the

transaction, Vodafone owns 100.0% of Arcor.

On 17 August 2008, the Group completed the acquisition of 70.0% of Ghana

Telecommunications Company Limited (‘Ghana Telecommunications’), a leading

telecommunications operator in Ghana, from the Government of Ghana for cash

consideration of US$900 million (£486 million).

On 18 December 2008, the Group completed the acquisition of an additional 4.8%

stake in Polkomtel S.A. for net cash consideration of €186 million (£171 million). The

acquisition increased Vodafone’s stake in Polkomtel S.A. from 19.6% to 24.4%.

On 30 December 2008, Vodacom acquired the carrier services and business network

solutions subsidiaries (‘Gateway’) of Gateway Telecommunications SA (Pty) Ltd.

Gateway provides services in more than 40 countries in Africa.

Treasury shares

The Companies Act 1985 permits companies to purchase their own shares out of

distributable reserves and to hold shares with a nominal value not to exceed 10% of

the nominal value of their issued share capital in treasury. If shares in excess of this

limit are purchased they must be cancelled. While held in treasury, no voting rights

or pre-emption rights accrue and no dividends are paid in respect of treasury shares.

Treasury shares may be sold for cash, transferred (in certain circumstances) for the

purposes of an employee share scheme, or cancelled. If treasury shares are sold, such

sales are deemed to be a new issue of shares and will accordingly count towards the

5% of share capital which the Company is permitted to issue on a non pre-emptive

basis in any one year as approved by its shareholders at the AGM. The proceeds of any

sale of treasury shares up to the amount of the original purchase price, calculated on

a weighted average price method, is attributed to distributable profits which would

not occur in the case of the sale of non-treasury shares. Any excess above the original

purchase price must be transferred to the share premium account.

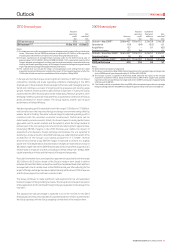

The Board considered the market reaction to the Group’s interim management

statement, issued on 22 July 2008, and introduced a £1 billion share repurchase

programme. This programme was completed on 18 September 2008. Details of

shares purchased are shown below:

Maximum

Total number value of

Average price of shares shares that

Total paid per share purchased may yet be

number of inclusive of under share purchased

shares transaction repurchase under the

purchased costs programme(1) programme(1)

Date of share purchase ‘000 Pence ‘000 £m

July 2008 161,364 133.16 161,364 785

August 2008 265,170 138.78 426,534 417

September 2008 309,566 134.71 736,100 –

Total 736,100 135.84 736,100 –

Note:

(1) No shares were purchased outside of the publicly announced share purchase programmes.

Shares purchased are held in treasury in accordance with section 162 of the

Companies Act 1985. The movement in treasury shares during the financial year is

shown below:

Number

Million £m

1 April 2008 5,133 7,856

Reissue of shares (43) (59)

Purchase of shares 736 1,000

Cancelled shares (500) (755)

Other receipts (4) (6)

31 March 2009 5,322 8,036

Financial position and resources continued