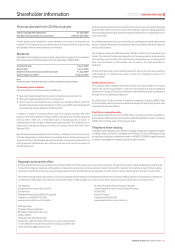

Vodafone 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

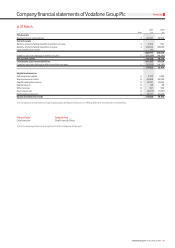

124 Vodafone Group Plc Annual Report 2009

Notes to the Company nancial statements continued

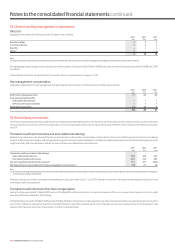

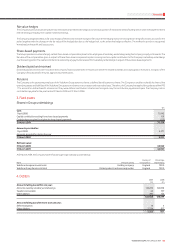

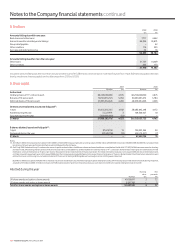

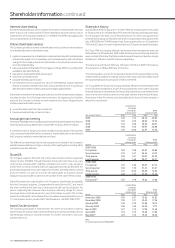

5. Creditors

2009 2008

£m £m

Amounts falling due within one year:

Bank loans and other loans 7,717 4,442

Amounts owed to subsidiary undertakings 84,394 93,891

Group relief payable – 42

Other creditors 174 393

Accruals and deferred income 54 16

92,339 98,784

Amounts falling due after more than one year:

Other loans 21,707 14,409

Other creditors 263 173

21,970 14,582

Included in amounts falling due after more than one year are other loans of £13,289 million, which are due in more than five years from 1 April 2009 and are payable otherwise

than by instalments. Interest payable on this debt ranges from 2.15% to 8.125%.

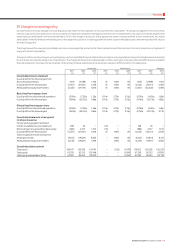

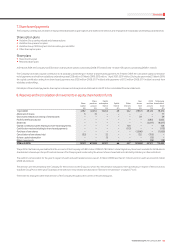

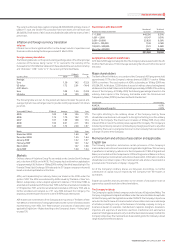

6. Share capital

2009 2008

Number £m Number £m

Authorised:

Ordinary shares of 113/7 US cents each 68,250,000,000 4,875 68,250,000,000 4,875

B shares of 15 pence each 38,563,935,574 5,784 38,563,935,574 5,784

Deferred shares of 15 pence each 28,036,064,426 4,206 28,036,064,426 4,206

Ordinary shares allotted, issued and fully paid(1):

1 April 58,255,055,725 4,182 58,085,695,298 4,172

Allotted during the year 51,227,991 3 169,360,427 10

Cancelled during the year (500,000,000) (32) – –

31 March 57,806,283,716 4,153 58,255,055,725 4,182

B shares allotted, issued and fully paid(2):

1 April 87,429,138 13 132,001,365 20

Redeemed during the year (87,429,138) (13) (44,572,227) (7)

31 March – – 87,429,138 13

Notes:

(1) At 31 March 2009, the Company held 5,322,411,101 (2008: 5,127,457,690) treasury shares with a nominal value of £382 million (2008: £368 million) and 50,000 (2008: 50,000) 7% cumulative fixed

rate shares of £1 each were authorised, allotted, issued and fully paid by the Company.

(2) On 31 July 2006, Vodafone Group Plc undertook a return of capital to shareholders via a B share scheme and associated share consolidation. A total of 66,271,035,240 B shares were issued on that day,

and 66,271,035,240 existing ordinary shares of 10 US cents each were consolidated into 57,987,155,835 new ordinary shares of 113/7 cents each. B shareholders were given the alternatives of initial

redemption or future redemption at 15 pence per share or the payment of an initial dividend of 15 pence per share. The initial redemption took place on 4 August 2006 with future redemption dates

on 5 February and 5 August each year until 5 August 2008 when the Company redeemed all B shares still in issue at their nominal value of 15 pence. B shareholders that chose future redemption were

entitled to receive a continuing non-cumulative dividend of 75 per cent of sterling LIBOR payable semi-annually in arrear until they were redeemed.

By 31 Mar ch 200 9, tot al capital of £9,026 million h ad bee n returned to shareholders, £5,735 mill ion by way of capit al redempti on and £3,291 mi llion by way of initial div id end (n ote 8). Du ri ng the per iod,

a transfer of £15 million (2008: £7 million) in respect of the B shares has been made from the profit and loss account reserve (note 8) to the capital redemption reserve (note 8).

Allotted during the year

Nominal Net

value proceeds

Number £m £m

UK share awards and option scheme awards 49,130,811 3 72

US share awards and option scheme awards 2,097,180 – 5

Total for share awards and option scheme awards 51, 227,991 3 77