Vodafone 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 Vodafone Group Plc Annual Report 2009

Notes to the consolidated nancial statements continued

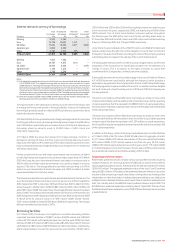

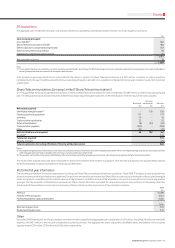

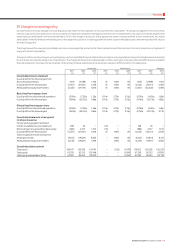

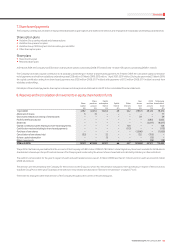

34. Directors and key management compensation

Directors

Aggregate emoluments of the directors of the Company were as follows:

2009 2008 2007

£m £m £m

Salaries and fees 4 5 5

Incentive schemes 2 4 3

Benefits – 1 1

Other(1) 1 – 4

7 10 13

Note:

(1) Other includes the value of the cash allowance taken by some individuals in lieu of pension contributions and payments in respect of loss of office and relocation to the US.

The aggregate gross pre-tax gain made on the exercise of share options in the year ended 31 March 2009 by directors who served during the year was £nil (2008: £nil, 2007:

£3 million).

Further details of directors’ emoluments can be found in “Directors’ remuneration” on pages 57 to 67.

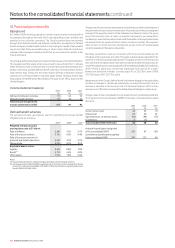

Key management compensation

Aggregate compensation for key management, being the directors and members of the Executive Committee, was as follows:

2009 2008 2007

£m £m £m

Short term employee benefits 17 20 29

Post-employment benefits:

Defined benefit schemes – 1 1

Defined contribution schemes 1 1 1

Share-based payments 14 10 6

32 32 37

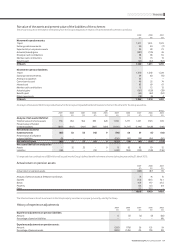

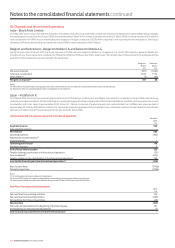

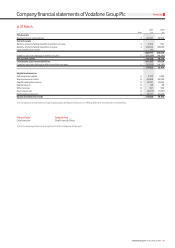

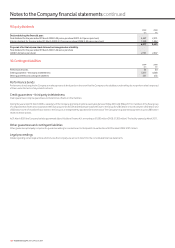

35. Related party transactions

The Group’s related parties are its joint ventures (see note 13), associated undertakings (see note 14), pension schemes, directors and members of the Executive Committee.

Group contributions to pension schemes are disclosed in note 26. Compensation paid to the Company’s Board and members of the Executive Committee is disclosed in

note 34.

Transactions with joint ventures and associated undertakings

Related party transactions can arise with the Group’s joint ventures and associates and primarily comprise fees for the use of Vodafone products and services including,

network airtime and access charges, and cash pooling arrangements. Except as disclosed below, no related party transactions have been entered into during the year which

might reasonably affect any decisions made by the users of these consolidated financial statements.

2009 2008 2007

£m £m £m

Transactions with associated undertakings:

Sales of goods and services 205 165 245

Purchase of goods and services 223 212 295

Amounts owed by/(owed to) joint ventures(1) 311 127 (842)

Net interest (income receivable from)/expense payable to joint ventures(1) (18) 27 20

Note:

(1) Amounts arise through Vodafone Italy and, for the year ended 31 March 2009, Indus Towers, being part of a Group cash pooling arrangement and represent amounts not eliminated on consolidation.

Interest is paid in line with market rates.

Amounts owed by and owed to associated undertakings are disclosed within notes 17 and 28. Dividends received from associated undertakings are disclosed in the

consolidated cash flow statement.

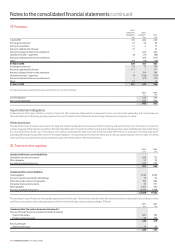

Transactions with directors other than compensation

During the three years ended 31 March 2009, and as of 18 May 2009, neither any director nor any other executive officer, nor any associate of any director or any other

executive officer, was indebted to the Company.

During the three years ended 31 March 2009, and as of 18 May 2009, the Company has not been a party to any other material transaction, or proposed transactions, in which

any member of the key management personnel (including directors, any other executive officer, senior manager, any spouse or relative of any of the foregoing, or any

relative of such spouse), had or was to have a direct or indirect material interest.