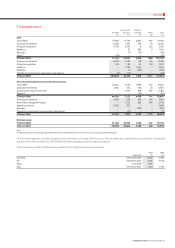

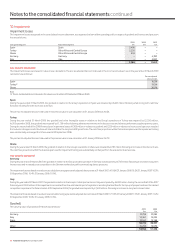

Vodafone 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

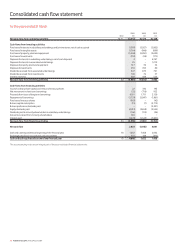

86 Vodafone Group Plc Annual Report 2009

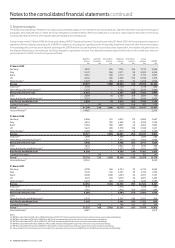

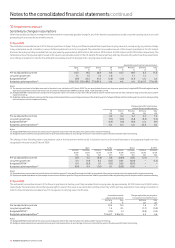

6. Taxation

Income tax expense

2009 2008 2007

£m £m £m

United Kingdom corporation tax (income)/expense:

Current year (132) − −

Adjustments in respect of prior years (318) (53) (30)

(450) (53) (30)

Overseas current tax expense/(income):

Current year 2,111 2,539 2,928

Adjustments in respect of prior years (934) (293) 215

1,177 2 ,246 3 ,143

Total current tax expense 727 2,193 3,113

Deferred tax on origination and reversal of temporary differences:

United Kingdom deferred tax 20 (125) (49)

Overseas deferred tax 362 177 (641)

Total deferred tax expense/(income) 382 52 (690)

Total income tax expense from continuing operations 1,109 2,245 2,423

Tax charged/(credited) directly to equity

2009 2008 2007

£m £m £m

Current tax charge/(credit) 134 (5) (2)

Deferred tax (credit)/charge (64) (65) 11

Total tax charged/(credited) directly to equity 70 (70) 9

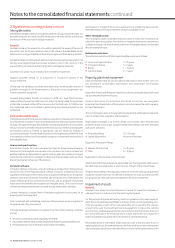

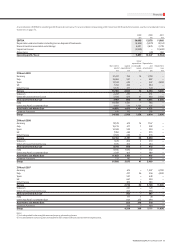

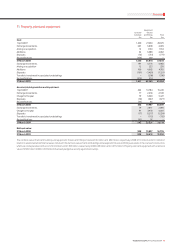

Factors affecting tax expense for the year

The table below explains the differences between the expected tax expense on continuing operations, at the UK statutory tax rate of 28% for 2009 and 30% for 2008 and

2007, and the Group’s total tax expense for each year. Further discussion of the current year tax expense can be found in the section titled “Operating results” on page 26.

2009 2008 2007

£m £m £m

Profit/(loss) before tax on continuing operations as shown in the consolidated income statement 4,189 9,001 (2,383)

Expected income tax expense/(income) on profit from continuing operations at UK statutory tax rate 1,173 2,700 (715)

Effect of taxation of associated undertakings, reported within operating profit 118 134 119

Impairment losses with no tax effect 1,652 – 3,480

Expected income tax expense at UK statutory rate on profit from continuing operations,

before impairment losses and taxation of associates 2,943 2,834 2,884

Effect of different statutory tax rates of overseas jurisdictions 382 320 346

Effect of current year changes in statutory tax rates (31) 66 1

Deferred tax on overseas earnings (26) 255 (373)

Assets revalued for tax purposes (155) (16) (197)

Effect of previously unrecognised temporary differences including losses (881) (833) (562)

Adjustments in respect of prior years(1) (1,124) (254) 145

Expenses not deductible for tax purposes and other items 423 321 577

Exclude taxation of associated undertakings (422) (448) (398)

Income tax expense from continuing operations 1,109 2,245 2,423

Note:

(1) See “Taxation” on page 26.

Notes to the consolidated nancial statements continued