Vodafone 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

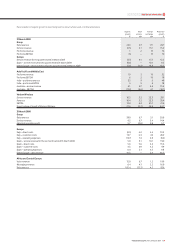

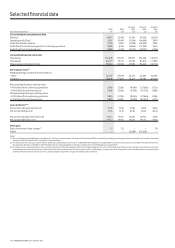

144 Vodafone Group Plc Annual Report 2009

Restated Restated Restated

2009 2008 2007 2006 2005

At/year ended 31 March £m £m £m £m £m

Consolidated income statement data

Revenue 41,017 35,478 31,104 29,350 26,678

Operating profit/(loss) 5,857 10,047 (1,564) (14,084) 7,878

Profit/(loss) before taxation 4,189 9,001 (2,383) (14,853) 7,285

Profit/(loss) for the financial year from continuing operations 3,080 6,756 (4,806) (17,233) 5,416

Profit/(loss) for the financial year 3,080 6,756 (5,222) (20,131) 6,598

Consolidated balance sheet data

Total assets 152,699 127,270 109,617 126,502 145,218

Total equity 84,777 76,471 67,293 85,312 111,958

Total equity shareholders’ funds 86,162 78,043 67,067 85,425 112,110

Earnings per share(1)

Weighted average number of shares (millions)

– Basic 52,737 53,019 55,144 62,607 66,196

– Diluted 52,969 53,287 55,144 62,607 66,427

Basic earnings/(loss) per ordinary share

– Profit/(loss) from continuing operations 5.84p 12.56p (8.94)p (27.66)p 8.12p

– Profit/(loss) for the financial year 5.84p 12.56p (9.70)p (32.31)p 9.80p

Diluted earnings/(loss) per ordinary share

– Profit/(loss) from continuing operations 5.81p 12.50p (8.94)p (27.66)p 8.09p

– Profit/(loss) for the financial year 5.81p 12.50p (9.70)p (32.31)p 9.77p

Cash dividends(1)(2)

Amount per ordinary share (pence) 7.77p 7.51p 6.76p 6.07p 4.07p

Amount per ADS (pence) 77.7p 75.1p 67.6p 60.7p 40.7p

Amount per ordinary share (US cents) 11.11c 14.91c 13.28c 10.56c 7.68c

Amount per ADS (US cents) 111.1c 149.1c 132.8c 105.6c 76.8c

Other data

Ratio of earnings to fixed charges(3) 1.2 3.9 – – 7.0

Deficit – – (4,389) (16,520) –

Notes:

(1) Se e note 8 to th e conso lidated financial statement s, “Earnings/( loss) pe r shar e”. Ea rn ings an d div idends per ADS is calcu lated by multiplying ear nings p er ordinar y share by ten , the num ber of ordinar y

shares per ADS. Dividend per ADS is calculated on the same basis.

(2) The final dividend for the year ended 31 March 2009 was proposed by the directors on 19 May 2009 and is payable on 7 August 2009 to holders of record as of 5 June 2009. This dividend has been

translated into US dollars at 31 March 2009 for ADS holders but will be payable in US dollars under the terms of the ADS depositary agreement.

(3) For the purposes of calculating these ratios, earnings consist of profit before tax adjusted for fixed charges, dividend income from associated undertakings, share of profits and losses from associated

undertakings and profits and losses on ordinary activities before taxation from discontinued operations. Fixed charges comprise one third of payments under operating leases, representing the

estimated interest element of these payments, interest payable and similar charges and preferred share dividends.

Selected nancial data