Vodafone 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2009 101

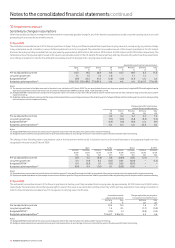

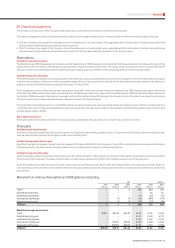

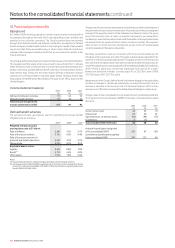

21. Transactions with equity shareholders

Share Additional Capital

premium Own shares paid-in redemption

account held capital reser ve

£m £m £m £m

1 April 2006 52,444 (8,198) 100,152 128

Issue of new shares 154 − (44) −

Own shares released on vesting of share awards − 151 − −

Share consolidation (9,026) − − −

B share capital redemption − − − 5,713

B share preference dividend − − − 3,291

Share-based payment charge, inclusive of tax charge of £16 million – − 77 −

31 March 2007 43,572 (8,047) 100,185 9,132

Issue of new shares 263 − (134) −

Own shares released on vesting of share awards 14 191 (14) −

B share capital redemption − − − 7

Transfer of B share nominal value in respect of own shares deferred and cancelled (915) − − 915

Share-based payment charge, inclusive of tax credit of £7 million − − 114 −

31 March 2008 42,934 (7,856) 100,151 10,054

Issue of new shares 74 – (70) –

Own shares released on vesting of share awards – 59 – –

Purchase of own shares – (1,000) – –

Cancellation of own shares held – 755 – 32

Other receipts from reissue of own shares – 6 – –

BEE(1) initial share-based payment charge – – 39 –

B share capital redemption – – – 15

Share-based payment charge, inclusive of tax charge of £9 million – – 119 –

31 March 2009 43,008 (8,036) 100,239 10,101

Note:

(1) BEE refers to the broad based black economic empowerment transaction undertaken by Vodacom in South Africa.

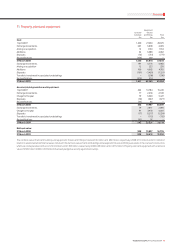

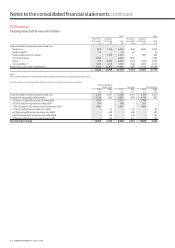

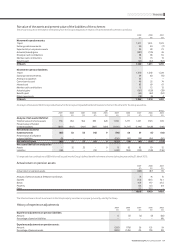

22. Movements in accumulated other recognised income and expense

Available-

for-sale Asset

Translation Pensions investments revaluation

reserve reserve reserve surplus Other Total

£m £m £m £m £m £m

1 April 2006 (restated) 3,118 (109) 1,044 112 − 4,165

(Losses)/gains arising in the year (3,802) 65 2,108 − − (1,629)

Transfer to the income statement on disposal (restated) 763 − − − − 763

Tax effect 22 (15) − − − 7

31 March 2007 101 (59) 3,152 112 − 3,306

Gains/(losses) arising in the year 5,827 (47) 1,949 − 37 7,766

Transfer to the income statement on disposal (7) − (570) − − (577)

Tax effect 53 10 − − − 63

31 March 2008 5,974 (96) 4,531 112 37 10,558

Gains/(losses) arising in the year 12,614 (220) (2,383) 68 (56) 10,023

Transfer to the income statement on disposal (3) − − − − (3)

Tax effect (134) 57 − − 16 (61)

31 March 2009 18,451 (259) 2,148 180 (3) 20,517

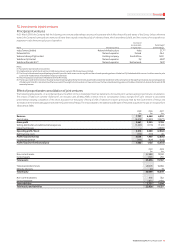

23. Movements in retained losses

Restated

2009 2008 2007

£m £m £m

1 April (81,980) (85,253) (67,431)

Profit/(loss) for the financial year 3,078 6,660 (5,351)

Equity dividends (note 7) (4,017) (3,653) (3,566)

Loss on issue of treasury shares (44) (60) (43)

B share capital redemption (15) (7) (5,713)

B share preference dividend − − (3,291)

Cancellation of shares (755) − –

Equity put rights and similar obligations(1) − 333 142

Transactions with minority shareholders (87) − −

31 March (83,820) (81,980) (85,253)

Note:

(1) In the year ended 31 March 2008, a charge of £333 million, representing the fair value of put options granted by the Group over the Essar group’s interest in Vodafone Essar, has been recognised

as an expense. The offsetting credit was recognised in retained losses, as no equivalent liability arose in respect of the fair value of the put options granted.