Vodafone 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Governance

Vodafone Group Plc Annual Report 2009 59

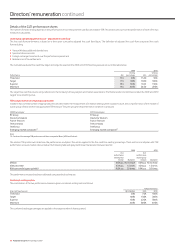

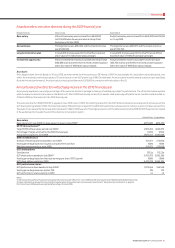

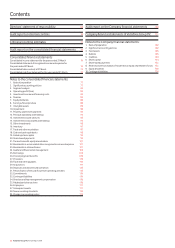

The remuneration package

The table below summarises the plans used to reward the executive directors in the 2009 financial year.

Summary Grant policy

Base salary

Set by the Remuneration Committee as part of the overall benchmarking •

process (see previous page).

Benchmark assumed to be the market level for the role.•

Base salaries set annually on 1 July.•

Annual bonus

Remuneration Committee reviews performance against targets over the

financial year. Actual results measured against the budget set at the start of

the year.

Summary of the plan in the 2009 financial year

• 2009 performance measures:

Three key financial measures: operating profit (25%), service revenue –

(25%) and free cash flow (25%);

Total communications revenue (10%) – this measure has been used to –

promote the new business area set out in the May 2006 strategy; and

Customer delight (15%) – customer satisfaction is a key component in the –

Group’s success.

Changes for the 2010 financial year

• Performance measures for the 2010 financial year:

Total communications’ now embedded in the Group’s strategy and no –

longer requires particular promotion, therefore it has been removed;

Free cash flow continues to be a key measure for the business and has an –

increased weighting;

Split of measures for the 2010 financial year: operating profit (25%), service –

revenue (25%), free cash flow (35%) and customer delight (15%); and

These measures relate to the business strategy of capital discipline, cost –

control and pursuing growth opportunities.

Bonus levels reviewed annually. Mix of •

performance measures and the performance

targets also reviewed.

Annual bonus paid in cash in June each year for •

performance over the previous financial year.

Target bonus is 100% of base salary earned over •

the financial year.

Maximum bonus is 200% of base salary earned •

and is only paid out for exceptional performance.

Group short term incentive

plan (‘GSTIP’)(1)

Long term incentives (details on page 60)

Global long term incentive

plan (‘GLTI’) base awards

Long term incentive all delivered in performance shares.•

No share option awards or deferred bonus awards made in the 2009 •

financial year and the Remuneration Committee does not foresee using

these arrangements in the immediate future.

Base award has vesting period of three years, subject to a matrix of two •

performance measures over this period:

Firstly, an operational performance measure (free cash flow); and –

Secondly, an equity performance multiplier (relative TSR). –

Performance details set out in more detail on page 60.•

Base award set annually and made in June/July.•

The Chief Executive’s base award will have a •

target face value of 137.5% of base salary

(maximum 550%) in July 2009.

The Chief Financial Officer’s base award will have •

a target face value of 110% of base salary

(maximum 440%) in July 2009.

Co-investment

matching awards Individuals may purchase Vodafone shares and hold them in trust for

•

three years in order to receive additional performance shares in the form

of a GLTI matching award.

Matching awards made under the GLTI plan have the same •

performance measures as the base award.

Matching award used to encourage increased share ownership and •

supports the share ownership requirements set out below.

Matching award made annually in June in line with •

the investment made.

Executive directors can co-invest up to two times •

net base salary.

Matching award will have a face value equal to •

50% of the equivalent multiple of gross basic

salary invested.

Share ownership

requirements Option to co-invest into the GLTI plan designed to encourage executives •

to meet their share ownership requirements.

Ownership against the requirements must be met after five years. •

Progress towards this requirement reviewed by the Remuneration •

Committee before granting long term awards.

The Chief Executive is required to hold four times •

base salary.

Other executive directors are required to hold •

three times base salary.

Other remuneration

Defined benefit pension The Chief Financial Officer is a member of the UK defined benefit scheme •

for pensionable salary up to the scheme cap of £110,000. Details of this

are set out in the pensions table on page 63. He receives the cash

allowance set out below on pensionable salary over the scheme cap.

Plan closed to new entrants.•

The Chief Financial Officer is the only executive •

director to receive this benefit.

Defined contribution

pension/cash allowance The pension contribution or cash allowance is available for the executives •

to make provisions for their retirement.

30% of basic salary taken either as a cash •

payment or a pension contribution.

Benefits

Company car or cash allowance worth £19,200 per annum.•

Private medical insurance.•

Chauffeur services, where appropriate, to assist with their role.•

• Benefits reviewed from time to time.

Note:

(1) GSTIP targets are not disclosed as they are commercially sensitive.