Vodafone 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2009 111

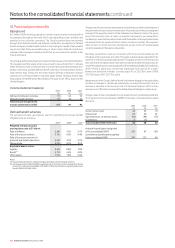

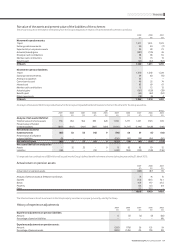

29. Acquisitions

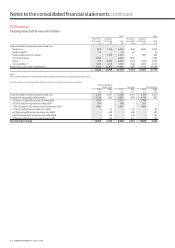

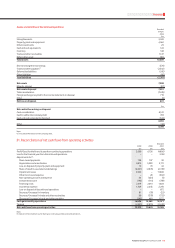

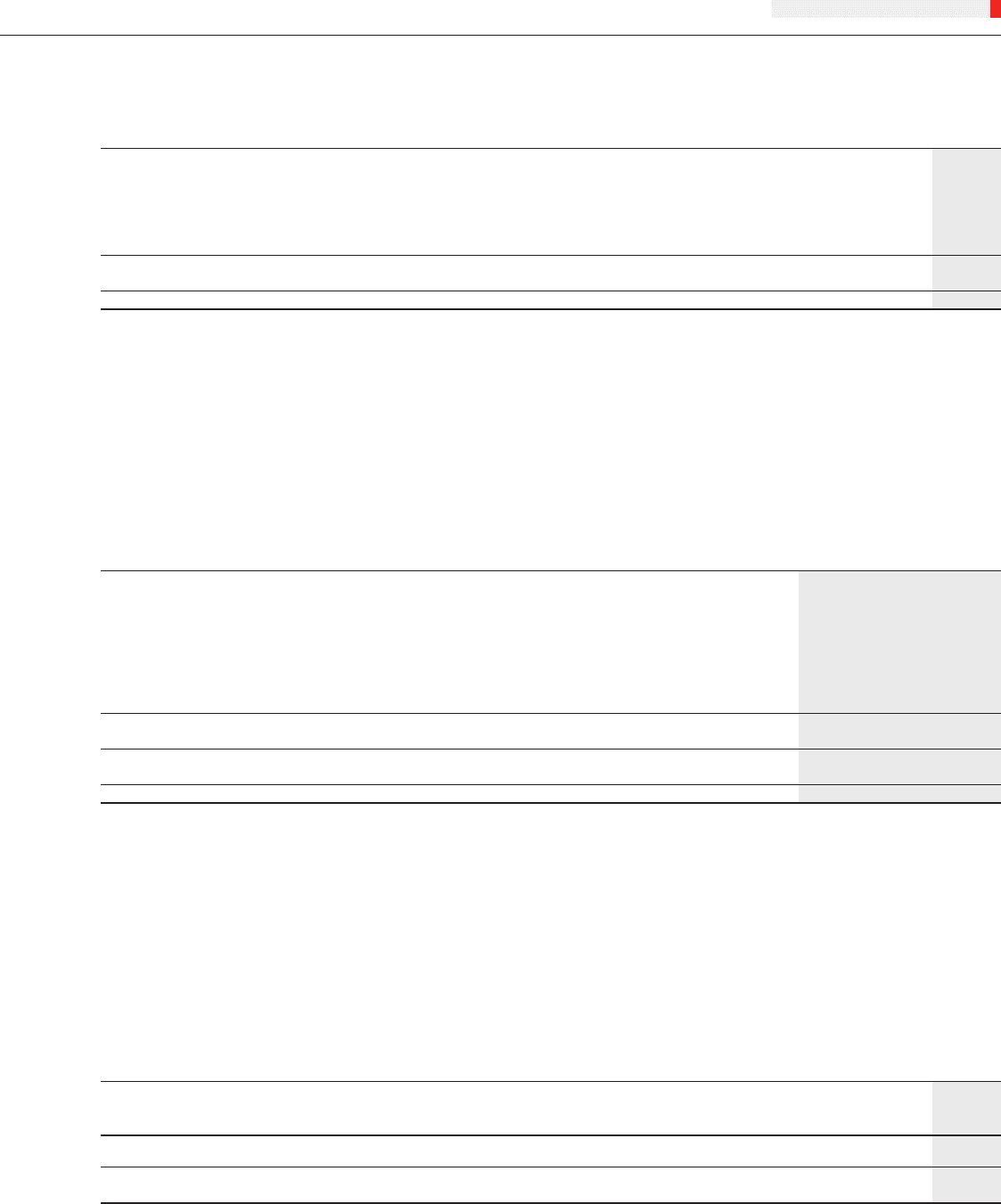

The aggregate cash consideration in respect of purchases of interests in subsidiary undertakings and joint ventures, net of cash acquired, is as follows:

£m

Cash consideration paid:

Arcor (26.4%)(1) 366

Ghana Telecommunications (70.0%) 486

Other acquisitions completed during the year 457

Other minority interest acquisitions 38

Acquisitions completed in previous years 24

1,371

Net overdrafts acquired 18

1,389

Note:

(1) This acquisition has been accounted for as a transaction between shareholders. Accordingly, the difference between the cash consideration paid and the carrying value of net assets attributable to

minority interests has been accounted for as a charge to retained losses.

