Vodafone 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 Vodafone Group Plc Annual Report 2009

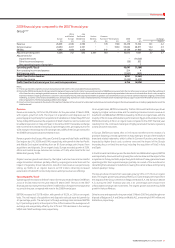

The impact of merger and acquisition activity and foreign exchange movements on

revenue, service revenue, EBITDA and adjusted operating profit are shown below:

Organic M&A Foreign Reported

growth activity exchange growth

% pps pps %

Revenue

Asia Pacific and Middle East 15.9 81.9 (10.4) 87.4

Service revenue

India – – – –

Other 16.2 – (7.2) 9.0

Asia Pacific and Middle East 16.2 86.6 (12.4) 90.4

EBITDA

India – – – –

Other 14.3 – (8.1) 6.2

Asia Pacific and Middle East 14.3 77.6 (13.2) 78.7

Adjusted operating profit

India – – – –

Other 8.1 – (3.4) 4.7

Asia Pacific and Middle East 8.1 7.6 (3.4) 12.3

India

At constant exchange rates, Vodafone Essar performed well since acquisition, with

growth in revenue of 55% assuming the Group owned the business for the whole

of both periods. Since acquisition, there were 16.4 million net customer additions,

bringing the total customer base to 44.1 million at 31 March 2008. Penetration

in mobile telephony increased following falling prices of both handsets and tariffs and

network coverage increases. The market remains competitive and prepaid offerings

are moving to lifetime validity products, which allow the customer to stay connected

to the network without requiring any top ups. Revenue continued to grow as the

customer base increased, particularly in outgoing voice as service offerings drove

greater usage.

The Indian mobile market continued to grow, with penetration reaching 23% by

the end of March 2008. Vodafone Essar, which successfully adopted the Vodafone

brand in September 2007, continued to perform well, with EBITDA slightly ahead

of expectations held at the time of the completion of the acquisition. This was partially

due to the Group’s rapid network expansion in this market together with

improvements in operating expense efficiency, particularly in customer care.

The outsourcing of the IT function was implemented during January 2008 and is

expected to lead to the faster roll out of more varied services to customers, while

delivering greater cost efficiencies.

Other Asia Pacific and Middle East

Service revenue increased by 9.0%, by 16.2% on an organic basis, driven by

performances in Egypt and Australia.

In Egypt, service revenue growth was 31.2% at constant exchange rates, benefiting

from a 52.7% increase in the average customer base and an increase in voice revenue,

with the fall in the effective rate per minute being offset by a 60.1% increase in usage.

The success of recent prepaid customer offerings, such as the Vodafone Family tariff,

contributed to the 45.8% growth in closing customers compared to the 2007

financial year.

In Australia, service revenue grew by 7.5% at constant exchange rates, which was

achieved despite the sharp regulatory driven decline in termination rates during the

year. Revenue growth in Australia reflected an 8.0% increase in the average customer

base and the mix of higher value contract customers. New Zealand also saw strong

growth in service revenue, which increased by 20.0%, or by 10.1% at constant

exchange rates, driven primarily by a 16.7% increase in the average contract customer

base and strong growth in data and fixed line revenue.

EBITDA grew by 6.2%, or by 14.3% on an organic basis, with the main drivers of growth

being Egypt and Australia.

In Egypt, EBITDA increased by 20.6% at constant exchange rates. Direct costs grew

due to prepaid airtime commission increases and 3G licence costs. Within operating

expenses, staff investment programmes, higher publicity costs and leased line costs

increased during the year, although operating expenses remained stable as a

percentage of service revenue.

The favourable performance in Australia was a result of the higher contract customer

base, achieved through expansion of retail distribution, with higher contract revenue

offsetting the increase in customer costs.

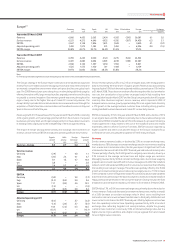

Verizon Wireless

2008 2007 % change

£m £m £ $

Revenue 10,144 9,387 8.1 14.5

Service revenue 9,246 8,507 8.7 15.2

EBITDA 3,930 3,614 8.7 15.3

Interest (102) (179) (43.0)

Tax(1) (166) (125) 32.8

Minority interest (56) (61) (8.2)

Group’s share of result in

Verizon Wireless 2,447 2,077 17.8 24.8

Note:

(1) The Group’s share of the tax attributable to Verizon Wireless relates only to the corporate

entities held by the Verizon Wireless partnership and certain state taxes which are levied on

the partnership.

Verizon Wireless increased its closing customer base by 10.6% in the year ended

31 March 2008, adding 6.5 million net additions to reach a total customer base of

67.2 million. The performance was particularly robust in the higher value contract

segment and was achieved in a market where the estimated mobile penetration

reached 88% at 31 March 2008.

The strong customer growth was achieved through a combination of higher gross

additions and Verizon Wireless’ strong customer loyalty, with the latter evidenced

through continuing low levels of churn. The 12.3% growth in the average mobile

customer base combined with a 2.7% increase in ARPU resulted in a 15.2% increase

in service revenue. ARPU growth was achieved through the continued success

of non-voice services, driven predominantly by data cards, wireless email and

messaging services. Verizon Wireless’ operating profit was impacted by efficiencies

in other direct costs and operating expenses, partly offset by a higher level of

customer acquisition and retention costs.

During the 2008 financial year, Verizon Wireless consolidated its spectrum position

through the Federal Communications Commission’s Auction 73, winning the auction

for a nationwide spectrum footprint plus licences for individual markets for

US$9.4 billion, which was fully funded by debt. This spectrum depth will allow Verizon

Wireless to continue to grow revenue, to preserve its reputation as the nation’s most

reliable wireless network, and to continue to lead in data services to satisfy the next

wave of services and consumer electronics devices.

The Group’s share of the tax attributable to Verizon Wireless for the year ended

31 March 2008 relates only to the corporate entities held by the Verizon Wireless

partnership. The tax attributable to the Group’s share of the partnership’s pre-tax

profit is included within the Group tax charge.

Operating results continued