Vodafone 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 Vodafone Group Plc Annual Report 2009

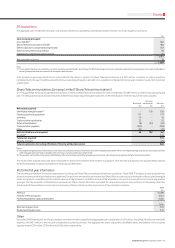

30. Disposals and discontinued operations

India – Bharti Airtel Limited

On 9 May 2007 and in conjunction with the acquisition of Vodafone Essar, the Group entered into a share sale and purchase agreement in which a Bharti group company

irrevocably agreed to purchase the Group’s 5.60% direct shareholding in Bharti Airtel Limited. During the year ended 31 March 2008, the Group received £654 million in

cash consideration for 4.99% of such shareholding and recognised a net gain on disposal of £250 million, reported in non-operating income and expense. The Group’s

remaining 0.61% direct shareholding was transferred in April 2008 for cash consideration of £87 million.

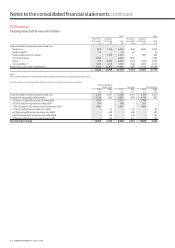

Belgium and Switzerland – Belgacom Mobile S.A. and Swisscom Mobile A.G.

During the year ended 31 March 2007, the Group disposed of its 25% interest in Belgacom Mobile S.A. to Belgacom S.A. and its 25% interest in Swisscom Mobile A.G.

to Swisscom A.G. These transactions completed on 3 November 2006 and 20 December 2006, respectively. The carrying value of these investments at disposal and the

cash effects of the transactions are summarised in the table below:

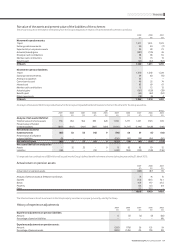

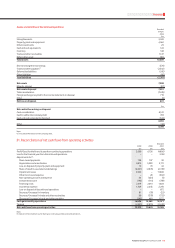

Belgacom Swisscom

Mobile Mobile

£m £m

Net assets disposed (901) (1,664)

Total cash consideration 1,343 1,776

Other effects(1) (1) (44)

Net gain on disposal(2) 441 68

Notes:

(1) Other effects include foreign exchange gains and losses transferred to the income statement and professional fees related to the disposal.

(2) Reported in other income and expense in the consolidated income statement.

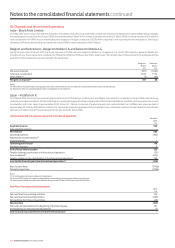

Japan – Vodafone K.K.

On 17 March 2006, the Group announced an agreement to sell its 97.7% holding in Vodafone K.K. to SoftBank. The transaction completed on 27 April 2006, with the Group

receiving cash of approximately ¥1.42 trillion (£6.9 billion), including the repayment of intercompany debt of ¥0.16 trillion (£0.8 billion). In addition, the Group received non-cash

consideration with a fair value of approximately ¥0.23 trillion (£1.1 billion), comprised of preferred equity and a subordinated loan. SoftBank also assumed debt of

approximately ¥0.13 trillion (£0.6 billion). Vodafone K.K. represented a separate geographical area of operation and, on this basis, Vodafone K.K. was treated as a discontinued

operation in Vodafone Group Plc’s annual report for the year ended 31 March 2006.

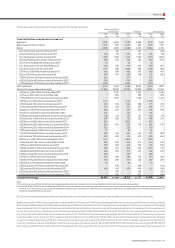

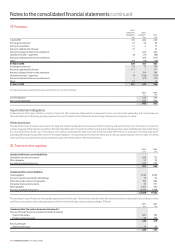

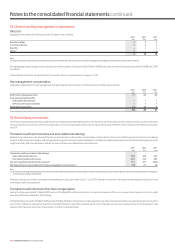

Income statement and segment analysis of discontinued operations

Restated

2007

£m

Segment revenue 520

Inter-segment revenue –

Net revenue 520

Operating expenses (402)

Depreciation and amortisation(1) –

Impairment loss –

Operating profit/(loss) 118

Net financing costs 8

Profit/(loss) before taxation 126

Taxation relating to performance of discontinued operations (15)

Loss on disposal(2) (672)

Taxation relating to the classification of the discontinued operations 145

Loss for the financial year from discontinued operations(3) (416)

Basic loss per share (0.76)p

Diluted loss per share (0.76)p

Notes:

(1) Including gains and losses on disposal of fixed assets.

(2) Includes £719 million of foreign exchange differences transferred to the income statement on disposal.

(3) Amount attributable to equity shareholders for the year ended 31 March 2007 was a loss of £419 million.

Cash flows from discontinued operations

2007

£m

Net cash flow from operating activities 135

Net cash flow from investing activities (266)

Net cash flow from financing activities (29)

Net cash flow (160)

Cash and cash equivalents at the beginning of the financial year 161

Exchange loss on cash and cash equivalents (1)

Cash and cash equivalents at the end of the financial year –

Notes to the consolidated nancial statements continued