Total goodwill acquired was £663 million and included £344 million in relation to Ghana Telecommunications and £319 million in relation to other acquisitions

completed during the year. In addition, amendments to provisional purchase price allocations on acquisitions completed in previous years resulted in a reduction in goodwill

of £50 million.

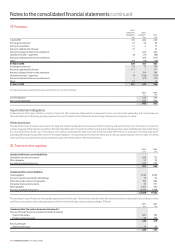

Ghana Telecommunications Company Limited (‘Ghana Telecommunications’)

On 17 August 2008, the Group completed the acquisition of 70.0% of Ghana Telecommunications for cash consideration of £486 million, all of which was paid during the

year. The initial purchase price allocation has been determined provisionally pending the completion of the final valuation of the fair value of net assets acquired.

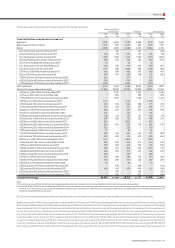

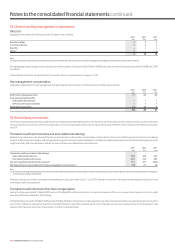

Fair value

Book value adjustments Fair value

£m £m £m

Net assets acquired:

Identifiable intangible assets(1) − 136 136

Property, plant and equipment 171 − 171

Inventory 10 − 10

Trade and other receivables 25 − 25

Deferred tax liabilities (8) (34) (42)

Trade and other payables (100) − (100)

Other (33) − (33)

Net identifiable assets acquired 65 102 167

Goodwill(2) 344

Total asset acquired 511

Minority interests (25)

Total consideration (including £3 million of directly attributable costs) 486

Notes:

(1) Id ent if iable inta ngible asset s of £136 mi llion consist of lice nces and spectr um fees of £112 mi llion and other intangible assets of £24 mi llion. The weighted aver age li ves of licences and spe ctrum fees ,

other intangible assets and total intangible assets are 11 years, one year and ten years respectively.

(2) The goodwill is attributable to the expected profitability of the acquired business and the synergies expected to arise after the Group’s acquisition of Ghana Telecommunications.

The results of the acquired entity have been consolidated in the income statement from the date of acquisition. From the date of acquisition, the acquired entity reduced

the profit attributable to equity shareholders of the Group by £389 million.

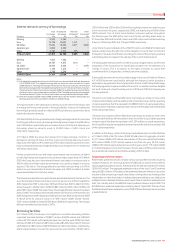

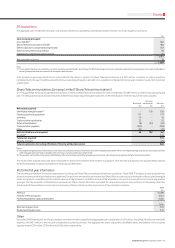

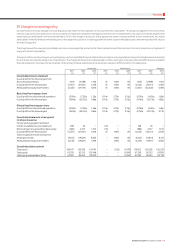

Pro forma full year information

The following unaudited pro forma summary presents the Group as if Ghana Telecommunications had been acquired on 1 April 2008. The impact of other acquisitions on

the pro forma amounts disclosed below is not significant. The pro forma amounts include the results of Ghana Telecommunications, amor tisation of the acquired intangible

assets recognised on acquisition and the interest expense on the increase in net debt as a result of the acquisitions. The pro forma amounts do not include any possible

synergies from the acquisition of Ghana Telecommunications. The pro forma information is provided for comparative purposes only and does not necessarily reflect the

actual results that would have occurred, nor is it necessarily indicative of future results of operations of the combined companies.

2009

£m

Revenue 41,069

Profit for the financial year 3,052

Profit attributable to equity shareholders 3,050

Pence

Basic earnings per share 5.78

Diluted earnings per share 5.76

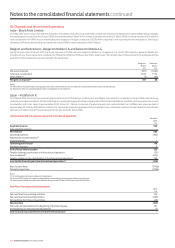

Other

During the 2009 financial year, the Group completed a number of smaller acquisitions for aggregate cash consideration of £475 million, including £18 million net overdrafts

acquired, with £457 million of the net cash consideration paid during the year. The aggregate fair values of goodwill, identifiable assets, and liabilities of the acquired

operations were £319 million, £378 million and £240 million, respectively.