Vodafone 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2009 85

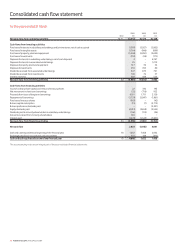

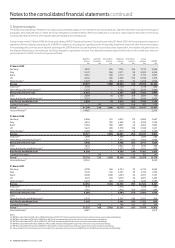

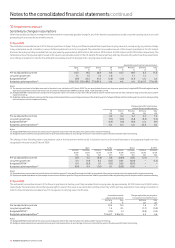

5. Investment income and nancing costs

2009 2008 2007

£m £m £m

Investment income:

Available-for-sale investments:

Dividends received 110 72 57

Other(1) − − 86

Loans and receivables at amortised cost(2) 339 451 452

Fair value through the income statement (held for trading):

Derivatives – foreign exchange contracts 71 125 160

Other(3) 275 66 −

Equity put rights and similar arrangements(4) − − 34

795 714 789

Financing costs:

Items in hedge relationships:

Other loans 782 612 548

Interest rate swaps (180) 61 (9)

Dividends on redeemable preference shares 53 42 45

Fair value hedging instrument (1,458) (635) 42

Fair value of hedged item 1,475 601 (47)

Other financial liabilities held at amortised cost:

Bank loans and overdrafts 452 347 126

Other loans(5) 440 390 276

Potential interest on settlement of tax issues(6) (81) 399 406

Equity put rights and similar arrangements(4) 627 143 32

Finance leases 1 7 4

Fair value through the income statement (held for trading):

Derivatives – forward starting swaps and futures 308 47 71

Other(7) − − 118

2,419 2,014 1,612

Net financing costs 1,624 1,300 823

Notes:

(1) Amount for 2007 includes a gain resulting from refinancing of SoftBank related investments received as part of the consideration for the disposal of Vodafone Japan on 27 April 2006.

(2) Amount for 2007 includes £77 million of foreign exchange gains arising from hedges of a net investment in a foreign operation.

(3) Includes foreign exchange gains on certain intercompany balances and investments held following the disposal of Vodafone Japan to SoftBank.

(4) Includes amounts in relation to the Group’s arrangements with its minority partners in India, its fixed line operations in Germany and, in respect of prior years, Telecom Egypt. Further information is

provided in “Option agreements and similar arrangements” on page 44.

(5) Amount for 2009 includes £94 million (2008: £72 million) of foreign exchange losses arising from hedges of a net investment in a foreign operation.

(6) Amount for 2009 includes a reduction of the provision for potential interest on tax issues.

(7) Amount for 2007 includes foreign exchange losses on certain intercompany balances and investments held following the disposal of Vodafone Japan to SoftBank.